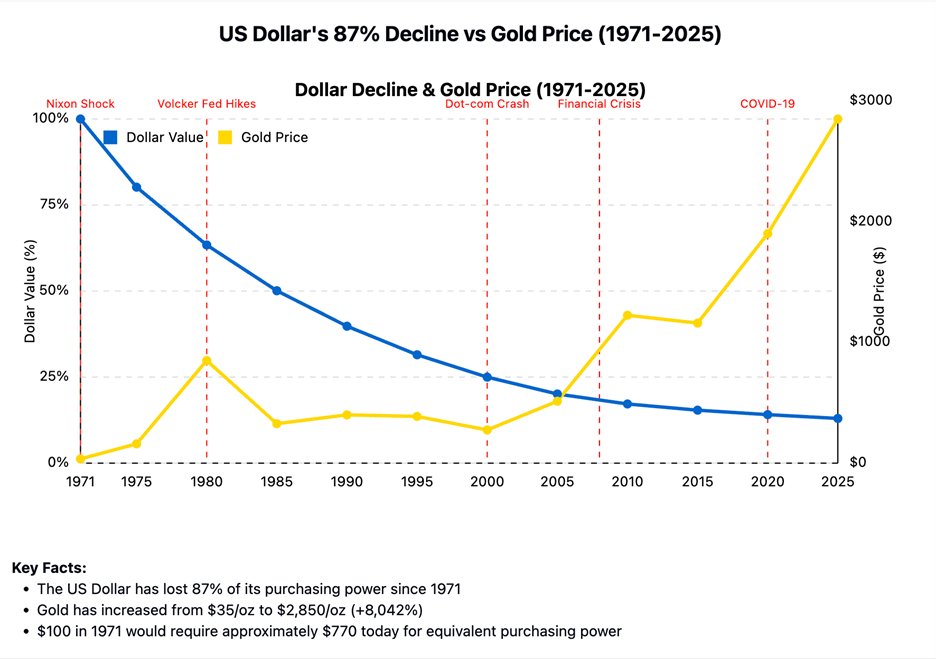

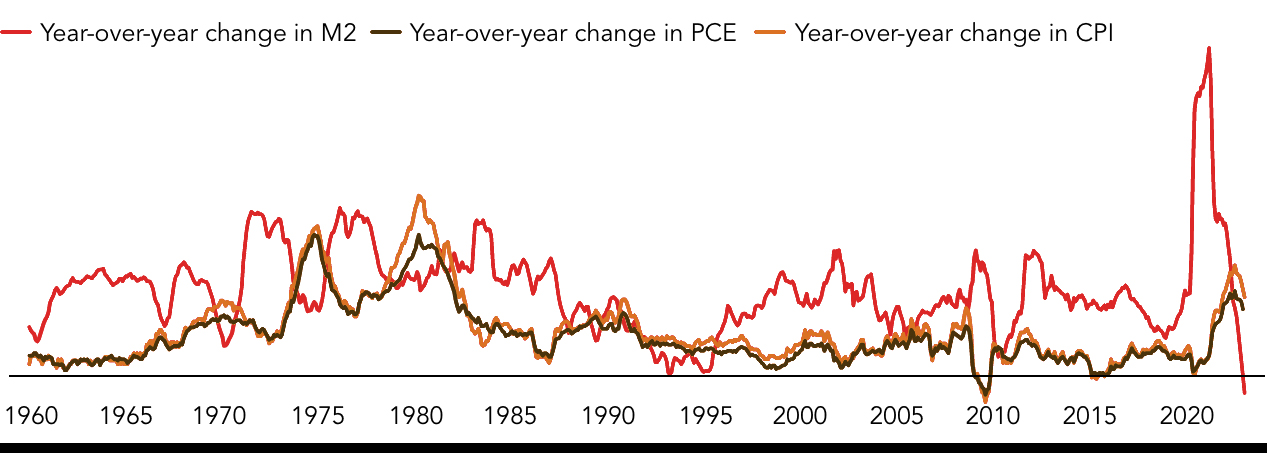

Since the US deserted the gold normal in 1971, the U.S. greenback has misplaced 87% of its buying energy. The US greenback’s decline highlights the basic worth proposition of bodily valuable metals as a retailer of worth and hedge towards forex debasement.

The Nixon Shock and Its Lasting Affect

On August 15, 1971, President Richard Nixon introduced that the US would not convert {dollars} to gold at a hard and fast worth, successfully ending the Bretton Woods system.

This momentous resolution, the “Nixon Shock,” essentially reworked the worldwide financial system.

Earlier than this resolution, the U.S. greenback, backed by gold, had maintained comparatively secure buying energy for many years. The gold normal disciplined financial coverage by requiring that forex be backed by bodily gold reserves.

With out this anchor, central banks gained unprecedented capability to broaden the cash provide.

The Penalties of Untethered Foreign money

The outcomes of this coverage shift have been dramatic:

- In 1971, the common worth of a brand new residence in the US was roughly $25,200. As of March 2025, that determine had surpassed $500,000.

- In 1971, a gallon of gasoline price round 36 cents. Right this moment, People pay over $3.80 per gallon on common.

- The typical household automotive that price $3,000 in 1971 would now price properly over $55,000.

These worth will increase usually are not merely the results of pure financial development or improved high quality—they essentially mirror the erosion of the greenback’s buying energy by persistent inflation.

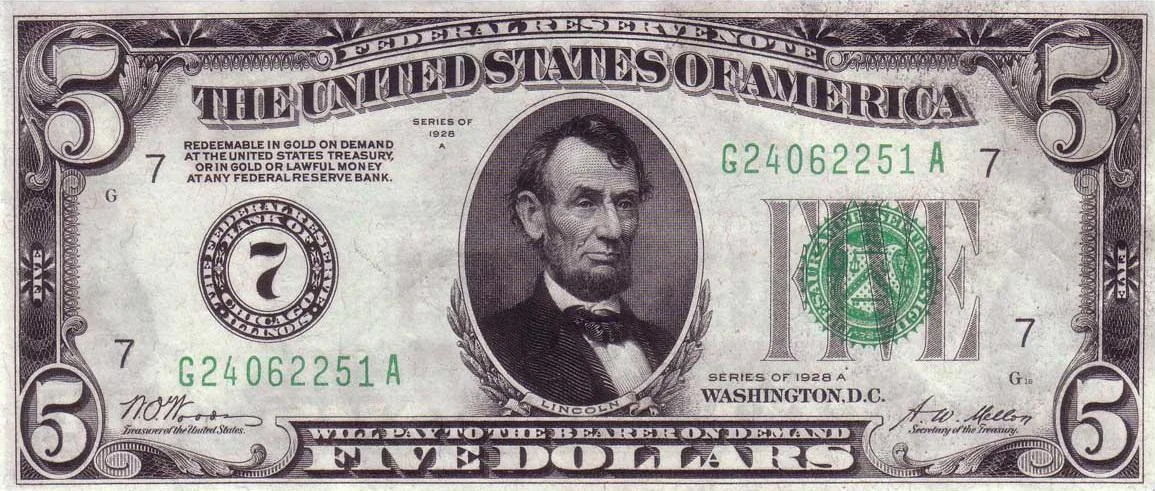

The federal authorities and Federal Reserve have dramatically expanded the cash provide, significantly throughout financial stress. Cash printing reached unprecedented ranges throughout the COVID-19 pandemic, with the M2 cash provide rising by almost 40% in simply two years.

Much more regarding, the Federal Reserve’s stability sheet has expanded past $8 trillion as of early 2025, sustaining traditionally excessive ranges regardless of makes an attempt at quantitative tightening.

Every newly created greenback dilutes the worth of each greenback already in circulation, functioning as a hidden tax on savers and people on fastened incomes.

Gold and Silver: Preserving Buying Energy

Whereas fiat currencies just like the U.S. greenback have persistently misplaced worth, bodily valuable metals have maintained their buying energy over millennia:

- An oz. of gold that purchased a nice males’s swimsuit in Historical Rome would nonetheless purchase one at present.

- Silver has equally preserved wealth all through human historical past, sustaining its worth whereas numerous paper currencies have failed.

The efficiency of gold since 1971 has been significantly telling. When Nixon closed the gold window, gold traded at $35 per ounce.

Right this moment, as of March 2025, it trades above $2,850 per ounce, reaching a number of all-time highs in latest months—a transparent reflection of the greenback’s declining worth fairly than gold “going up” in any absolute sense.

Gold Bullion: The Final Inflation Defend Amid Rising Tariffs and International Financial Uncertainty

Right this moment’s macroeconomic panorama is more and more dominated by rising protectionist insurance policies, notably propelled by the second Trump administration’s substantial new tariffs on Chinese language imports and potential commerce obstacles with different financial companions. Whereas these tariffs purpose to defend home industries, they concurrently generate inflationary pressures inside provide chains and escalate enter prices for producers.

In a local weather of elevated financial uncertainty and potential forex fluctuations, investing in gold bullion stands out as a extremely prudent selection. Bodily gold acts as a conventional safeguard towards inflation and forex depreciation, providing important safety, particularly when world commerce tensions threaten financial stability.

As central banks repeatedly broaden their stability sheets and sovereign debt reaches unprecedented ranges, gold’s inherent worth and its distinctive place exterior the monetary system make it a vital factor in any funding portfolio geared toward preserving wealth.

Not like currencies that danger debasement resulting from unpredictable financial insurance policies, gold persistently retains its buying energy by numerous financial cycles and geopolitical upheavals. This valuable steel provides buyers a tangible, transportable retailer of worth that has confirmed resilient to centuries of financial turbulence.

Spend money on your future—embrace the soundness and safety solely gold can supply throughout these unsure instances.

BullionStar: Your Companion in Wealth Preservation

In an period of unprecedented financial growth and forex debasement, bodily valuable metals supply a time-tested various to holding depreciating fiat forex.

BullionStar gives buyers with safe entry to investment-grade gold, silver, platinum, and palladium—property which have preserved wealth for 1000’s of years.

Our storage options in Singapore, New Zealand, and the United States supply extra safety by geographic diversification, defending your property from political danger in single international locations.

The Path Ahead

Current cycles of inflation, rising world debt burdens, and growing geopolitical tensions have solely strengthened the case for valuable metals. The proof is obvious, with the U.S. nationwide debt exceeding $35 trillion and world central banks actively diversifying their reserves with record-high gold purchases.

The greenback’s 87% decline since 1971 is a stark reminder that fiat currencies usually are not dependable long-term shops of worth.

Whether or not you’re safeguarding current wealth or making a monetary legacy for future generations, bodily valuable metals supply safety towards the continued devaluation of paper currencies.

Go to BullionStar at present to learn the way our premium bullion merchandise and safe storage options may also help you protect your buying energy in an more and more unsure financial panorama.