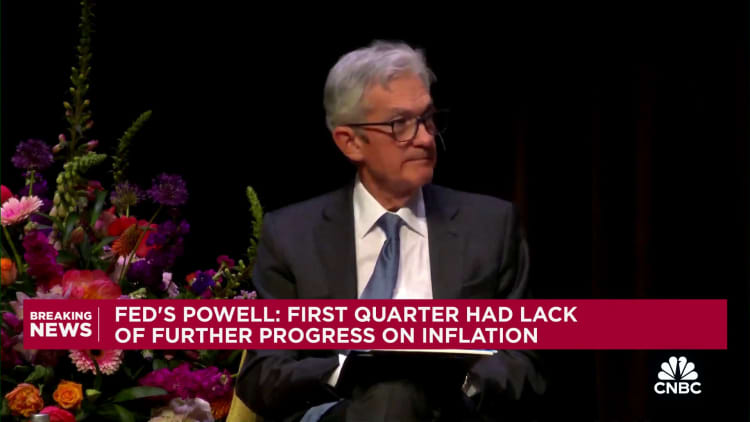

Federal Reserve Chair Jerome Powell reiterated Tuesday that inflation is falling extra slowly than anticipated and can hold the central financial institution on maintain for an prolonged interval.

Talking to the annual normal assembly of the International Bankers’ Affiliation in Amsterdam, the central financial institution chief famous that the fast disinflation that occurred in 2023 has slowed significantly this 12 months and precipitated a rethink of the place coverage is headed.

“We didn’t count on this to be a easy street. However these [inflation readings] have been larger than I believe anyone anticipated,” Powell mentioned. “What that has advised us is that we’ll have to be affected person and let restrictive coverage do its work.”

Whereas he expects inflation to return down by means of the 12 months, he famous that hasn’t occurred thus far.

“I do suppose it is actually a query of maintaining coverage on the present price for longer than had been thought,” he mentioned.

Nevertheless, Powell additionally repeated that he doesn’t count on the Fed to be elevating charges.

The Fed has been holding its key in a single day borrowing price in a focused vary of 5.25%-5.5%. Although the speed has been there since July, it’s the highest stage in some 23 years.

“I do not suppose that it is seemingly, based mostly on the info that we’ve, that the subsequent transfer that we make could be a price hike,” he mentioned. “I believe it is extra seemingly that we’ll be at a spot the place we maintain the coverage price the place it’s.”

Markets vacillated as Powell spoke round 10 a.m. ET and main averages have been close to breakeven approaching midday ET. Treasury yields edged decrease, and futures merchants barely raised the market-implied chance of the Fed’s first price lower coming in September.

Powell’s feedback mirrored sentiments he expressed throughout his Might 1 information convention after the newest Federal Open Market Committee assembly.

The committee unanimously voted to carry the road on charges whereas additionally expressing that it had seen a “lack of additional progress” on getting inflation again to the Fed’s 2% goal, regardless of a sequence of 11 rate of interest will increase.

Tuesday introduced a contemporary spherical of discouraging inflation knowledge, when the Labor Division’s producer value index, a proxy for wholesale prices, rose a higher-than-expected 0.5% in April on the again of a surge in companies costs.

Although the index on its floor indicated additional value pressures, Powell referred to as the report “blended” as a number of the elements confirmed easing motion.

“Is inflation going to be extra persistent going ahead? … I do not suppose we all know that but. I believe we’d like greater than 1 / 4’s value of information to actually make a judgement on that,” he mentioned.