The Comex report for final month accurately recognized a possible huge transfer in silver whereas the identical report two months in the past preceded an enormous up transfer for the value of gold. The information this month isn’t as apparent or compelling, however it’s clear the stress on the Comex continues to construct.

The CME Comex is the Trade the place futures are traded for gold, silver, and different commodities. The CME additionally permits futures consumers to show their contracts into bodily steel via supply. You could find extra element on the CME right here (e.g., vault varieties, main/minor months, supply clarification, historic information, and so forth.).

The information beneath seems at contract supply the place the possession of bodily steel adjustments palms inside CME vaults. It additionally reveals information that particulars the motion of steel out and in of CME vaults. It is extremely doable that if there’s a run on the greenback, and a flight into gold, that is the information that may present early warning indicators.

Gold

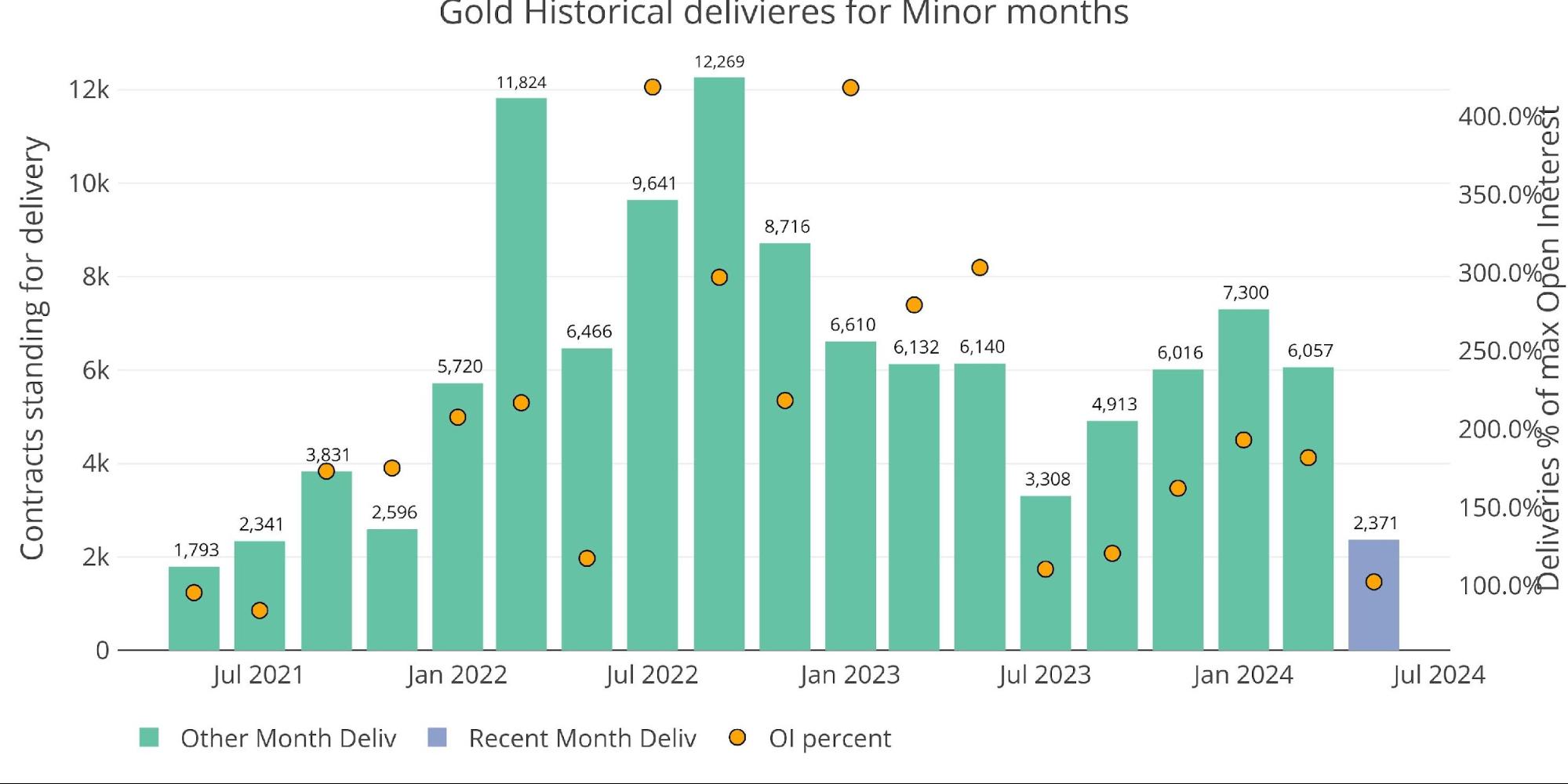

Could is a minor supply month in gold. The supply quantity this month was truly fairly small. The two,371 contracts had been the smallest supply quantity since July 2021.

Determine: 1 Current like-month supply quantity

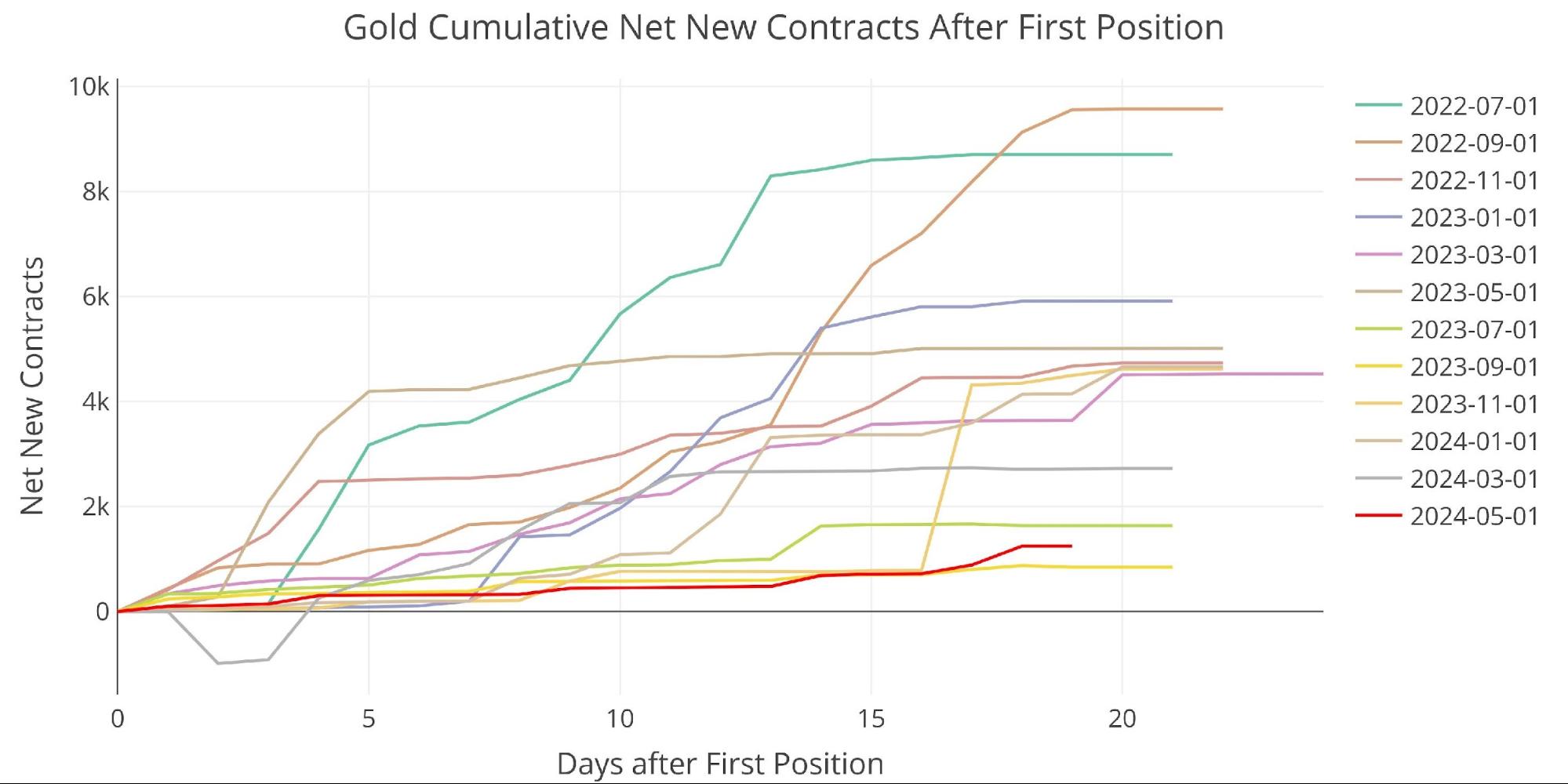

Web new contracts are the primary cause for the low supply quantity. Contracts delivered after the supply window began is among the lowest in current historical past.

Determine: 2 Cumulative Web New Contracts

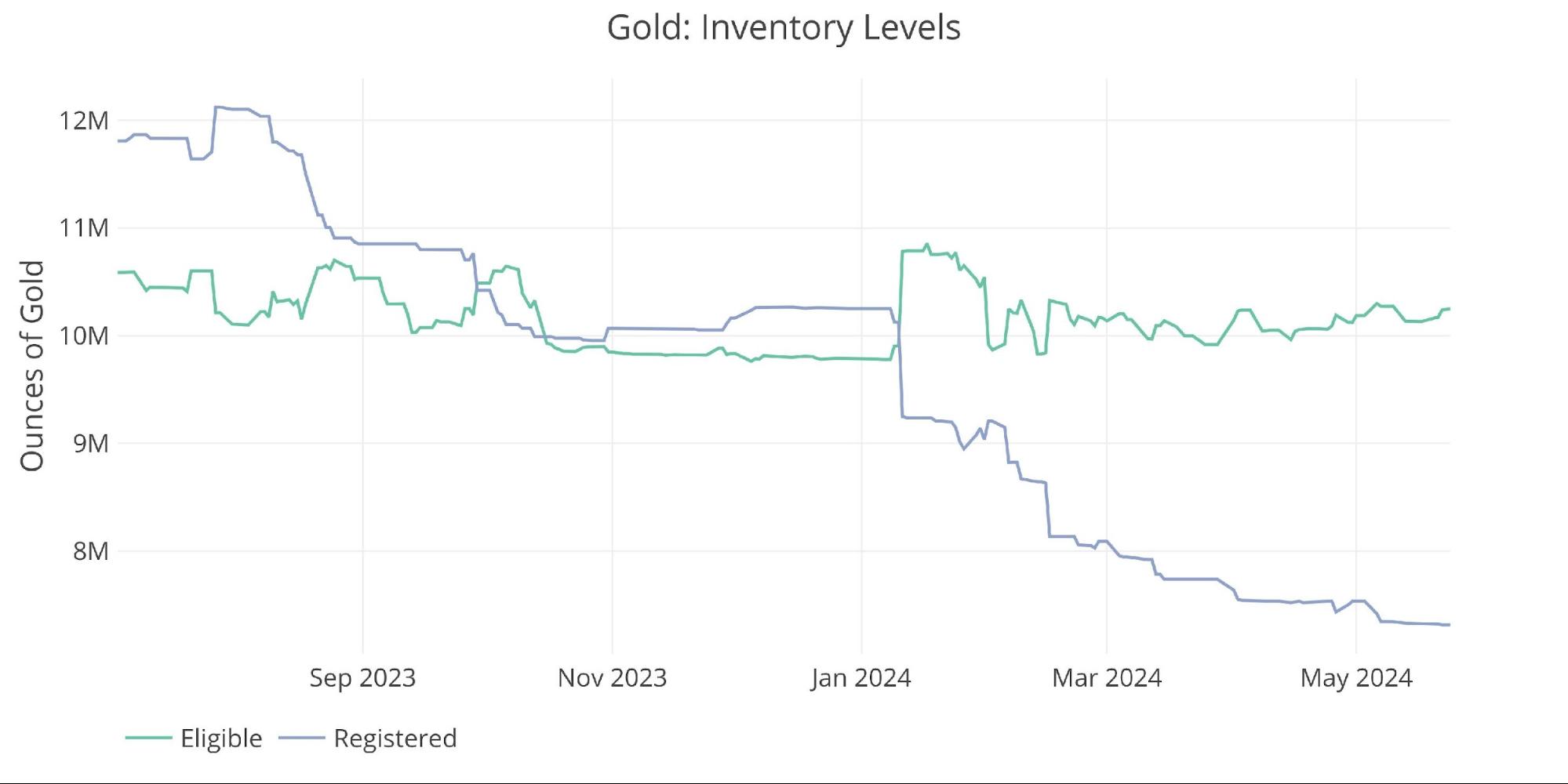

Stock ranges have been very secure the previous couple of months with only a gradual drop in Registered.

Determine: 3 Stock Knowledge

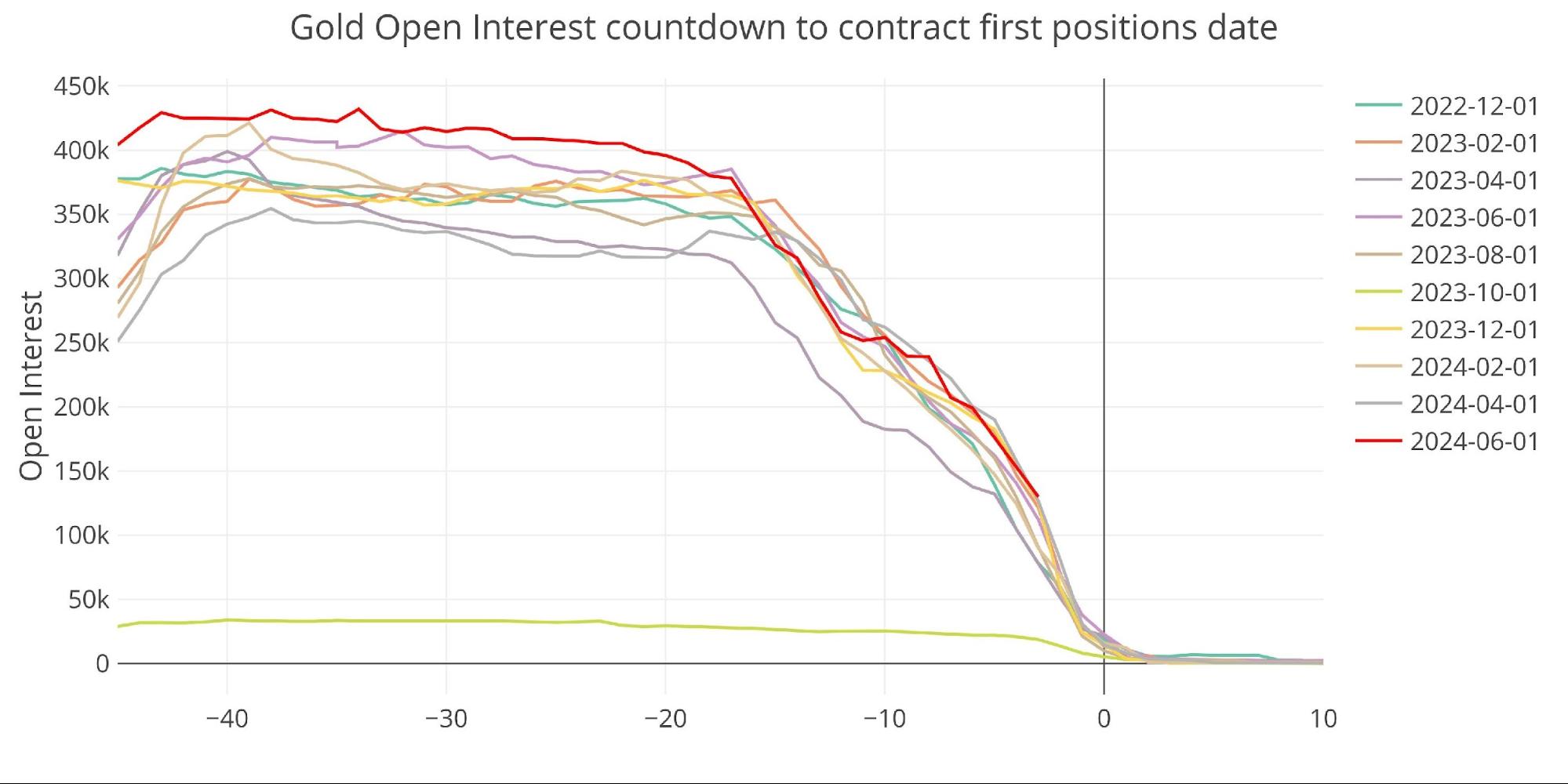

Heading into the key supply month of June reveals Open Curiosity is way increased than common.

Determine: 4 Open Curiosity Countdown

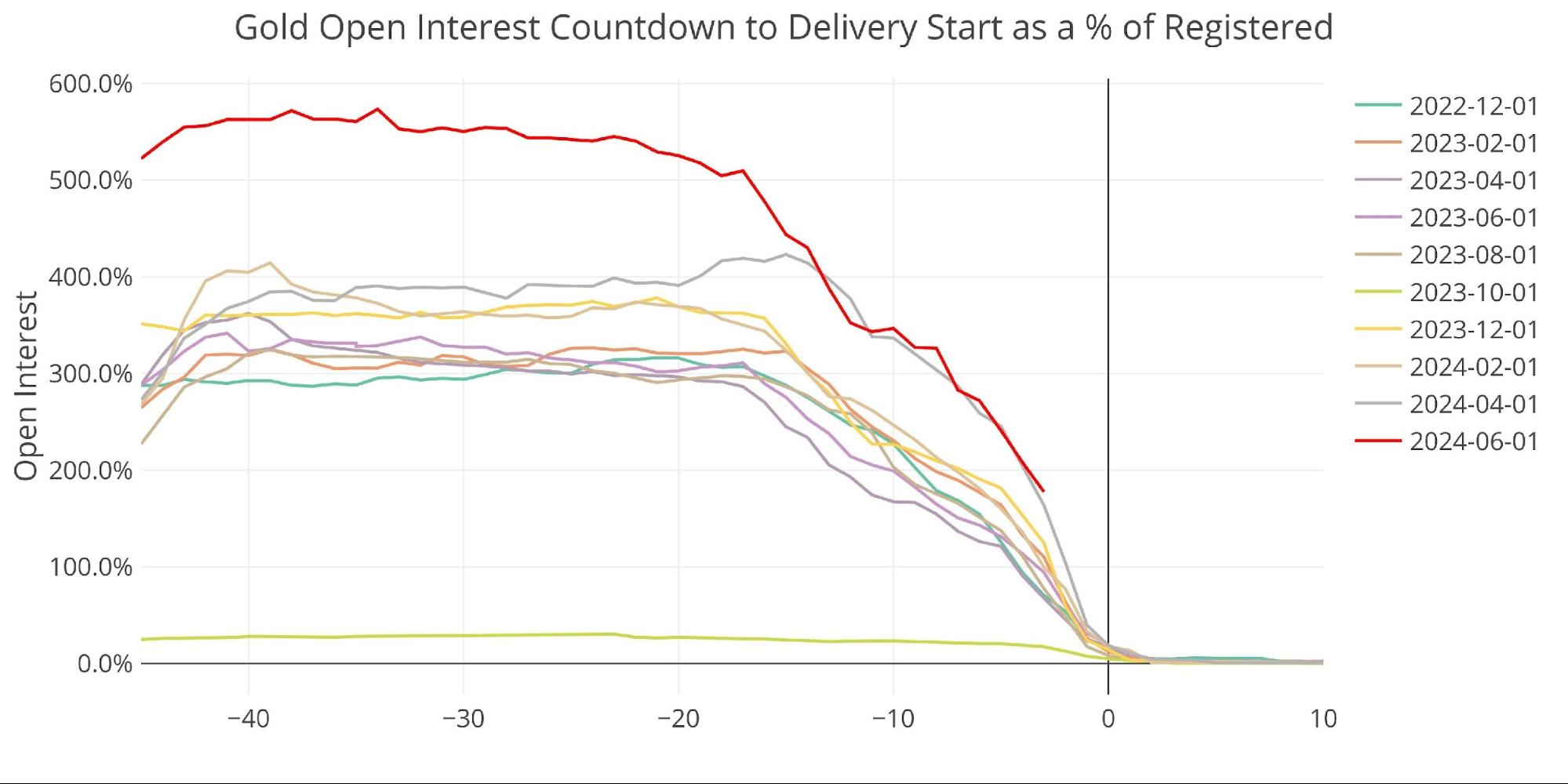

This may be seen extra clearly on a relative foundation the place the present degree of contracts relative to Registered steel is the best in current months.

Determine: 5 Open Curiosity Countdown P.c

Silver

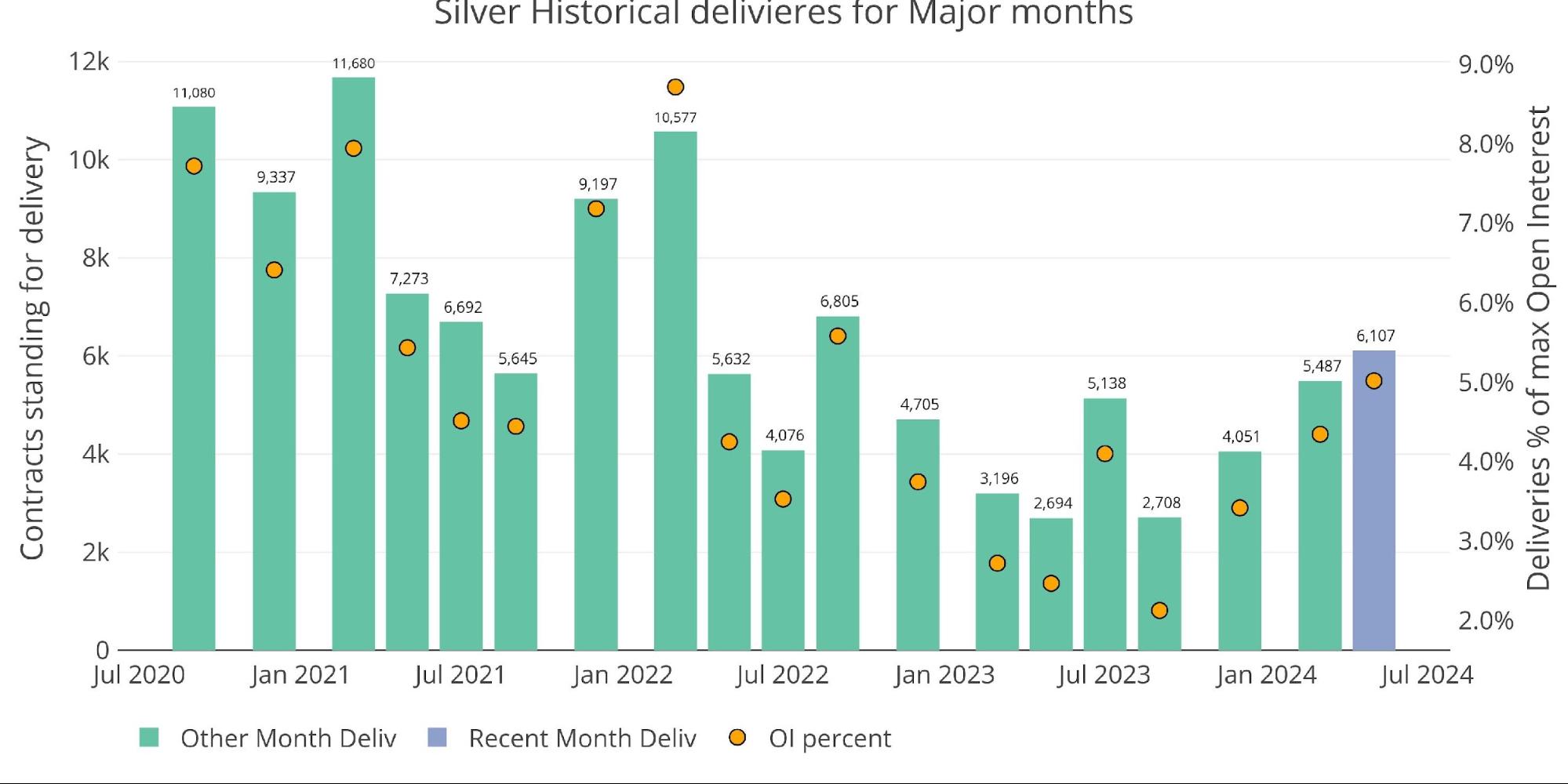

Could supply is a serious supply month for silver. Supply quantity reached the best since September 2022 with 6,107 contracts delivered.

Determine: 6 Current like-month supply quantity

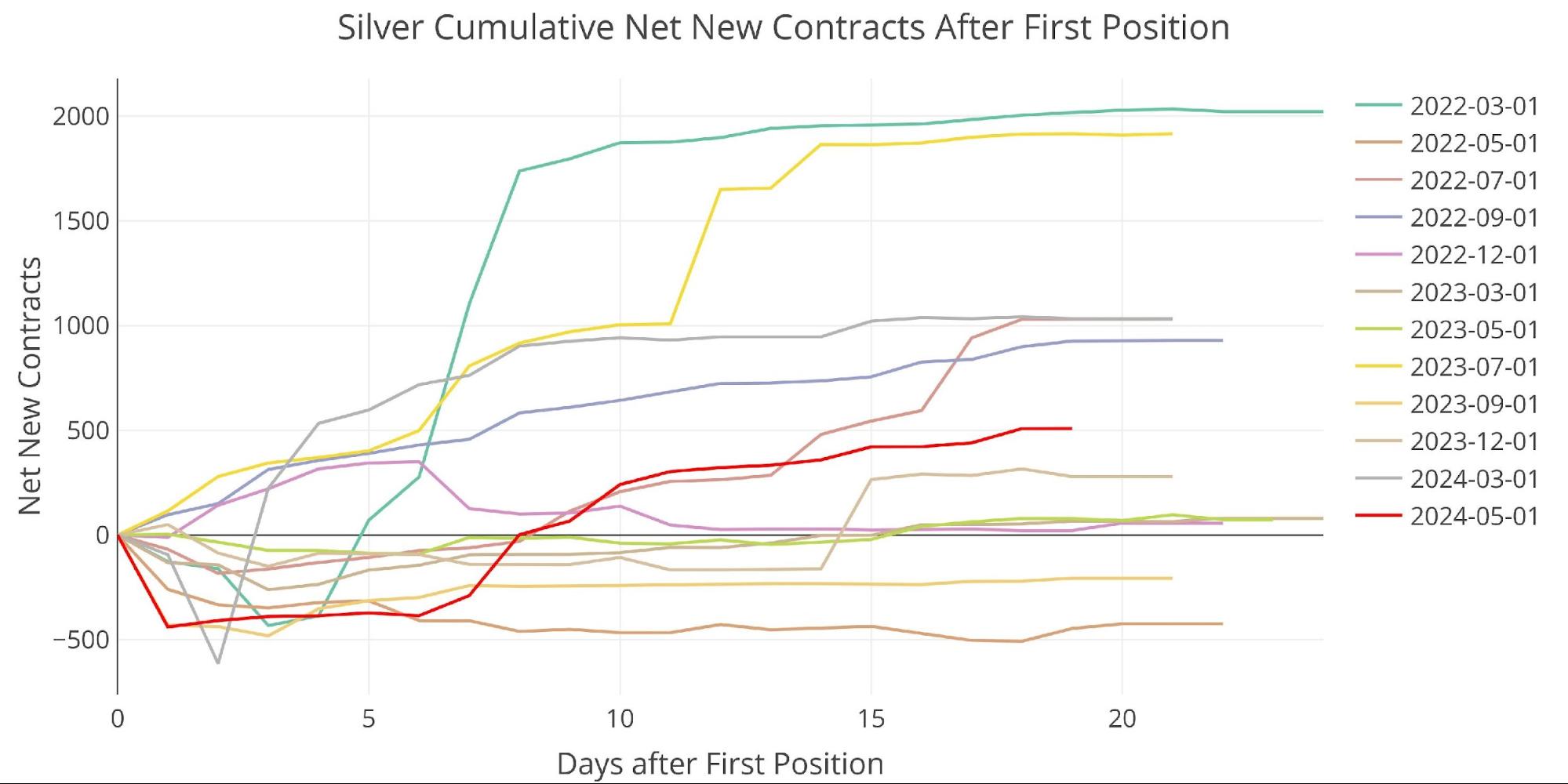

In contrast to previous months, this was not pushed by internet new contracts which represented solely 500 of the entire contracts delivered.

Determine: 7 Cumulative Web New Contracts

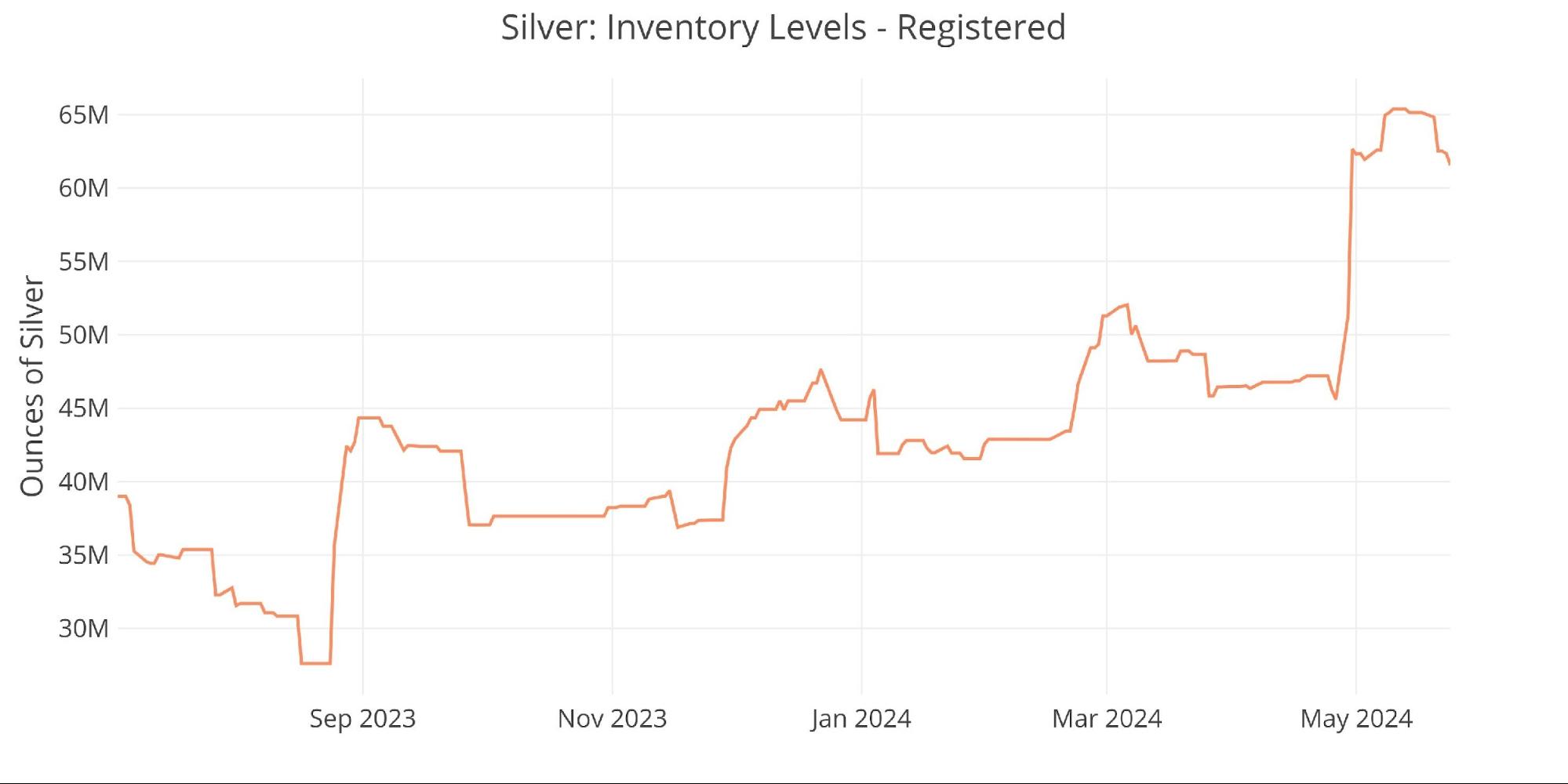

Registered and Eligible have been plotted individually to make the charts extra readable. Eligible noticed a serious drop in Could after an enormous surge in April.

Determine: 8 Stock Knowledge

Registered noticed the alternative motion with a big spike increased and just some drifting out over the month. This surge doubtless represents a transfer by the CME to shore up accessible stock and scale back stress in the marketplace. This clearly didn’t have the impression of preserving costs contained although.

Determine: 9 Stock Knowledge

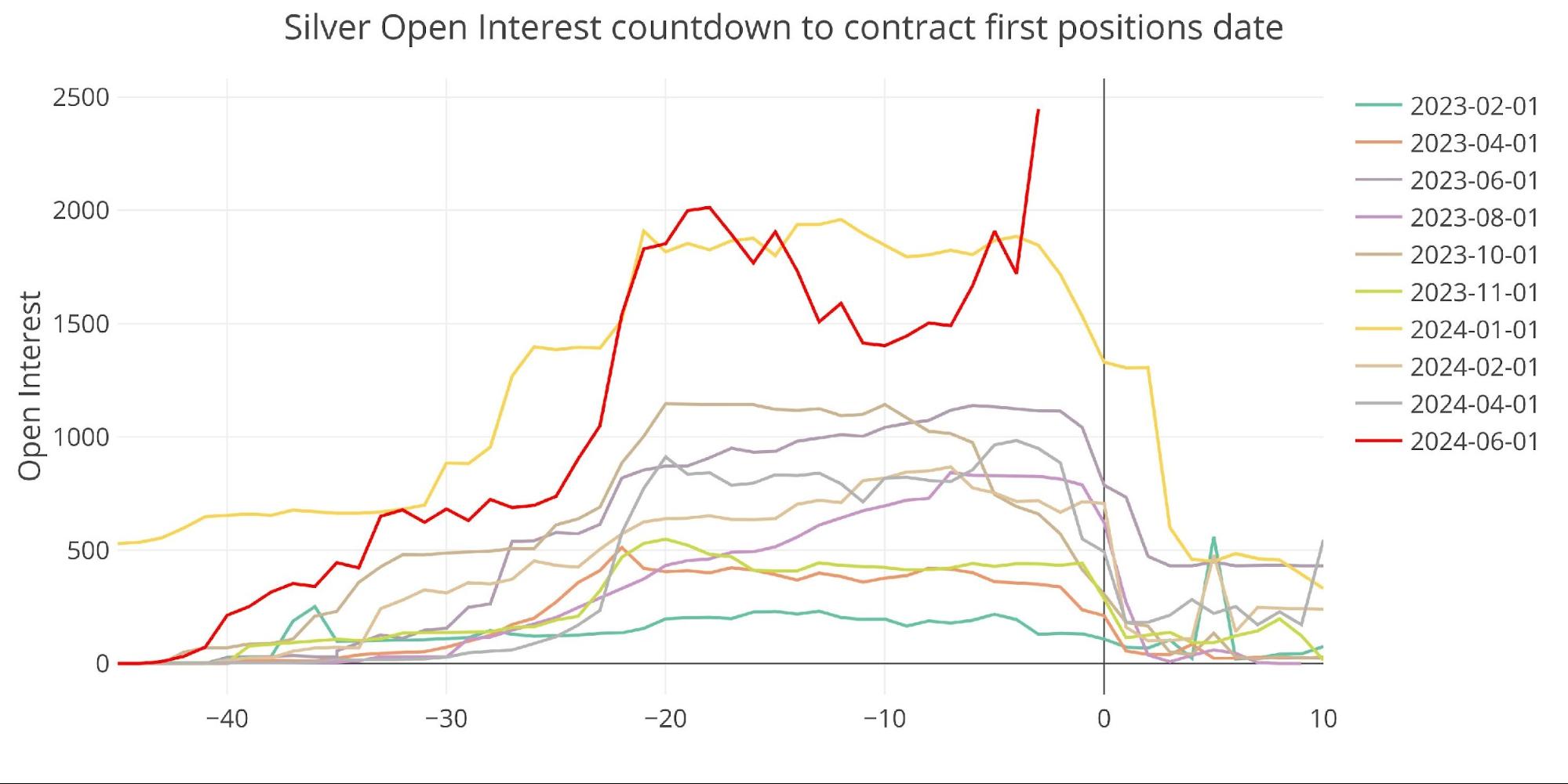

As we strategy the supply interval for June, you’ll be able to see that the silver contract has spiked in current days.

Determine: 10 Open Curiosity Countdown

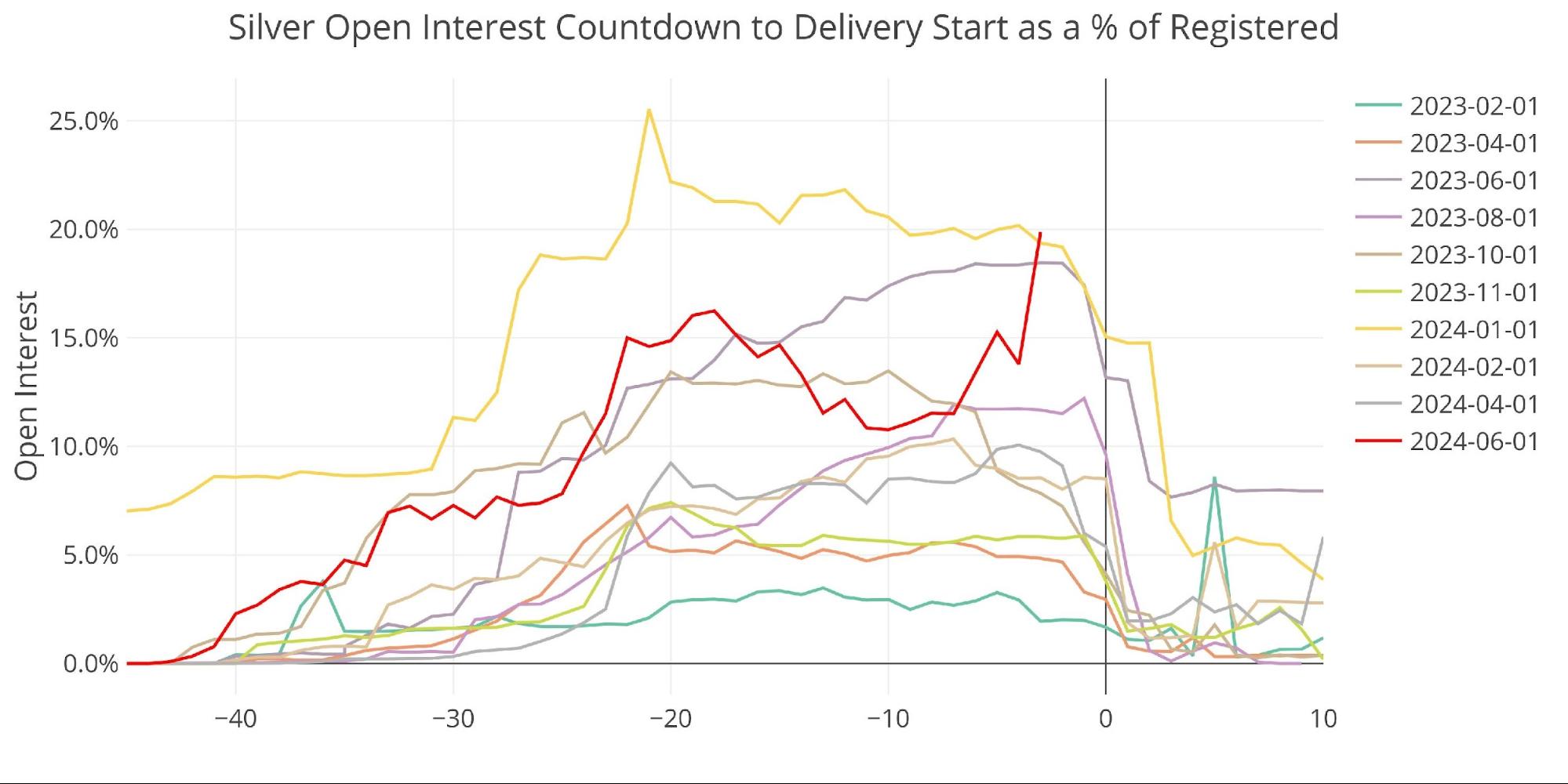

Even with the current spike in Registered, the rise in contracts has surged to an all-time excessive on a share foundation.

Determine: 11 Open Curiosity Countdown P.c

Conclusion

The information on the Comex continues to indicate a bodily market below stress. This has clearly translated to increased costs. Whereas costs might consolidate, the information reveals the bull market nonetheless has loads of room to run.

Knowledge Supply: https://www.cmegroup.com/

Knowledge Up to date: Nightly round 11PM Japanese

Final Up to date: Could 24, 2024

Gold and Silver interactive charts and graphs could be discovered on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist in the present day!