As autumn leaves start to fall, buyers typically really feel a chill that has nothing to do with the climate. October has lengthy been related to market volatility and abrupt downturns; a phenomenon often called the “October Impact.”

However what’s behind this unsettling pattern, and the way can savvy buyers defend their portfolios? Let’s discover the October Impact and why gold is likely to be your finest pal throughout these turbulent instances.

Understanding the October Impact

The October Impact refers back to the notion that inventory markets usually tend to decline in the course of the month of October. Whereas not backed by sturdy statistical proof, this perception has deep roots in monetary historical past and continues to affect investor conduct.

A number of of essentially the most important market crashes in historical past have occurred in October, cementing its fame as a harmful month for buyers:

- The Panic of 1907: This extreme financial disaster shook the New York Inventory Change, inflicting the inventory market to fall by practically 50% from its peak the earlier yr.

- Black Tuesday (1929): This market collapse marked the beginning of the Nice Despair. In simply two days – October 28 and 29, 1929 – the Dow Jones Industrial Common (DJIA) plunged a mixed 25%. Inside weeks, by mid-November, the Dow had shed practically 50% of its worth.

- Black Monday (1987): This crash noticed the biggest single-day proportion decline in U.S. inventory market historical past. The DJIA plummeted 22.6% in in the future, shedding over $500 billion in worth.

- Friday the thirteenth Mini-Crash (October 1989): On this ominous date, the DJIA plummeted 190.58 factors, or 6.91%, in a single buying and selling session. This sharp decline was attributed to the collapse of a $6.75 billion leveraged buyout deal for UAL Company, the dad or mum firm of United Airways. This occasion is notable for occurring simply 4 days after the key indices had reached all-time highs.

- 2008 Monetary Disaster: Though the disaster started in September and lasted for months, October 2008 noticed essentially the most extreme market declines. On October 15, the Dow Jones Industrial Common (DJIA) plummeted 733 factors, a 7.9% drop that marked the second-largest single-day level decline in historical past at the moment.

These dramatic occasions have left a long-lasting impression on the collective reminiscence of buyers, contributing to the October Impact delusion. However what drives this persistent perception, and the way does it influence investor conduct?

Psychological Impression

These psychological elements work in tandem, making a suggestions loop that may contribute to market volatility throughout October.

- Anchoring Bias: Buyers are likely to fixate on previous October crashes, main them to anticipate related occasions. This cognitive bias causes individuals to rely too closely on preliminary info (the “anchor”) when making choices. Recollections of historic market crashes function highly effective anchors, influencing threat notion and funding decisions, even when present market situations differ considerably from these previous occasions.

- Media Affect: Monetary information retailers typically spotlight historic October crashes, reinforcing nervousness amongst buyers. The media’s tendency to deal with dramatic occasions and draw parallels between present market situations and previous crashes can amplify investor issues. This elevated protection throughout October can result in heightened market sensitivity and volatility, as buyers react to each present information and historic comparisons introduced by the media.

- Self-Fulfilling Prophecy: Even the expectation of a downturn could cause buyers to promote preemptively, doubtlessly triggering the very decline they concern. As extra buyers act on this concern by promoting shares or holding off on new investments, it could possibly create downward stress available on the market. This collective conduct can result in precise market declines, perpetuating the cycle.

Gold’s Efficiency a Protected Haven Throughout Market Crashes

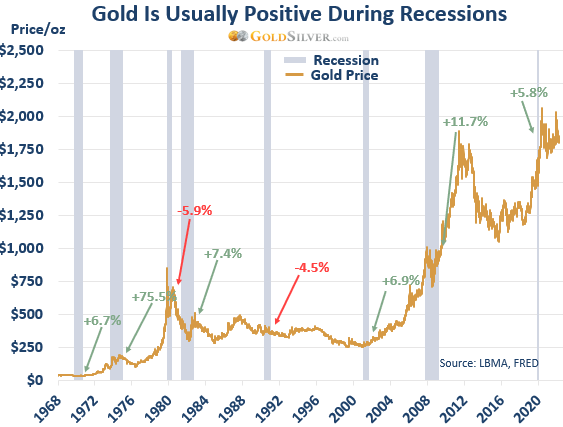

Whereas October could carry market jitters, it additionally presents a possibility for buyers to think about diversifying their portfolios with gold. Traditionally, gold has served as a safe-haven asset throughout instances of financial uncertainty and market volatility.

- 1973-1974 Oil Disaster: Throughout this 23-month bear market the place the S&P 500 dropped 48%, gold costs soared by 73%.

- 1987 Black Monday: Whereas the inventory market plummeted 22.6% in a single day, gold costs rose by 4.6% within the following week.

- 2000-2002 Dot-com Crash: Because the S&P 500 fell 49% over this era, gold costs elevated by 12.4%, providing a hedge towards the tech-driven market decline.

- 2008 Monetary Disaster: Whereas the S&P 500 fell by 38.5%, gold costs elevated by 5.5% over the yr. Extra impressively, from 2007 to 2009, because the disaster unfolded, gold surged by 25.5%.

- 2020 COVID-19 Crash: Gold reached report highs later within the yr as buyers sought security amid financial uncertainty. From the market backside in March 2020 to its peak in August, gold costs rose by roughly 40%.

Traditionally gold has a robust observe report of performing nicely after a disaster. The next graph exhibits the 9 largest crashes within the S&P 500 for the reason that mid-Seventies.

The inexperienced containers imply gold rose in the course of the market crash; yellow means gold fell however lower than the S&P 500; and pink means it fell extra.

Whereas shares crashed, gold would protect and even develop your wealth as a rule.

Why Gold Shines Throughout Turbulent Occasions

Gold’s enduring enchantment as a safe-haven asset is rooted in its distinctive traits.

First, it has maintained its worth over centuries, offering a dependable hedge towards inflation and foreign money fluctuations. Second, gold’s worth actions typically diverge from these of shares and bonds, providing essential portfolio diversification. Lastly, its international acceptance ensures liquidity even when monetary markets are in turmoil.

These attributes, mixed with gold’s historic resilience throughout market downturns, make it a compelling possibility for buyers looking for to fortify their portfolios.

Defending Your Portfolio with Gold

For buyers involved in regards to the October Impact or normal market volatility, incorporating gold right into a portfolio could be a prudent technique.

- Diversification: Allocating a portion of your portfolio to gold may also help mitigate total threat. Monetary advisors typically suggest a 5-10% allocation to treasured metals as a part of a diversified funding technique.

- Greenback-Price-Averaging: As an alternative of making an attempt to time the market, take into account frequently investing in gold all year long. This method is called dollar-cost-averaging and may also help easy out worth fluctuations and cut back the influence of short-term volatility.

Throughout market crashes, many buyers panic and make rash choices. Nonetheless, historical past typically exhibits that one of the best plan of action is to remain calm and preserve your long-term funding technique. Gold’s stability throughout market turmoil can present the reassurance wanted to keep away from impulsive promoting.

October Impact: Extra Fantasy than Actuality

Whereas the October Impact could also be extra delusion than actuality, it serves as a reminder of the significance of portfolio safety and emotional self-discipline in investing. By understanding the psychological elements behind market volatility and contemplating gold as a safe-haven asset, buyers can navigate unsure instances with higher confidence.

Keep in mind, a well-balanced portfolio that features gold may also help you climate market storms, whether or not they are available in October or another month of the yr. The secret’s to have a stable technique in place earlier than market turbulence hits. This fashion, when others are panicking, you may stay calm, understanding that your diversified portfolio, together with gold, is designed to face up to market fluctuations.

In the long run, profitable investing isn’t about predicting each market transfer, however about being ready for numerous eventualities. Gold’s historic efficiency throughout market downturns makes it a worthwhile instrument on this preparation, doubtlessly offering stability whenever you want it most.

Finest,

Brandon S.

Editor, GoldSilver