Practically half a century in the past Herbert and Nelson Hunt inherited an enormous fortune from their father H.L. Hunt, a big-time Texas oil tycoon. With a robust shared perception in valuable metals, the brothers turned their eyes to silver as a hedge towards the raging inflation of the Nineteen Seventies.

Their plan was far-fetched however easy – to purchase up as a lot silver as doable and thereby drive up its value. They bought a mixture of bodily silver and futures contracts to construct their holdings. By 1979, the billionaire brothers had amassed sufficient silver to manage roughly one-third of your entire world provide.

The worth of silver skyrocketed from round $6 per ounce in 1979 to a peak of almost $50 per ounce in January 1980 – a acquire of over 700% in lower than a 12 months.

Nonetheless, this drew the eye of regulators and different market individuals. Fearing market manipulation, the Commodity Futures Buying and selling Fee (CFTC) and exchanges carried out new guidelines to restrict the shopping for of commodities on margin. This was a big blow to the Hunt brothers, who had been extremely leveraged. Unable to satisfy margin calls, they had been pressured to liquidate a lot of their belongings.

On March 27, 1980, referred to as “Silver Thursday,” the value of silver collapsed, and the Hunt brothers’ empire crumbled. They finally declared chapter and confronted authorized penalties for his or her actions…

Silver: The Small Market With Sky-Excessive Potential

The Hunt brothers’ story is greater than only a enjoyable piece of monetary trivia. It’s a lesson we are able to be taught from at present. You see, there’s a motive they determined to nook the silver market – as an alternative of the inventory, bonds, and even gold market…

- The Silver Market Is Severely Tiny — As of 2024, the worldwide home fairness market is round $105 trillion. The worldwide bond markets? Over $130 trillion… In the meantime the market cap for investable silver bullion is estimated to be round $150 billion. Dozens of corporations within the U.S. that dwarf your entire bodily silver market many occasions over.

- Gold Endures Whereas Silver Is Consumed — Practically all of the gold ever mined remains to be round in some kind – even jewellery that’s hundreds of years outdated. However silver could be very typically utilized in gadgets like batteries and electronics, and finally discarded. A big chunk of silver mined yearly leads to landfills, additional shrinking the provision…

- Opening A New Silver Mine Takes a Lengthy Time — From discovery to manufacturing, the complete means of opening a brand new silver mine can take anyplace from 10 to twenty years. When the worldwide silver provide begins getting low, prefer it has for the final couple of years, you’ll be able to’t simply ramp up manufacturing subsequent quarter. A silver mine might be below development for a number of years earlier than it yields its first nugget of silver.

- Silver May Be the Most Undervalued Asset Out There — If you take a look at the value of silver at its peak in comparison with at present, you will see that silver remains to be low cost. Shares, bonds, oil, gold, hire, the value of meat… the value of all of those belongings have multiplied many occasions over time. However silver remains to be round $30 in comparison with its $50 peak in 1980.

- Silver Delivers BIG Throughout Bull Markets — The smaller measurement of the silver market in comparison with the gold market implies that it may be extra unstable. Smaller markets are usually extra vulnerable to cost swings attributable to decrease liquidity and will be influenced extra simply by giant transactions.

The comparatively small measurement of the silver market is why two brothers (albeit billionaires) had been in a position to affect the silver market themselves – as a result of when huge cash arrives, it could actually flood the silver market and set the value hovering.

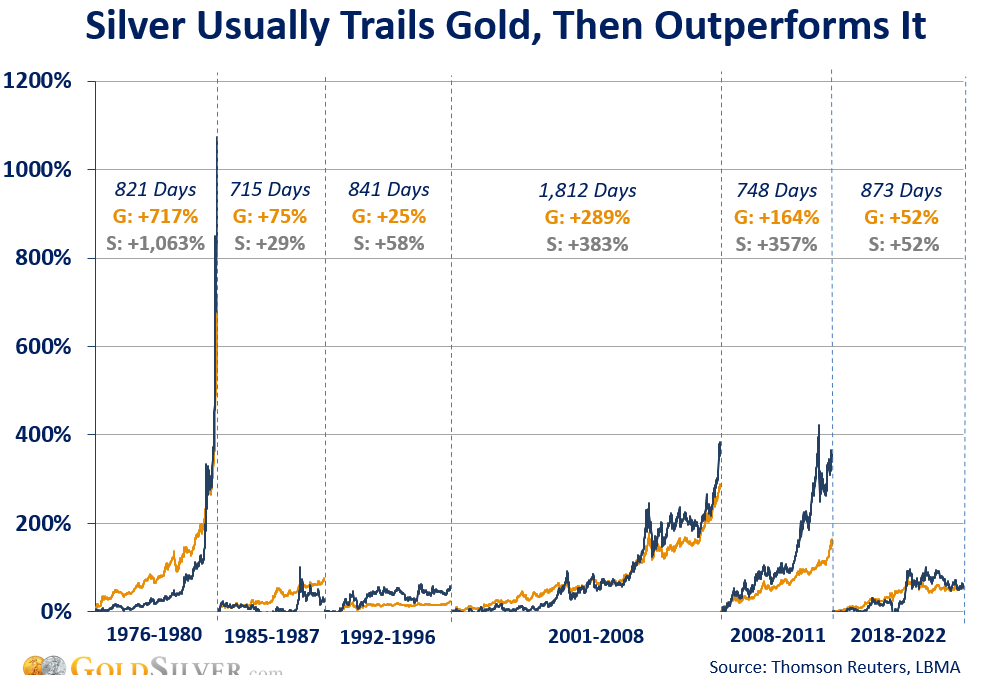

After we have a look again at a few of the largest valuable metals bull markets of the final century, you’ll see that gold typically begins off scorching, however it’s silver that usually comes away with the largest beneficial properties.

You might also discover how 90% of the upward transfer tends to occur within the final 10% of bull market. That closing spike is when everybody else jumps on the bandwagon, and that’s the place you see the actually life-changing beneficial properties. That final closing transfer is why it’s extremely essential to ensure you’ve accrued sufficient silver BEFORE the bull market occurs.

Should you’ve heard our personal Mike Maloney discuss silver hitting triple digits, this historic information says he is perhaps onto one thing. If silver does attain these costs – whether or not it’s one 12 months or 5 years from now – that will be a acquire of over 300% from at present’s costs.

Clearly, this isn’t more likely to occur in a single day — however with silver costs hovering round $30/oz, now might be the proper time to build up. As a result of when the dear metals bull market arrives, historical past suggests silver has extra upside potential than simply about another asset.

GoldSilver makes it straightforward to get began with our InstaVault program, it doesn’t matter what your finances.

ADD SILVER TO YOUR PORTFOLIO TODAY

Greatest,

Brandon S.

GoldSilver