Crude oil futures held to positive aspects Tuesday as OPEC caught to its demand forecasts, relying on regular financial development this yr.

Oil costs rallied greater than 2% on Monday with U.S. crude oil reserving its finest day since Feb. 8. The market has recovered the losses from final week, after promoting off to four-month lows within the wake of the choice by OPEC+ to extend crude manufacturing in October.

Listed below are Tuesday’s closing power costs:

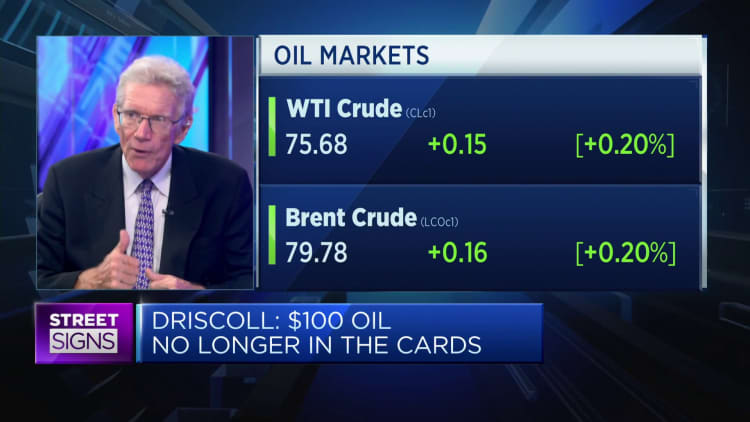

- West Texas Intermediate July contract: $77.90 per barrel, up 16 cents or 0.21%. 12 months to this point, U.S. oil has gained 8.7%.

- Brent August contract: $81.92 per barrel, up 29 cents, or 0.36%. 12 months to this point, the worldwide benchmark is forward 6.3%.

- RBOB Gasoline July contract: $2.40 per gallon, little modified. 12 months to this point, gasoline is up 14.5%.

- Pure Fuel July contract: $3.12 per thousand cubic toes, up 7.67%. 12 months to this point, gasoline has superior 24%.

OPEC is projecting oil demand development of two.2 million barrels per day for 2024 and 1.8 million bpd in 2025, in response to the group’s month-to-month report. The oil producers see world financial development of two.8% this yr and a couple of.9% in 2025.

OPEC expects the companies sector to keep up secure momentum and drive financial development within the second half of the yr, “notably supported by journey and tourism, with a consequent constructive impression on oil demand.”

WTI vs. Brent

John Evans, analyst at oil dealer PVM, stated merchants gave the impression to be “shopping for the dip” after many buyers deserted their lengthy positions within the wake of the OPEC+ manufacturing resolution.

“After oil costs skilled a bearish confluence of occasions, shook out a lot size and toyed with being oversold, there’s virtually an inevitability within the rally again to present ranges,” Evans stated in a observe.

Cash managers lower their internet lengthy place in Brent by 69% week over week to the bottom degree since 2014 within the wake of the OPEC+ resolution, in response to JPMorgan.

Regardless of the bearish sentiment final week, Goldman Sachs forecast the market will enter right into a deficit on summer season gas demand that can push Brent again as much as $86 per barrel within the third quarter.

Phil Flynn, senior market analyst on the Value Futures Group, stated “the market appeared to awaken” to the truth that the world is “sleepwalking into a worldwide oil provide deficit” given OPEC’s manufacturing cuts stay in place for now and rig counts are falling within the U.S.

Merchants are looking forward to the conclusion of the Federal Reserve assembly and U.S. inflation knowledge for Might on Wednesday. The Worldwide Power Company will launch its month-to-month oil market report the identical day.