This publish opinions BullionStar’s monetary efficiency and milestones for the monetary 12 months ending 30 June 2023 (FY 2023).

At BullionStar, transparency in sharing our monetary efficiency is a key a part of our custom. We offer detailed insights into our gross sales information, highlighting demand for various treasured metals merchandise and classes, together with different important developments. For these considering exploring our monetary journey additional, hyperlinks to opinions of earlier years are available beneath:

BullionStar Financials FY 2022 – 12 months in Overview

BullionStar Financials FY 2021 – 12 months in Overview

BullionStar Financials FY 2020 – 12 months in Overview

BullionStar Financials FY 2019 – 12 months in Overview

BullionStar Financials FY 2018 – 12 months in Overview

BullionStar Financials FY 2017 – 12 months in Overview

BullionStar Financials FY 2016 – 12 months in Overview

BullionStar Financials FY 2015 – 12 months in Overview

FY 2023, from 1 July 2022 to 30 June 2023, marked one more strong 12 months for BullionStar, as we noticed gross sales revenues reaching SGD 396.4 million. The gross sales income for FY2023 was marginally larger (1.2%) in comparison with FY 2022.

The spot gold worth in US {dollars} ended fiscal 12 months 2023 inside 5.76% of the place it had opened (open of $1814.45 on 1 July 2022 and shut of $1919 on 30 June 2023). Spot gold hit a low of $1615 in H2 2022 earlier than the worth returned to an all-time-high of $2067 on 4 Might 2023 on the heels of the liquidation of Silvergate Financial institution, the collapse of Silicon Valley Financial institution, Signature Financial institution and First Republic Financial institution on high of sturdy Central Financial institution gold purchases in Q1 2023.

The spot worth of silver in US {dollars} gained 11% over fiscal 12 months 2022, opening at $20.47 on 1 July 2022 to shut at $22.73 on 30 June 2023. Silver traded in a channel between $17.56 and $21.23 for many of H2 2022 earlier than breaking out in mid-November 2022 and rising to a excessive of $24.63 in January 2023. With volatility returning to the silver market in H1 2023, we noticed spot silver then fall sharply to $19.92 in March 2023 earlier than taking an aggressive U-turn and rising to the fiscal 12 months excessive of $26.1 in mid-April and early Might 2023 in response to the identical catalysts listed above for gold.

Central Banks Accrued Bodily Gold at Report Ranges

FY 2023 noticed us publish many articles about Central Financial institution gold purchases right here, right here, right here and right here.

On the danger of sounding like a damaged file, you will need to ask the query, “Why are Central Banks shopping for bodily gold presently, even when the worth of Gold denominated in US Greenback phrases is near its All-Time Excessive and better than some other interval in historical past?”

For H1 2023, The World Gold Council reported:

The primary goal of a Central Financial institution is to make sure monetary stability for its nation, and because the geopolitical panorama internationally is growing fragmented, fractured and polarized, the earlier strategies of portfolio allocation and managing reserves in a world that was eager on globalization and connectedness is now not efficient nor legitimate.

Central Banks are more and more motivated to diversify their reserve belongings into bodily gold as a result of a number of engaging traits it possesses. Gold is straightforward to purchase and promote (liquid), has an extended historical past of being cash and as a confirmed retailer of worth throughout 1000’s of years. It eliminates the chance {that a} nation that points a forex goes bankrupt (no default or counterparty danger), is of the identical high quality and likeness internationally (homogeneous), and it’s price is acknowledged internationally (ubiquitous).

Whereas different belongings held by Central Banks could share sure particular person traits listed above, the collective mixture of such traits are distinctive to bodily Gold.

With the “weaponization” of the US greenback and the SWIFT system, most not too long ago used to impose sanctions on Russia, Central Banks which might be overly concentrated in holding US greenback denominated reserves or belongings or understand worldwide sanctions to be a possible menace to their nation, are logically shifting their belongings or reserves out of US greenback belongings and the SWIFT system. Gold is pure recipient of these outflows.

Are the dangers confronted by Centrals Banks on this altering world a lot completely different from these confronted by us at a person stage?

Inflation was a International Phenomenon

FY 2023 was additionally marked by important inflationary pressures globally, each in developed economies and rising economies. Inflation in the US hit a 40-year excessive in the beginning of FY 2023 with a 9.1% print, whereas the Eurozone hit a file excessive of 10.6% in October 2022 and equally the UK confronted peak inflation at 11.1% in October 2022. Venezuela, dealing with hyperinflation for years, continued to wrestle with excessive inflation (exceeding 400%) throughout this era. Lebanon, experiencing extreme financial disaster, noticed inflation exceeding 250%. Argentina grappled with comparable challenges with inflation exceeding 100%. A number of different international locations, together with Turkey, Sri Lanka, Iran and Zimbabwe additionally skilled important inflation pressures throughout this era.

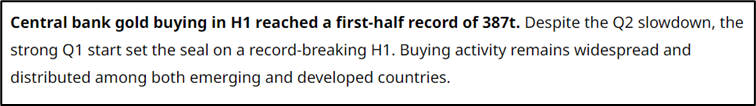

In a response to the above, we noticed the US Central Financial institution, the Federal Reserve, spend a lot of FY 2023 attempting to quash the inflation pressures within the US economic system by mountain climbing rates of interest aggressively. In FY 2023, we noticed the US Fed Funds Charges go from 1.75% in July 2022 to five.25% by finish June 2023!

United States Fed Funds Charges

Throughout the identical interval, we noticed the US greenback worth of spot gold act as a hedge and noticed an 5.76% improve in worth as proven within the chart beneath. Bodily gold is usually thought of a option to shield towards inflation for given its restricted provide and its high quality as a tangible asset with no counterparty danger, the place in contrast to fiat currencies, which central banks can print extra of, the availability of bodily gold is comparatively fastened and finite. This shortage helps keep its worth over time, as growing demand doesn’t get met with an ever-growing provide, and in contrast to digital belongings or shares, bodily gold is a bodily asset you could maintain and retailer, which is interesting throughout occasions of uncertainty and monetary instability.

Development in Our Folks and Vaulting Infrastructure

Over FY 2023, we’ve invested in our folks and infrastructure by increasing our staff and vaulting infrastructure. This funding positions us for continued progress and success sooner or later.

With Singapore’s distinctive place of being a small, impartial, politically secure nation, and having a balanced diplomacy by participating with all main powers whereas sustaining its personal pursuits and upholding its dedication to worldwide legislation, we’re lucky to have seen important progress in worldwide prospects trusting us as custodians to vault their bullion with us throughout these turbulent occasions as geopolitical tensions worsen.

Our vault was additionally featured in Channel NewsAsia’s (CNA) documentary movie on Singapore’s nationwide reserve belongings. The CNA documentary, which is titled “Singapore Reserves: The Untold Story | Singapore Reserves Revealed”, will be considered on the CNA Insider channel on YouTube right here.

The section that includes BullionStar’s CEO in BullionStar treasured metals vault, and which additionally options footage from the MAS gold vault, runs from roughly minutes 11:46 till 15:35. That section will be seen right here.

FTX Collapse and the Aftermath

As one of many earliest bullion sellers in world to simply accept Bitcoin again in Might 2014 and that continues to allow prospects to purchase, promote or commerce bullion with cryptocurrency, we obtained an inflow of consumers that swapped their cryptocurrencies for treasured metals to be saved at BullionStar or swapped their saved treasured metals for cryptocurrencies throughout FY 2023.

In a flight to security and safety, we had been lucky to win over new prospects who positioned their belief in our state-of-the-art vault storage answer that provides full direct authorized possession of their saved bullion and full insurance coverage protection together with 5 completely different audit strategies to confirm the existence and correctness of the saved bullion for absolute transparency and peace of thoughts.

BullionStar Financials FY 2023 – 12 months in Overview – Gross sales

BullionStar’s gross sales revenues remained strong in FY 2023, totalling SGD 396.4 M.

Gross sales per Product Class

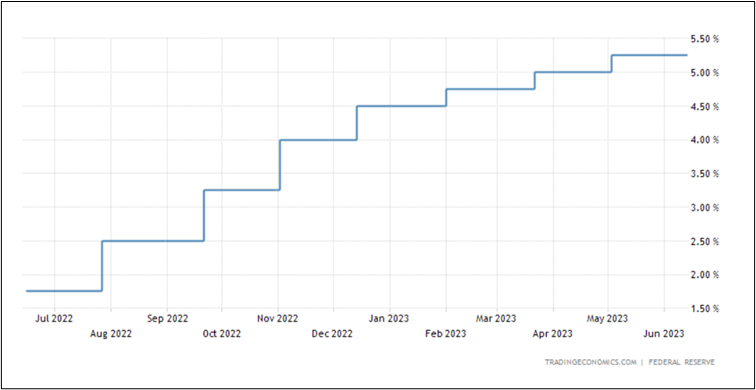

In FY2023, gold represented 73.56% of gross sales, and silver represented 25.28% of gross sales, with the remaining 1.16% comprising principally platinum gross sales. This breakdown in illustration is similar to the breakdown in FY2022.

Throughout the total gold product class, 79.22% of gross sales in FY2023 represented gold bars, 20.4% represented gold cash, with the rest attributed to numismatics, gold jewelry, and different merchandise which collectively comprised 0.38%. Because of this 58.28% of all FY 2023 gross sales had been in gold bars, 15% in gold cash, and 0.28% in different gold product segments.

Throughout the gold bar class, greater than 78% of gross sales comprised the bigger funding gold bars, with 38% representing 1kg gold bars, and 40% representing 100g gold bars. Throughout the gold coin class, the main vendor was Canadian Gold Maples (40% of gold coin gross sales), adopted by United Kingdom Gold Britannia (21.12% of gold coin gross sales.)

Throughout the silver product class, 86.82% of income from silver throughout FY2023 represented silver bars, 12.97% represented silver cash and rounds, and the remaining 0.21%, was attributed to numismatics and different merchandise. Because of this 21.95% of all FY 2023 gross sales had been in silver bars and three.28% in silver cash.

Throughout the silver bar class, 51.7% of silver bars offered had been 1kg silver bars, whereas a further 8% had been LBMA Good Supply silver bars. Throughout the silver coin class, the Royal Canadian Mint’s Canadian Silver Maples had been the main vendor, representing 22.39% of silver cash gross sales. Coming in at a really shut second, The Royal Mint’s Silver Britannia represented 21.32% of silver cash gross sales.

BullionStar recorded 33,033 buyer purchase orders in FY 2023, in comparison with 29,496 purchase orders in FY 2022, representing 11.99% improve within the variety of buyer purchase orders.

With FY 2023 gross sales revenues being 1.2% larger than FY 2022 in comparison with a 11.99% improve within the variety of purchase orders, it’s not stunning that the typical order dimension in FY 2023, SGD 11,932.53, is decrease than the corresponding determine from FY 2022 of SGD 13,219.87. Equally, the median order dimension in FY2023 was SGD 1,244.87, additionally decrease than the corresponding determine in FY2022 of SGD 1,357.74.

As one of many world’s most international bullion sellers with a robust worldwide profile, there have been prospects from a staggering 116 international locations represented in BullionStar’s FY2023 gross sales. Since BullionStar was launched in 2012, there have been BullionStar prospects from 126 international locations internationally.

Throughout FY2023, there have been 3,047,510 visits to the BullionStar.com web site, which was a 29.3% improve on the variety of web site visits in FY2022.