Even the mainstream is beginning to acknowledge the huge downside of vacant workplace buildings littering American cities, slowly turning them into post-Covid wastelands. Whereas just a few pundits are claiming (in considerably Orwellian vogue) that the surge in empty business actual property is definitely an opportunity for a utopian turnaround within the ashes of Covid weirdness, the potential for an “City Doop Loop” triggered by CRE is now being extensively acknowledged as a attainable set off for a broader financial meltdown.

With a pre-existing downside amplified drastically by COVID-19 after which set in stone, the rising workplace emptiness price has no actual answer. The issue is slowly and steadily getting worse, changing into a “new regular” that merely can’t go on without end with out additional financial repercussions. And this time is distinct from different main downturns in that in earlier shocks, like 9/11 and the 2008 monetary disaster, everybody kind of agreed that finally, issues would decide again up once more. This time, it’s everlasting.

Take only a few examples:

New York — There’s a brand new document for workplace vacancies in Manhattan, which have risen above 17%, and present no indicators of slowing down. Vacancies have grown 70% in Manhattan since Covid (rising 20% nationally in the identical interval), with the Monetary District hardest hit.

Pittsburgh — At the moment sitting above 20% vacant, or 27% if you happen to consider subleases, it’s estimated that practically half of the town’s business actual property may very well be empty inside 4 years. If not reversed, a neighborhood disaster (on the very least) appears all however assured.

Portland — With the best workplace emptiness price within the nation — a mind-melting 30% or extra — Portland officers are providing determined pleas within the type of tax credit and different incentives to fill its abandoned business buildings.

Los Angeles — Demand is so low for business actual property that, in a single case, builders deserted plans to construct a shiny new 61-story workplace tower instead of an empty business constructing. As an alternative, they demolished it and put in a handful of EV charging stations.

There’s no nice answer. Most cities are floating quixotic proposals to show empty places of work into residences to “repair” the disaster, however that is typically too costly to be sensible and requires navigating plenty of bureaucratic purple tape, like adjustments to zoning legal guidelines.

Recognizing how dependent their cities are on property taxes harvested from business actual property, getting municipal governments to vary zoning legal guidelines really is perhaps the simplest half. Vacant workplace buildings equate to plummeting income, forcing cities to make up the loss by growing taxes elsewhere or lowering spending.

For one, New York Metropolis’s business actual property accounts for 20% of the property tax and 10% of general income, with the town comptroller projecting a $1.1 billion shortfall from vacant places of work in 2024. In Boston, property taxes on workplace buildings comprise a staggering 22% of complete income.

Even essentially the most optimistic, desperately attempting to see this disaster as an “alternative” to start out contemporary, are being compelled to acknowledge the challenges. However turning business areas into residential ones and hoping for one of the best is without doubt one of the solely few “Hail Mary” choices cities have left to keep away from an extra implosion that bleeds into the banking sector and units off a series response.

Final yr’s failures of Silicon Valley Financial institution, Signature Financial institution, First Republic Financial institution, and Credit score Suisse confirmed that extra progress is required in a variety of areas to make sure that banks aren’t too large to fail. Learn our weblog for extra concerning the classes discovered. https://t.co/PFtEp1X8Ri pic.twitter.com/HBzgWsVC2f

— IMF (@IMFNews) March 31, 2024

For the hopeful, akin to Dana Lind of the Penn Institute for City Analysis, the customer’s market in large cities offers a golden alternative that was missed through the 2008 disaster. She hopes native consumers will use these empty buildings to invigorate cities by serving native wants, or that the empty places of work will likely be purchased by cities themselves and become vibrant neighborhood facilities:

“Sensible buyers see what is going on in American downtowns 4 years out from the onset of the pandemic—the enterprise fundamentals of cities like New York, Boston, or Houston are comparatively secure and will even dramatically enhance. Why not purchase?”

Certain, fundamentals may enhance. However will they? She goes on to say:

“As business properties fall into foreclosures in 2024, cities may take steps to raised form the town they need sooner or later by really investing in these properties themselves.”

All of it sounds pretty. Sadly, I’m much less assured the CRE disaster will be contained this fashion, and that it gained’t contribute to a broader meltdown.

Empty places of work imply fewer individuals visiting the encompassing shops and eating places. Because the financial harm begins to snowball, the domino impact finally reaches the banking sector, particularly smaller and mid-size banks — and thus, the “Doom Loop” takes type. If we’re to take the current failure of regional companies like New York Group Bancorp as proof, this vicious spiral could already be starting.

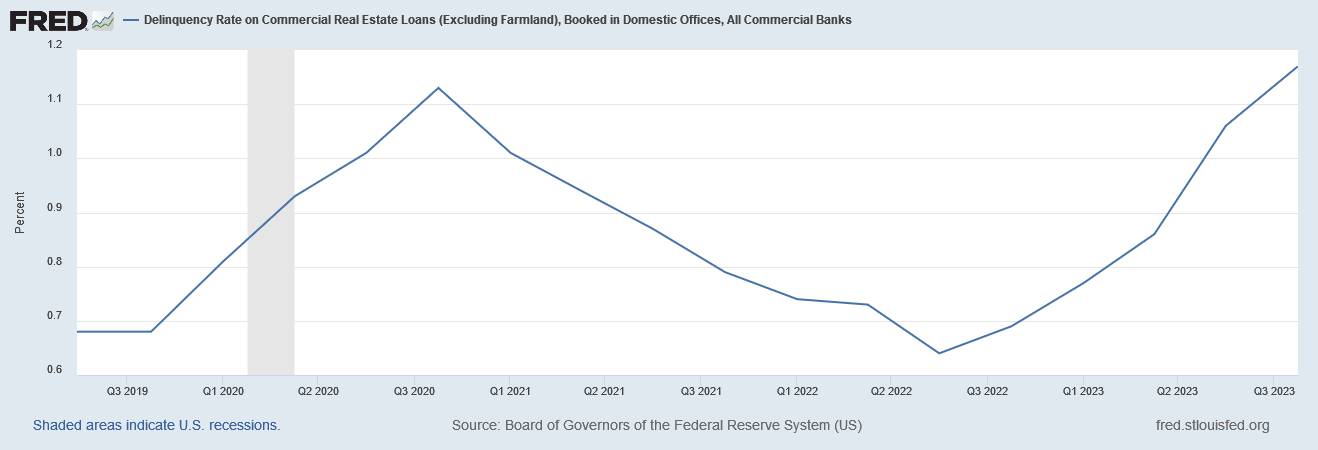

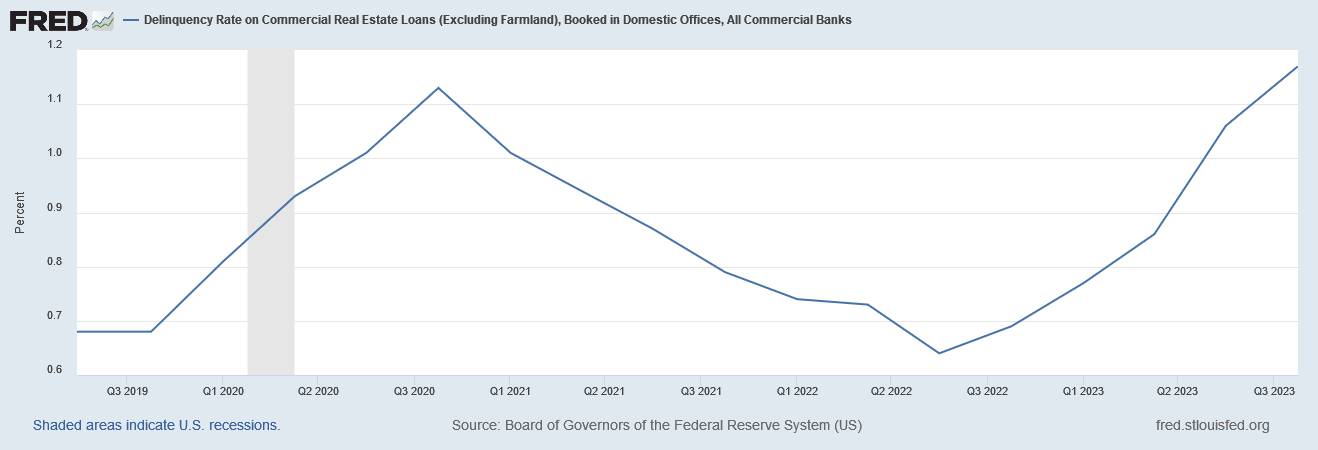

CBS reported in January that workplace mortgage delinquencies have been up a surprising 4 instances in comparison with the earlier yr. In beneath two years, business actual property loans totaling $1.5 trillion are resulting from expire, portending catastrophe for the economic system when the invoice comes due and workplace house owners can’t pay it. In accordance with knowledge from the St. Louis Fed, delinquency charges on business actual property loans have already ticked above their Covid peak:

Occupancy Charge on CRE Loans (Excluding Farmland), Booked in Home Places of work, Q3 2019 to Q3 2023

In an business that lives and dies by rates of interest, the issue offers one other highly effective supply of strain on the Fed to chop charges this yr, boosting the underside line for business landlords and builders who’re being squeezed by a excessive value of borrowing and already scrambling to vary the phrases of their debt.

A current Moody’s podcast presents a glimmer of hope that there are sufficient elements to offset the challenges of CRE delinquencies. However with the speed cuts that the market hoped for final yr now anticipated to be a lot much less vital, will put additional stress on a CRE market that’s hooked on rock-bottom borrowing prices. If the Fed cuts charges too low, inflation will spiral uncontrolled, however preserve them too excessive, and different issues (like CRE) will proceed to bend and break.

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist in the present day!