The next evaluation breaks down the Fed stability sheet intimately. It exhibits completely different components of the stability sheet and the way these quantities have modified. It additionally exhibits historic rate of interest developments.

Breaking Down the Stability Sheet

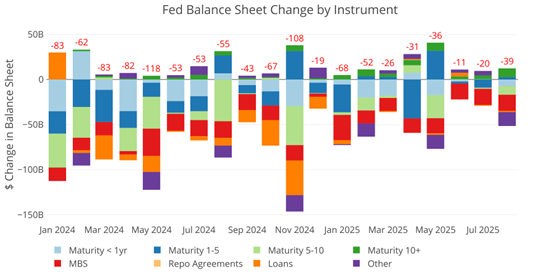

In March, the Fed introduced an additional discount within the stability sheet runoff from $25B a month to $5B a month. The information exhibits that they’ve been lowering the tempo of runoff however haven’t but gotten all the way down to the goal $5B a month. The reductions have fallen, however so have the additions.

Determine: 1 Month-to-month Change by Instrument

The desk beneath gives extra element on the Fed’s QT efforts. As proven, the present measurement of the stability sheet is $6.6T which implies it might take over 100 years to totally wind down their stability sheet on the new $5B tempo.

Determine: 2 Stability Sheet Breakdown

The weekly exercise will be seen beneath. As proven, it’s been principally in line with huge chunks alongside the best way. It’s also permitting a spread of maturities and merchandise to roll off.

Determine: 3 Fed Stability Sheet Weekly Adjustments

The chart beneath exhibits the stability on detailed objects in Loans and likewise Repos. These have been the applications arrange within the wake of the SVB collapse early final yr. The entire applications have dropped all the way down to zero at this level displaying that the emergency measures have come to an in depth.

Determine: 4 Mortgage Particulars

Yields

Yields have been fluctuating inside a band since Sept 2022, ranging principally between 3.25% and 4.75%. The vary of charges has begun to widen in latest months and the yield curve takes on a extra regular form.

Determine: 5 Curiosity Charges Throughout Maturities

This normalization of the yield curve will be seen within the chart beneath. The unfold between the two yr and 10 yr continues to maneuver up. This doesn’t imply a recession is now not possible as a result of the inverted yield curve can work on a major lag.

Determine: 6 Monitoring Yield Curve Inversion

The chart beneath exhibits the present yield curve, the yield curve one month in the past, and one yr in the past. The lengthy finish has moved up whereas the medium-term bonds have stayed fairly flat for a yr. As soon as the Fed lowers charges in September, it should convey down the very short-term a part of the curve.

Determine: 7 Monitoring Yield Curve Inversion

The Fed Takes Losses

When the Fed makes cash, it sends it again to the Treasury. This has netted the Treasury near $100B a yr. This may be seen beneath.

Determine: 8 Fed Funds to Treasury

Chances are you’ll discover within the chart above that 2023 and 2024 are displaying $0. That’s as a result of the Fed has been dropping cash. Based on the Fed: The Federal Reserve Banks remit residual web earnings to the U.S. Treasury after offering for the prices of operations… Optimistic quantities characterize the estimated weekly remittances attributable to U.S. Treasury. Destructive quantities characterize the cumulative deferred asset place … deferred asset is the quantity of web earnings that the Federal Reserve Banks want to appreciate earlier than remittances to the U.S. Treasury resume.

Principally, when the Fed makes cash, it provides it to the Treasury. When it loses cash, it retains a damaging stability by printing the distinction. That damaging stability has simply exceeded $238B!

Determine: 9 Remittances or Destructive Stability

Who Will Fill the Hole?

The Fed has not been shopping for within the Treasury marketplace for over a yr (they’ve been promoting); nevertheless, the Treasury remains to be issuing tons of recent debt. Who has been selecting up the slack for the reason that Fed stepped away?

Worldwide holdings have elevated an honest quantity during the last yr by over $750B. Sadly, this pales compared to the quantity of debt issued by the Treasury total which is nearer to $2T.

One factor to notice is that the final 5 months have seen virtually zero improve in worldwide holdings. It has stayed utterly flat. That is possible associated to the present debt ceiling. No new issuance – no new shopping for.

Be aware: knowledge is up to date on a lag. The most recent knowledge is as of June

Determine: 10 Worldwide Holders

It must be famous that China continues to scale back holdings of US Treasuries. They’ve dropped $500B during the last decade, whereas Japan has been principally flat over the identical time. The slack has been picked up by different international locations.

Determine: 11 Common Weekly Change within the Stability Sheet

Historic Perspective

The ultimate plot beneath takes a bigger view of the stability sheet. It’s clear to see how the utilization of the stability sheet has modified for the reason that World Monetary Disaster.

Determine: 12 Historic Fed Stability Sheet

Conclusion

The Fed stability sheet has been very quiet for a couple of years. A gentle, sluggish discount. If Trump continues to exert stress on the Fed, then it should possible see a reversal of the QT. This may imply new all-time highs within the Fed stability sheet will likely be coming sooner or later.

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist right now!