Please observe: the CoTs report was printed 06/28/2024 for the interval ending 06/25/2024. “Managed Cash” and “Hedge Funds” are used interchangeably.

The Dedication of Merchants report is a weekly publication that reveals the breakdown of possession within the Futures market. For each contract, there’s a lengthy and a brief, so the online positioning will at all times be zero, however the report reveals who’s positioned lengthy or brief. Traditionally, Hedge Funds (Managed Cash) dominate the value motion in each Gold and Silver.

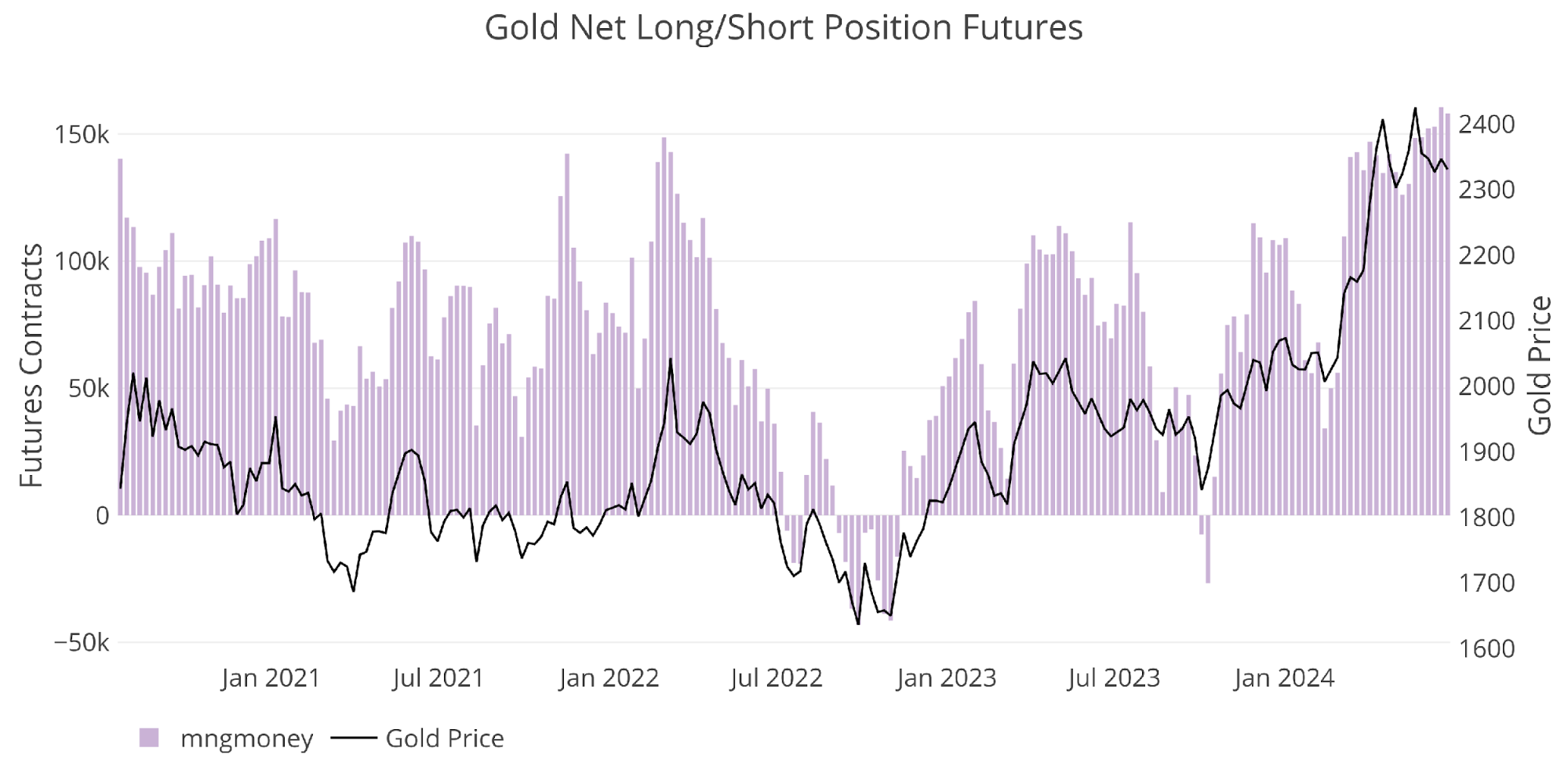

Gold

Present Traits

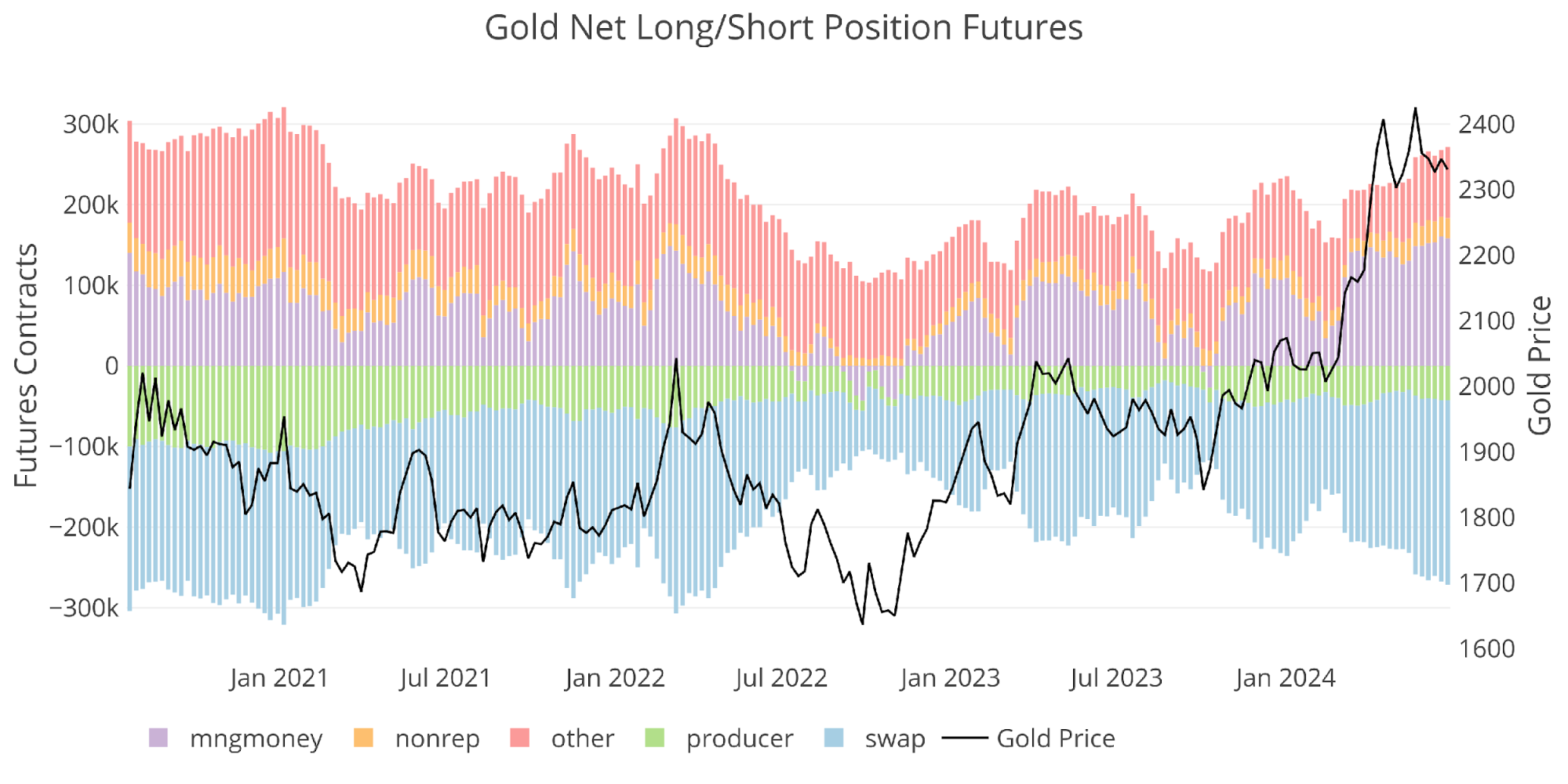

Beneath reveals internet positioning for the 5 foremost teams of futures holders. Internet positioning has been drifting up in latest weeks which can make it tougher for the rally to proceed increasing.

Determine: 1 Internet Place by Holder

Managed Cash is in full management of the value motion, driving costs greater. The latest value spikes have been so fast that the COTs report might not have caught the motion of Managed Cash from a weekly perspective. It’s presumed that fast strikes like that have been virtually positively Managed Cash.

Determine: 2 Managed Cash Internet Place

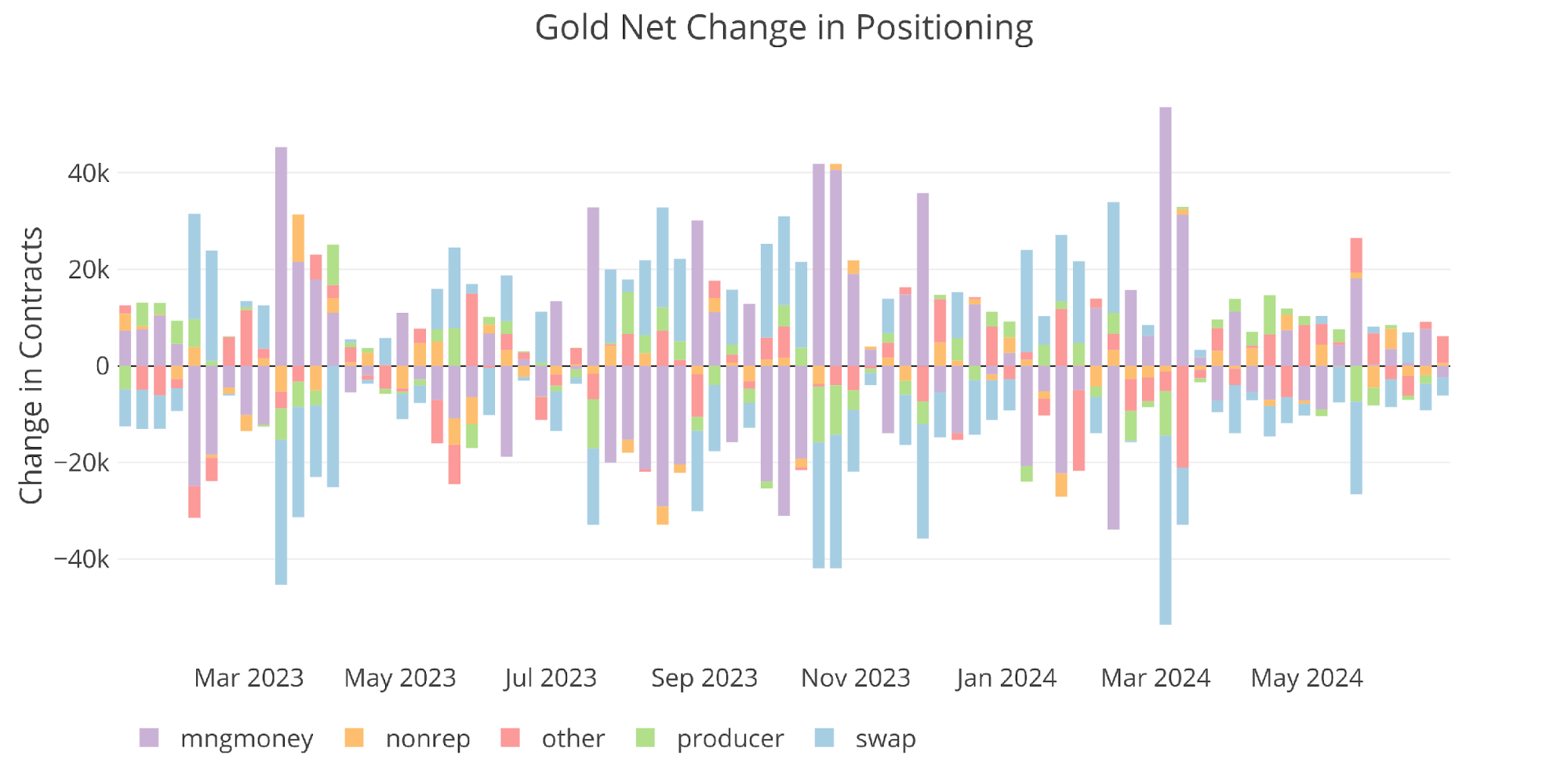

Weekly Exercise

The general exercise has been very muted in latest weeks which might be why the metallic is usually range-bound for now.

Determine: 3

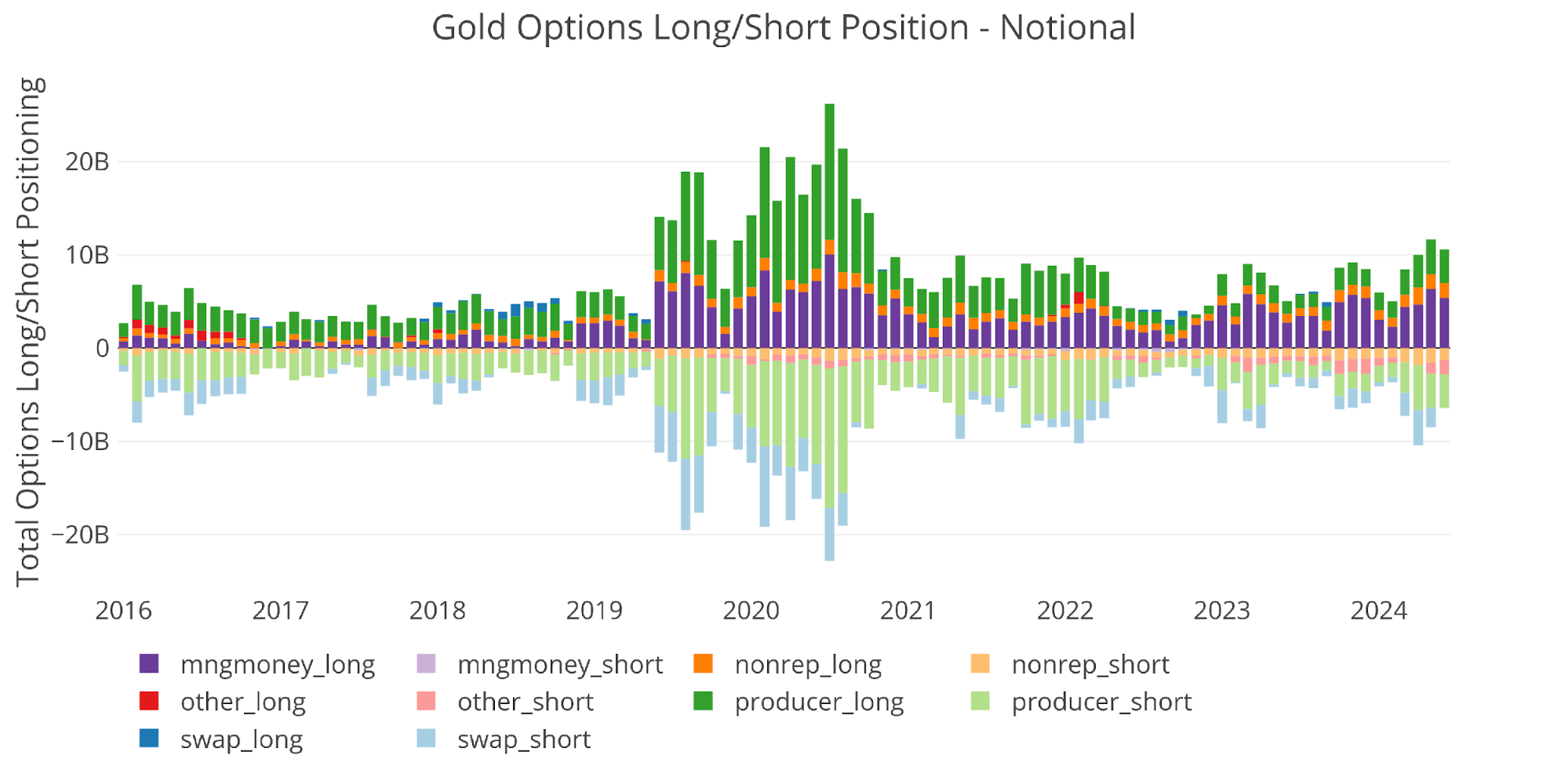

The exercise within the choices market is beginning to decide up some, reaching multi-year highs.

Determine: 4 Choices Positions

Silver

Present Traits

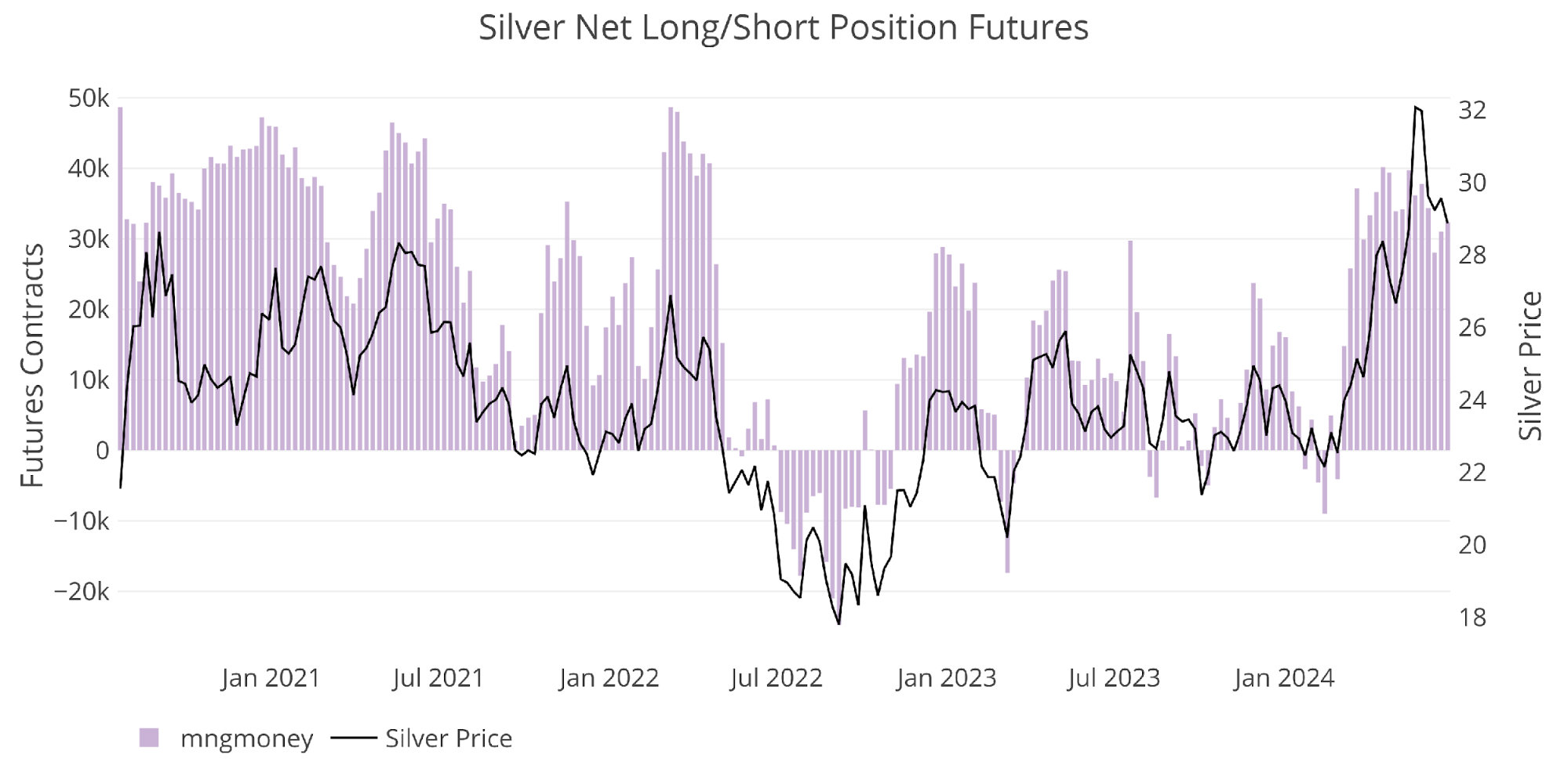

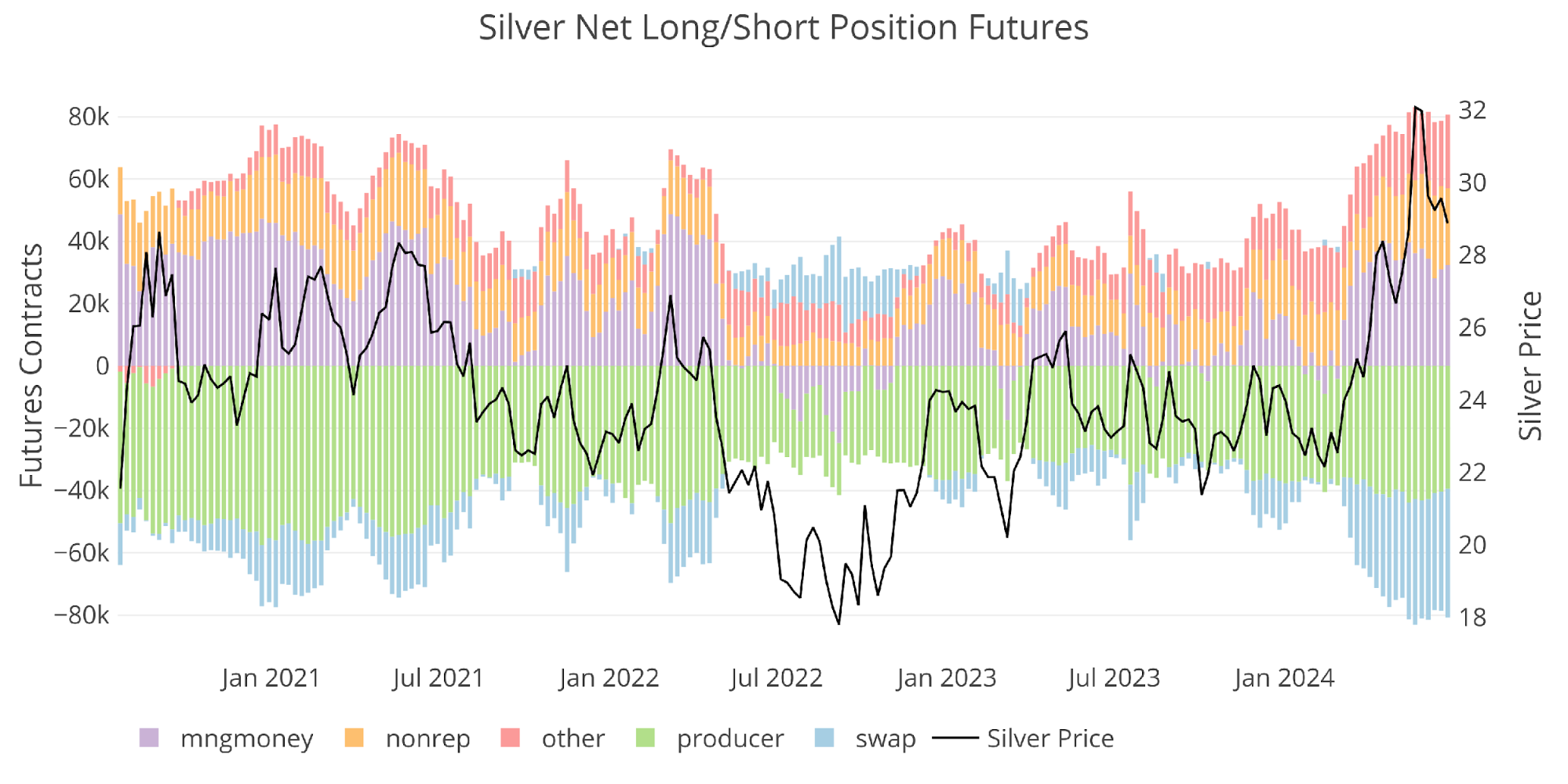

Silver complete internet positioning has reached the very best level in a number of years elevating issues in regards to the quantity of power left to gasoline the market greater.

Determine: 5 Internet Place by Holder

Identical to gold, the value of Silver is overwhelmingly dominated by Managed Cash positioning.

Determine: 6 Managed Cash Internet Place

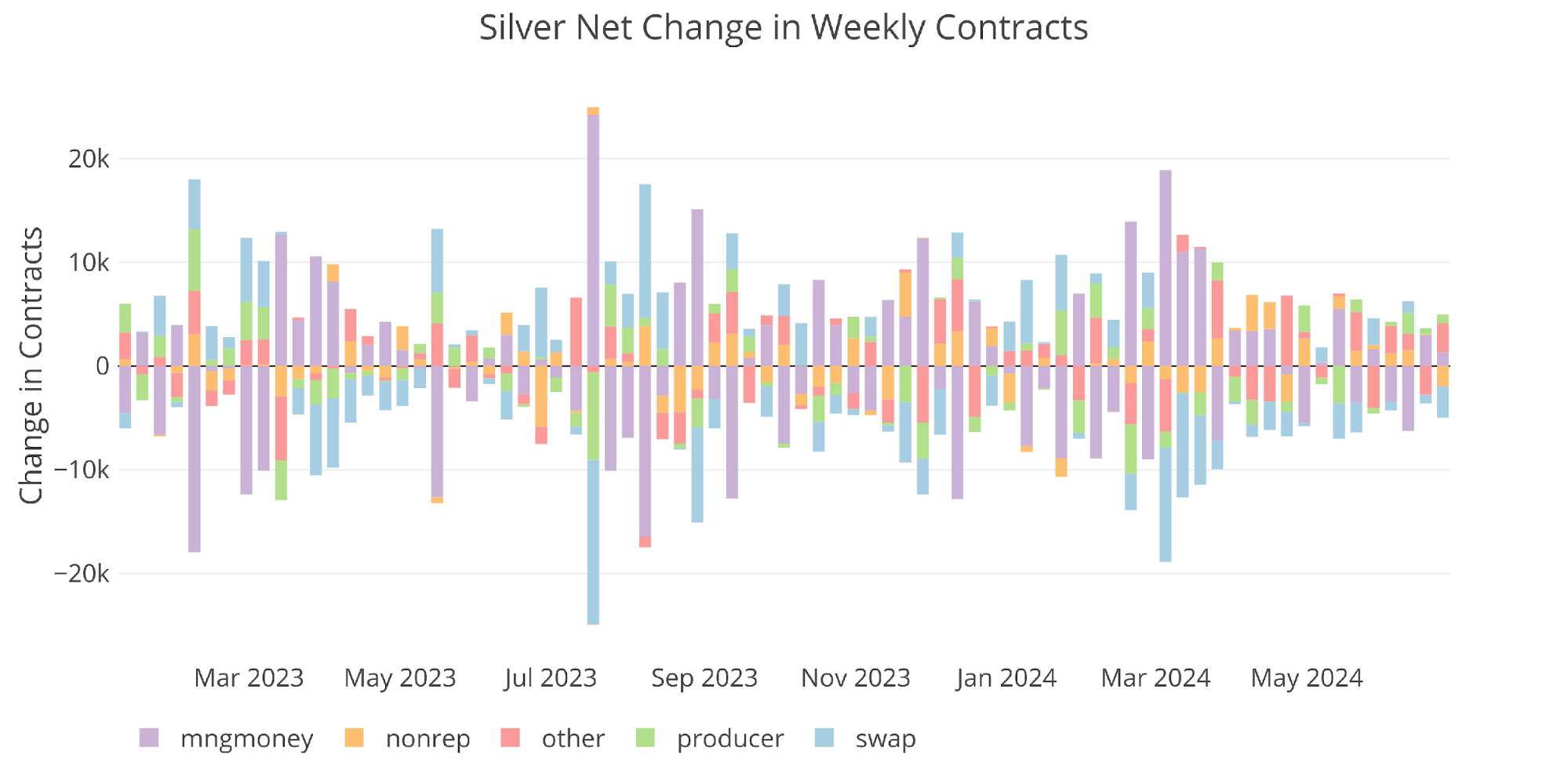

Weekly Exercise

Additionally just like gold, the exercise has been pretty muted the final a number of weeks.

Determine: 7 Internet Change in Positioning

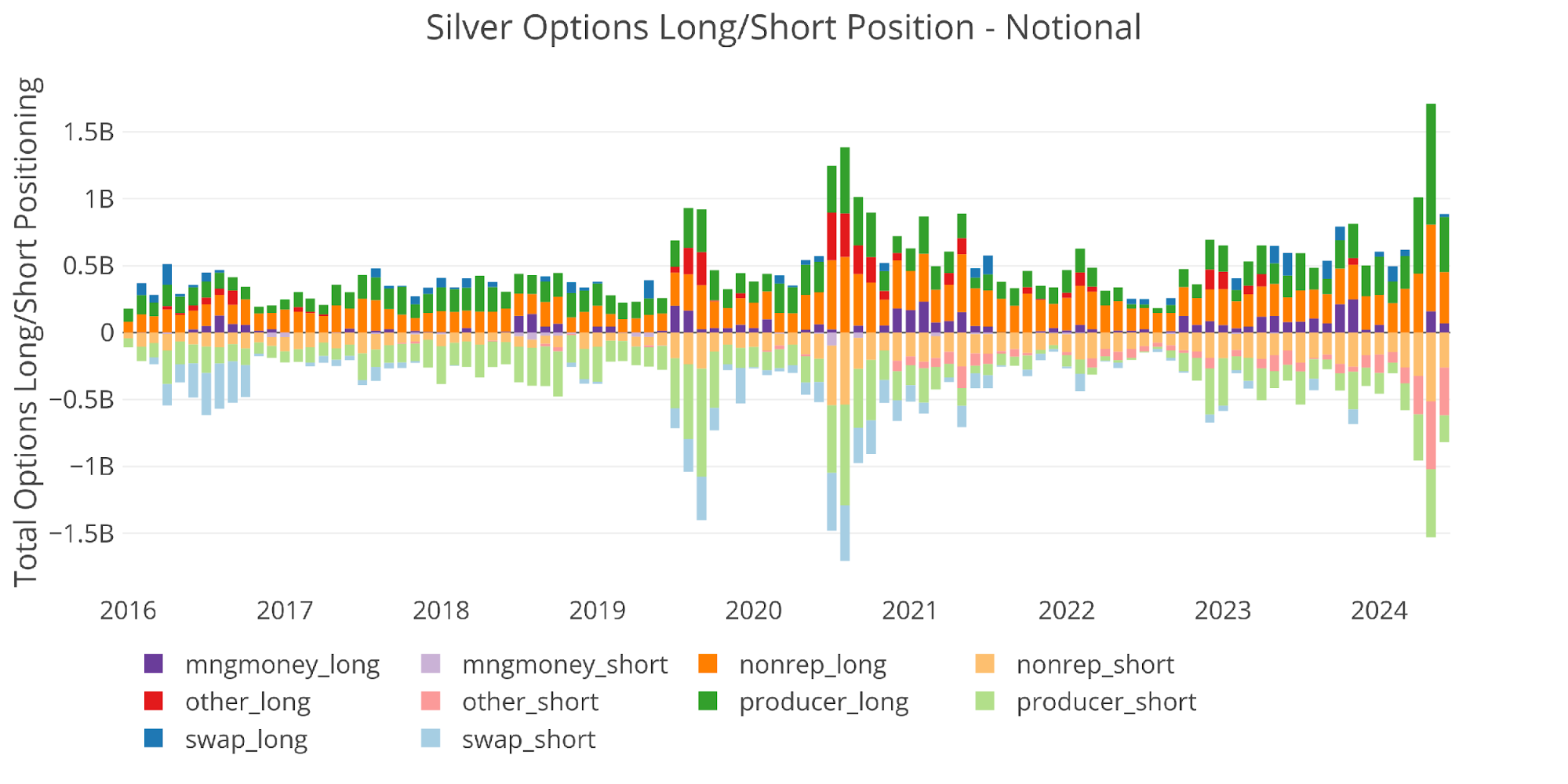

The choices market is beginning to present indicators of life, indicating that speculators could possibly be a driving issue behind latest value strikes.

Determine: 8 Choices Positions

Conclusion

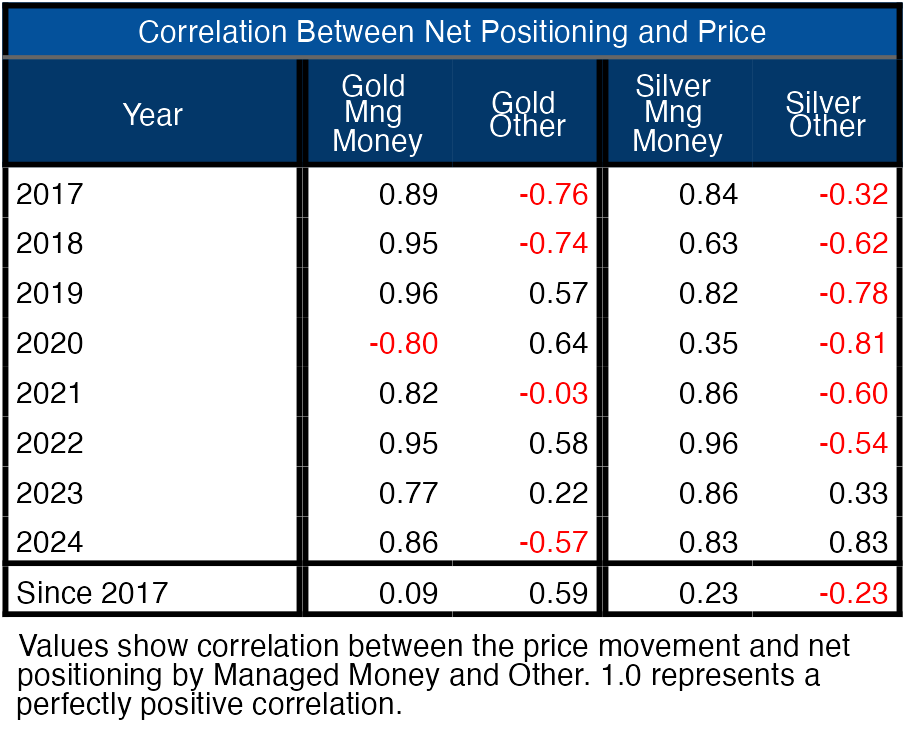

The desk under reveals the correlation of value motion to positioning for Managed Cash and Others (presumably non-institutional). You’ll be able to see how Managed Cash dominates the value motion aside from 2020. Sooner or later, the value motion is not going to be pushed by futures merchants, however by bodily demand. That’s when costs will explode greater as individuals understand there’s not sufficient gold and silver to go round.

Determine: 9 Correlation Desk

Irrespective of the way you slice it although, the short-term strikes in gold and silver are clearly pushed by the futures merchants. Over the long run although, the sluggish and regular value advance in gold is being pushed by fundamentals comparable to central financial institution shopping for and bodily accumulation.

Information Supply: https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

Information Up to date: Each Friday at 3:30 PM as of Tuesday

Final Up to date: Jun 25, 2024

Gold and Silver interactive charts and graphs may be discovered on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Name 1-888-GOLD-160 and converse with a Valuable Metals Specialist at this time!