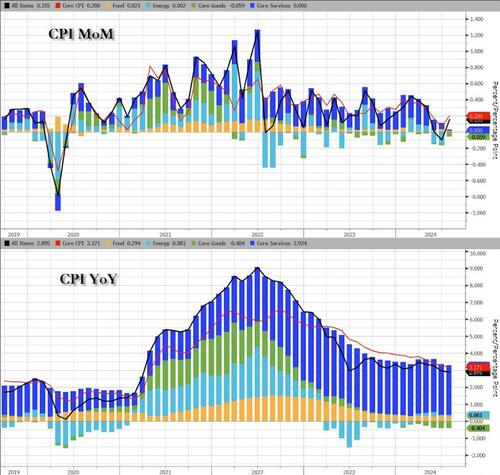

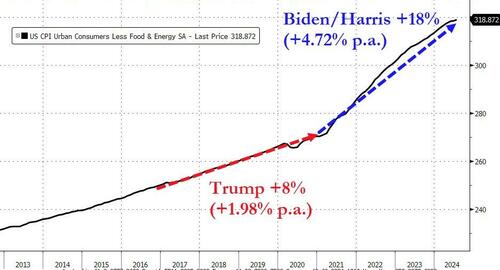

Following final month’s ‘deflationary’ print (-0.1% MoM), analysts anticipated headline CPI to rise 0.2% MoM and so they have been spot on, shifting the YoY CPI print to 2.9% (from 3.0%) – the bottom since March 2021…

Supply: Bloomberg

Items deflation continues to pull general CPI decrease…

Supply: Bloomberg

For context, Items costs are down 1.9% YoY – the largest deflationary impulse since 2004. Companies costs proceed to rise YoY however on the slowest tempo since 2022…

Supply: Bloomberg

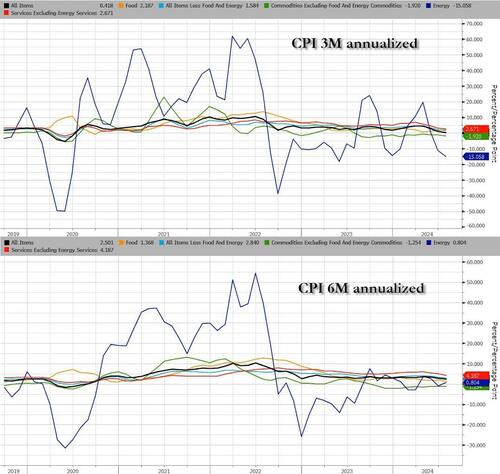

The 3m and 6m annualized CPI charges proceed to pattern decrease (with Power a very risky issue)….

Supply: Bloomberg

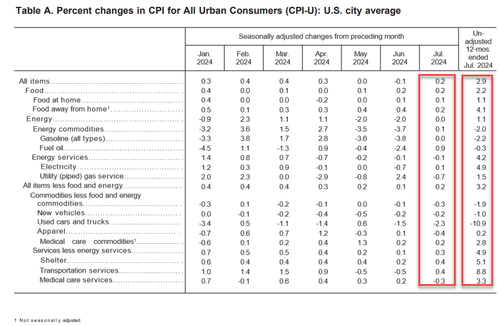

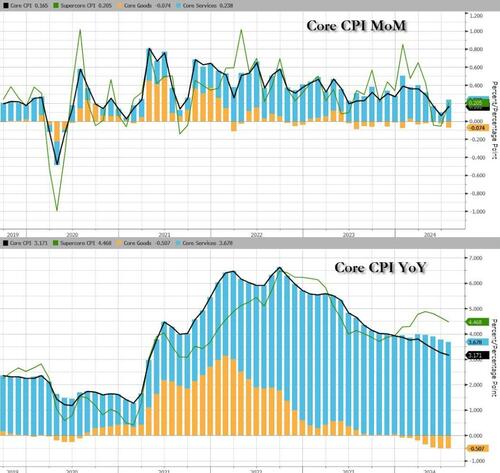

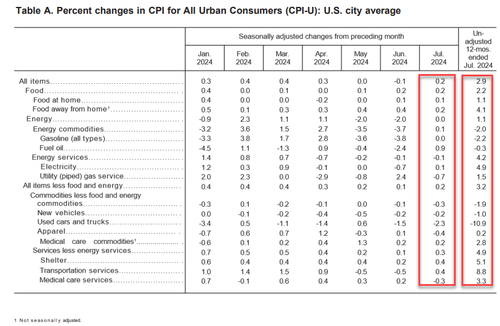

Core CPI additionally rose 0.2% MoM (as anticipated), and the YoY fee of inflation slowed to three.2% (from 3.3%) – the bottom since April 2021…

Supply: Bloomberg

Whereas Core CPI is slowing YoY, the Core items deflation seems to have stalled…

Supply: Bloomberg

Nevertheless, that’s the fiftieth straight month of MoM will increase in Core CPI, and a file excessive…

Supply: Bloomberg

Underneath the hood, used automotive costs fell 2.3% together with airline fares (-1.2%) whereas Automotive insurance coverage prices jumped 1.2% and furnishings costs rose 0.3%…

Supply: Bloomberg

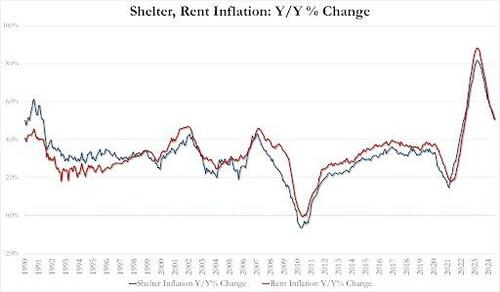

Maybe extra worrying is the truth that hire inflation has stopped falling…

Supply: Bloomberg

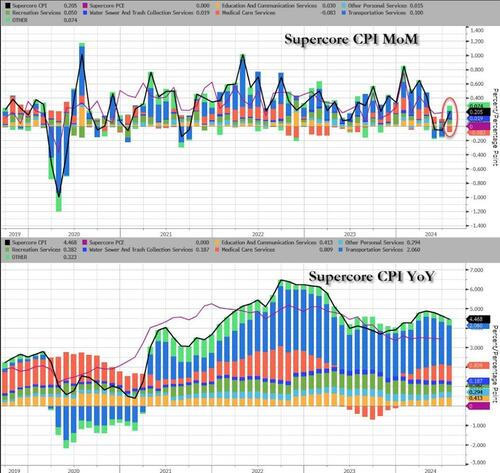

Lastly, the so-called SuperCore CPI rose 0.2% MoM (identical as the remainder), dragging the YoY all the way down to 4.73% (nonetheless notably elevated)…

Supply: Bloomberg

Transportation Companies jumped notably MoM..

Supply: Bloomberg

So, is that this ‘good’ information or unhealthy information?

Lastly, cash provide development is reaccelerating…

Supply: Bloomberg

Is that this the trough for CPI?

As Bloomberg notes, whereas the tempo of inflation has come down, its nonetheless rising, and shoppers within the New York-Newark-Jersey Metropolis, NY-NJ-PA metro, and the Dallas space nonetheless are coping with inflation in extra of 4% — the best amongst giant metro areas within the US.

Will The Fed actually reduce charges as hire inflation inflects larger for the primary time since 2023?

Loading…