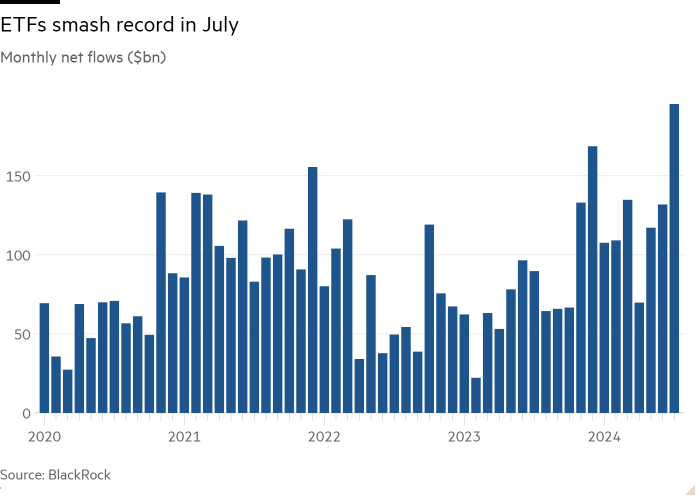

Traders poured report sums into trade traded funds in July, highlighting the exuberance that gripped world monetary markets earlier than this week’s sharp sell-off.

Web inflows into ETFs globally hit $195bn in July, in response to figures from BlackRock, completely eclipsing the month-to-month report of $169bn in December 2023. About $124bn of that flowed into US-listed ETFs, the second-highest quantity on report behind December’s $129bn.

The shopping for frenzy was extensive ranging, with mounted earnings ETFs attracting a report $60.5bn, fairness funds sucking in $127bn — their greatest month since December — and gold ETFs grabbing $3.2bn, the very best determine since March 2022. Energetic ETFs within the US as soon as once more set a report for brand spanking new investments with $27.9bn after beforehand setting excessive water marks in January, March and December, in response to Morningstar.

Todd Rosenbluth, head of analysis at VettaFi, a consultancy, stated July’s record-breaking spree was pushed by rising expectations that the US Federal Reserve would quickly be part of within the world financial easing cycle, offering a extra supportive backdrop for markets globally.

“There was robust optimism that the Fed would start chopping rates of interest at an affordable tempo, and buyers embraced ETFs to get publicity to the broad market,” Rosenbluth stated, with ETFs monitoring the S&P 500 and small-cap Russell 2000, in addition to company bonds, significantly in demand.

Pat Tschosik, senior portfolio strategist at Ned Davis Analysis, additionally stated the elevated perception in a coming Fed minimize had turbocharged flows into mounted earnings methods in current weeks.

“We had a really robust feeling that bonds have been going to rally, and all this did was speed up that bond shopping for — perhaps to the purpose the place we’ve overdone it,” Tschosik stated.

Regardless of the market ructions of current days, Rosenbluth stated ETF buyers had stored the religion, with Monday — the worst day of the worldwide market sell-off — seeing an extra $3.8bn of internet inflows rolling into the SPDR S&P 500 ETF Belief (SPY), $1.8bn into the Invesco QQQ Belief (QQQ) and $625mn into the iShares Core S&P 500 ETF (IVV), in response to VettaFi’s information.

Whereas that is in all probability a constructive signal for markets, a level of uncertainty should stay, provided that any elevated demand to brief these ETFs would additionally lead to internet inflows.

VettaFi’s information does counsel that US-listed small cap ETFs suffered $1bn of outflows on Monday, after financial information launched on Friday hinted at a sudden weakening of the US economic system.

“For small caps to stay in favour we have to see a [US] recession being prevented,” Rosenbluth stated, even when rising expectations of aggressive US charge cuts ought to show supportive.

Karim Chedid, head of funding technique for iShares within the Emea area at BlackRock, was additionally upbeat.

As of Friday, when market volatility had already began to rise, Chedid stated “the [ETF] stream image hadn’t drastically modified” from July’s report inflows, in response to BlackRock’s information.

Extra broadly, Chedid didn’t imagine July’s report ETF shopping for, and the next market upheaval, was an indication of buyers getting carried away by irrational exuberance.

“Previously couple of days we have now had orderly buying and selling. We haven’t had panic or a reversal of exuberance,” he stated. “We now have seen some unwind of carry [trades] however there hasn’t been panic promoting.”

Chedid stated that fairness market valuations have been supported by “a strong earnings image, so I do suppose that the flows are backed up by fundamentals”, fairly than merely sentiment.

July’s report inflows have been pushed by shopping for just about throughout the board.

Gold, which noticed a 3rd straight month of internet shopping for, was getting used “as a geopolitical threat hedge [rather] than an fairness drawdown hedge”, in addition to a “broad portfolio diversifier”, in response to Chedid.

In mounted earnings, authorities bond ETFs pulled in $19.8bn, essentially the most since October 2023, with each brief and longer length funds witnessing comparable ranges of demand.

Funding grade company bonds attracted $13.6bn, the second-highest month-to-month tally on report, “holding up fairly properly, regardless that spreads have tightened”, Chedid stated.

Excessive-yield company bonds accounted for an extra $4bn after being flat in June, and rising market debt notched up a fourth consecutive month of shopping for, taking in $3.2bn.

On the fairness facet, expertise ETFs continued to guide sector flows, with an extra $10bn of shopping for, whereas financials, industrials and utilities ETFs have been additionally in demand.

Chedid stated this painted an image of “breadth in fairness flows, not a rotation”.

“A whole lot of commentators have been speaking about market rotation, out of tech into different sectors, into high quality and worth [stocks]. That’s not what we noticed,” he added.

Nonetheless, Chedid believed demand for utilities, in addition to healthcare, which chalked up a second consecutive month of inflows, confirmed some buyers have been positioning into extra defensive sectors that usually profit from decrease charges.

US small cap ETF flows hit $14.2bn — the second-highest determine on report.