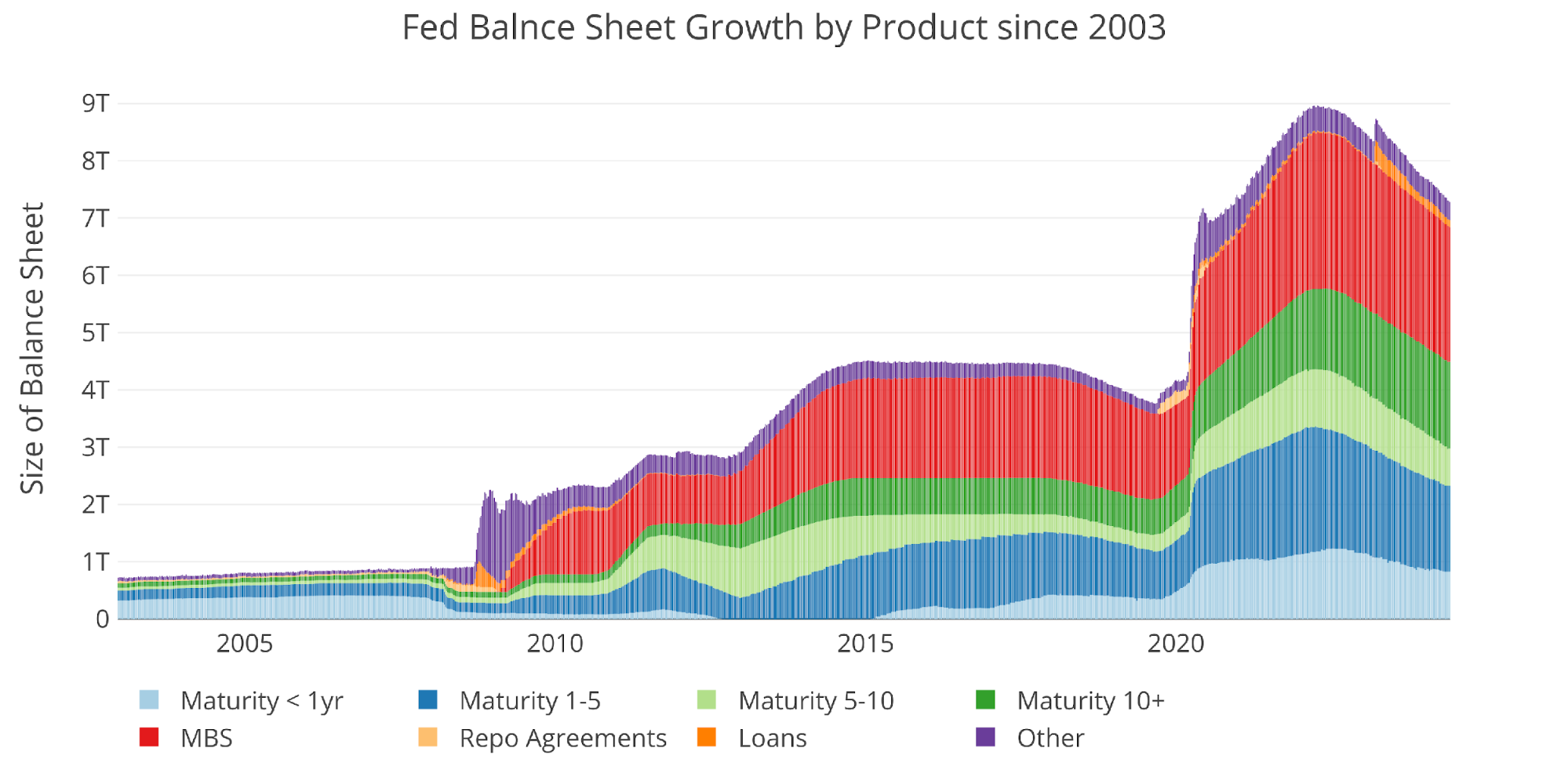

The next evaluation breaks down the Fed steadiness sheet intimately. It exhibits completely different components of the steadiness sheet and the way these quantities have modified. It additionally exhibits historic rate of interest tendencies.

Breaking Down the Steadiness Sheet

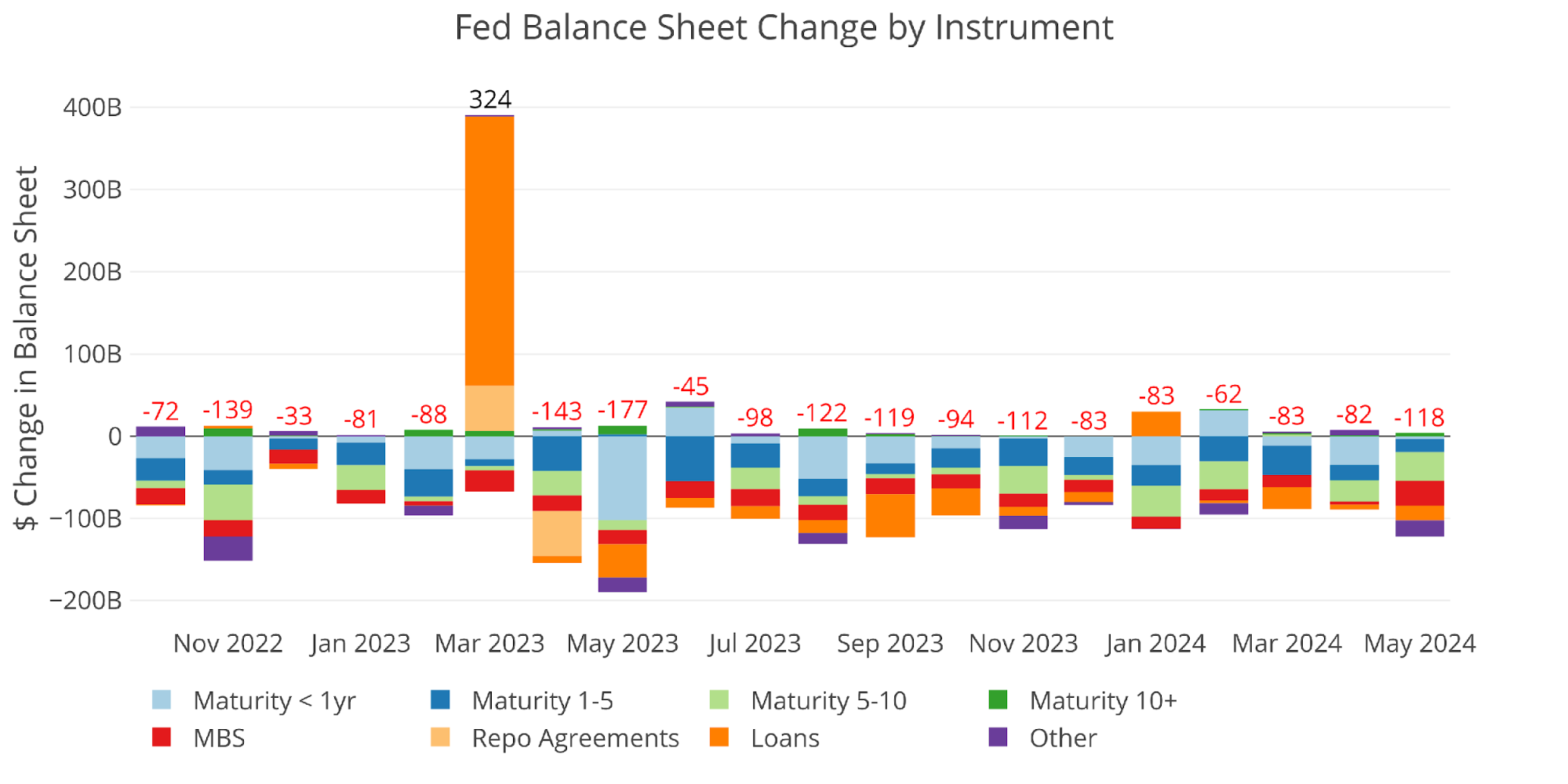

The Fed’s steadiness sheet shrunk by $118B in Could. This was the biggest quantity since September of final yr. The steadiness sheet had been shrinking by about $80B for the final a number of months and noticed an enormous drop this month.

Determine: 1 Month-to-month Change by Instrument

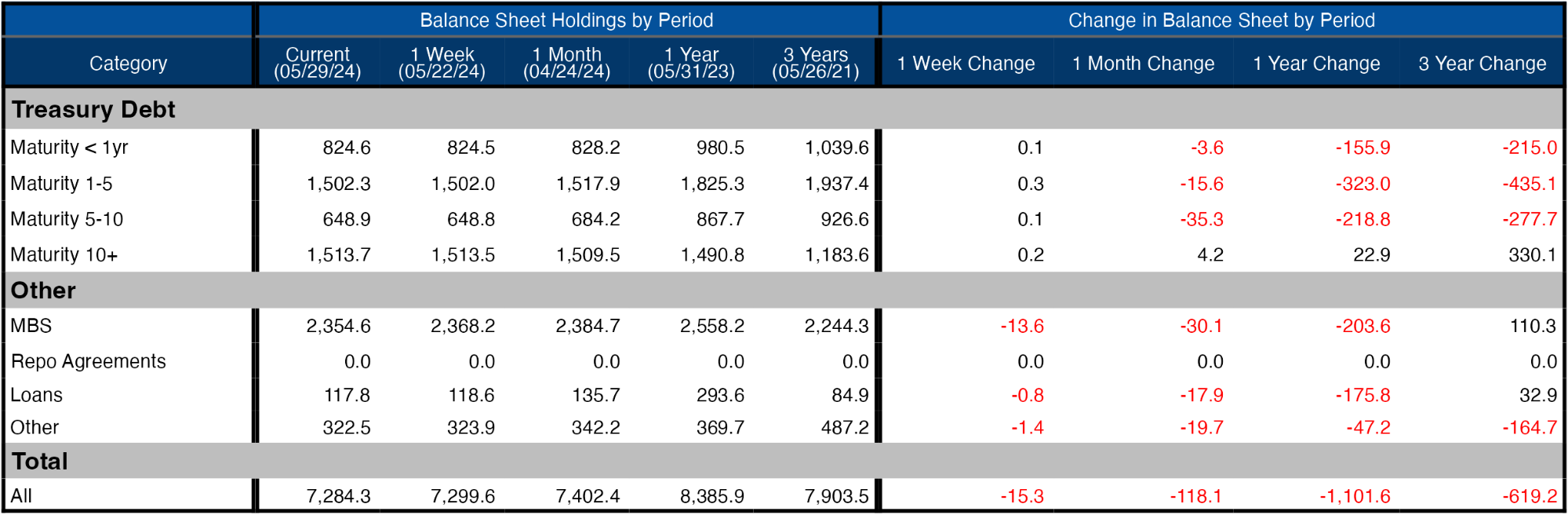

The desk beneath offers extra element on the Fed’s QT efforts. Sarcastically, long term debt of 10+ years has elevated throughout all time durations.

Determine: 2 Steadiness Sheet Breakdown

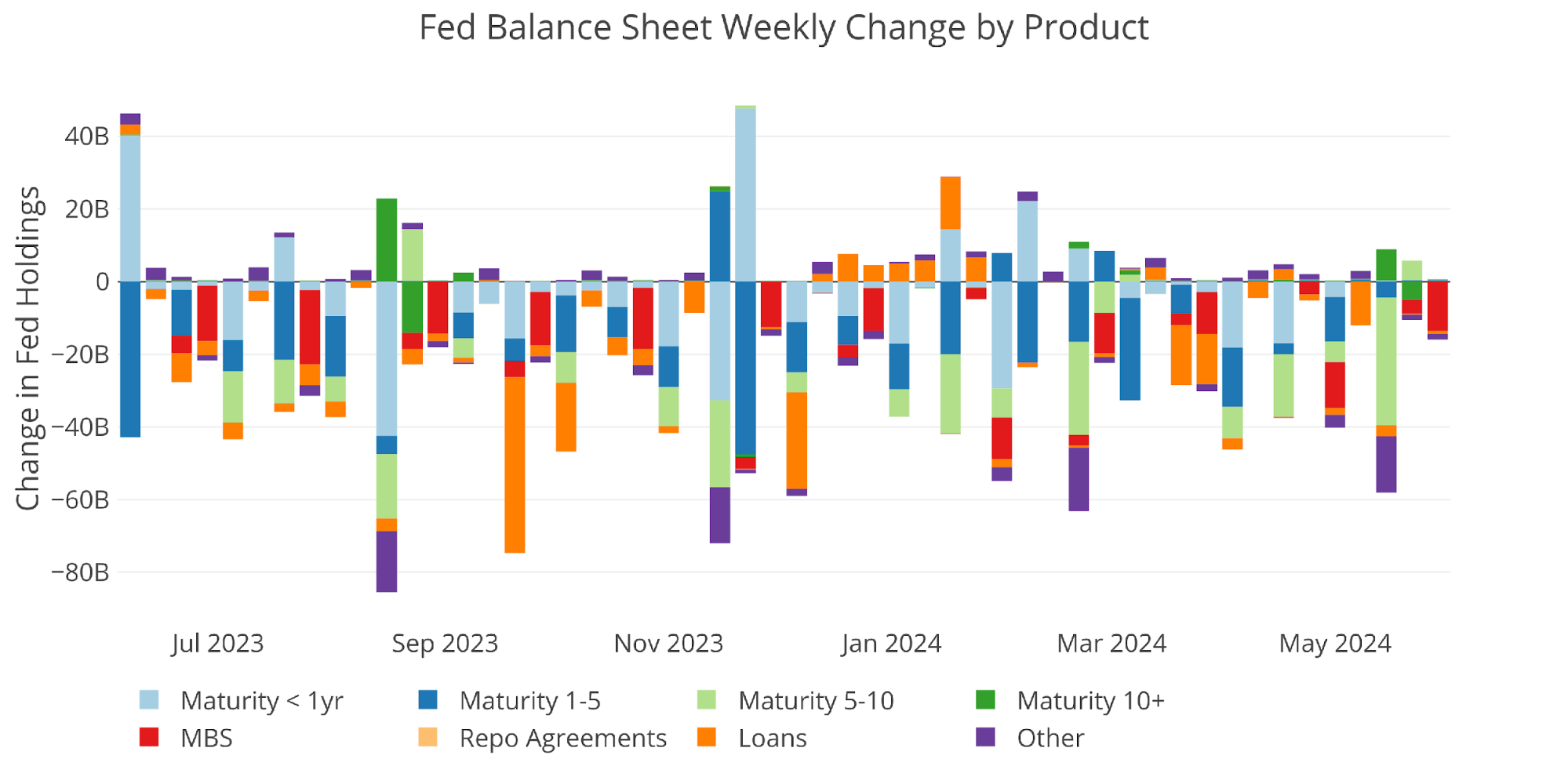

The weekly exercise could be seen beneath. It exhibits {that a} massive driver of the drop this final month was 5-10-year maturity.

Determine: 3 Fed Steadiness Sheet Weekly Adjustments

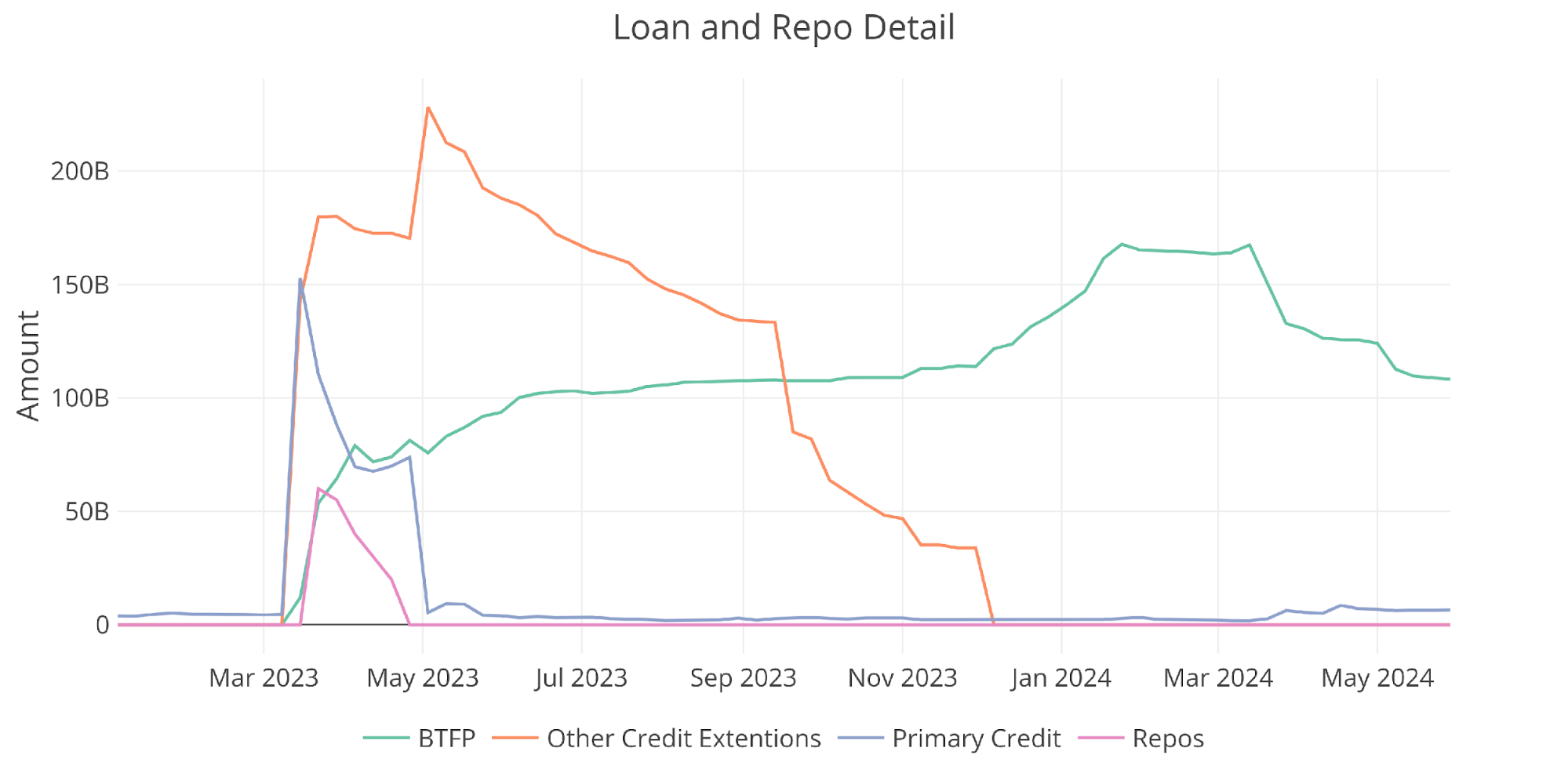

The chart beneath exhibits the steadiness on detailed gadgets in Loans and likewise Repos. These had been the packages arrange within the wake of the SVB collapse final yr. Three of the 4 packages have dropped near zero, however the Financial institution Time period Funding Program (BTFP) stays elevated. The BTFP was this system that allowed banks to worth their Treasury belongings at par for as much as one yr. That quantity has began dropping some after the 1 yr interval expired however it nonetheless stays north of $100B. We will observe this metric over the subsequent few months to see how the banks are doing.

Determine: 4 Mortgage Particulars

Yields

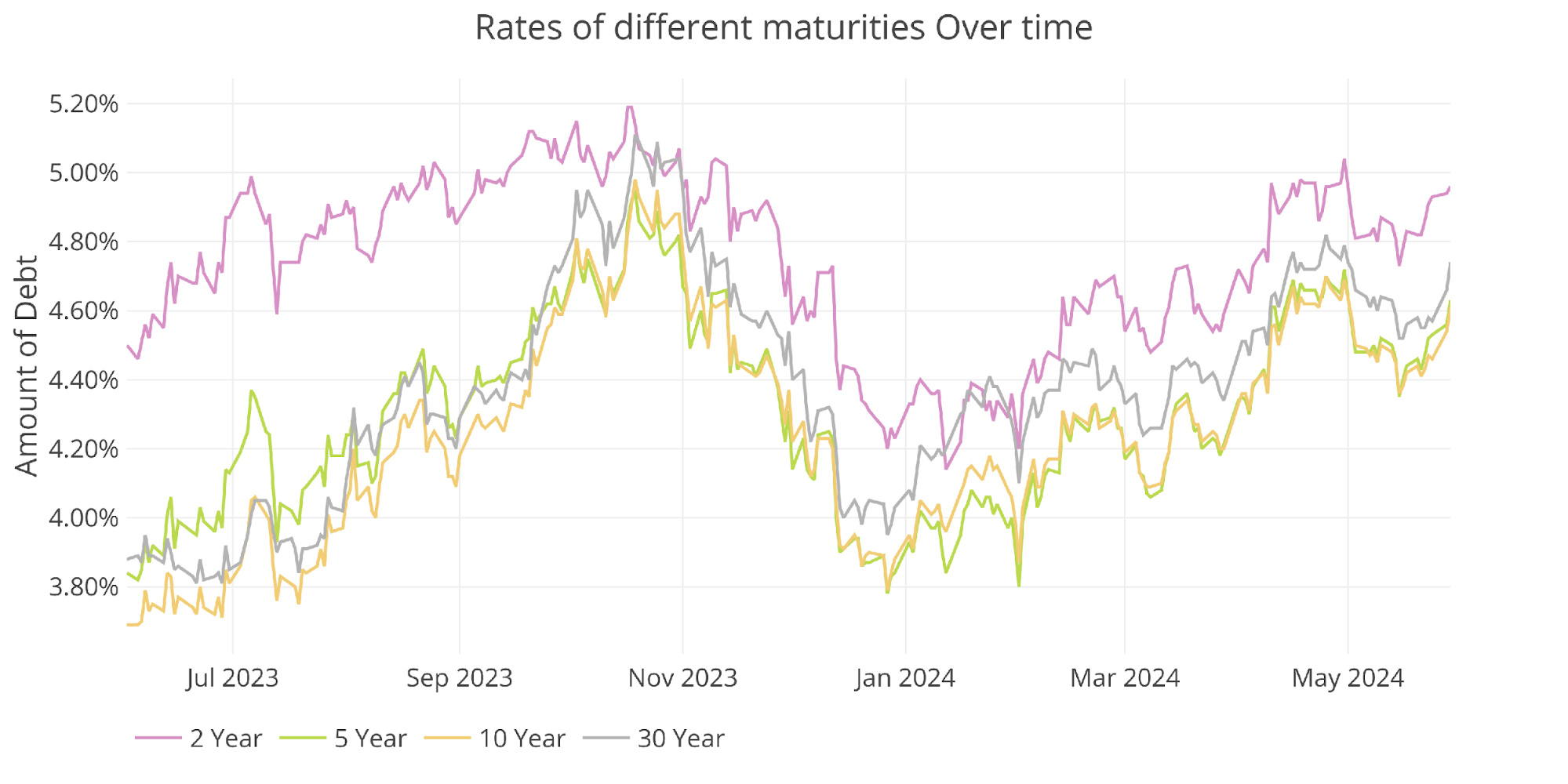

Yields have climbed again up in current weeks.

Determine: 5 Curiosity Charges Throughout Maturities

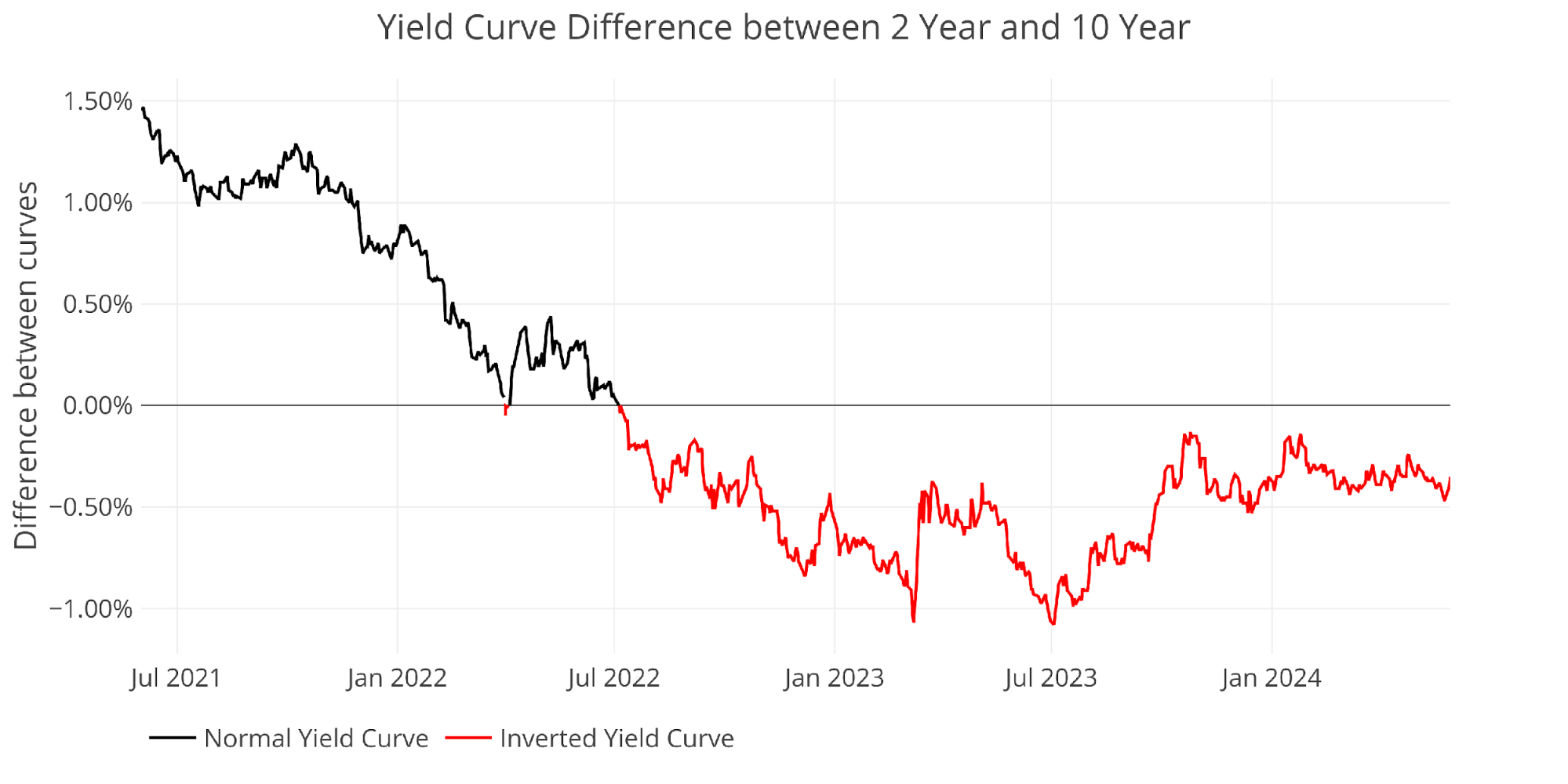

The yield curve stays inverted at -35bps.

Determine: 6 Monitoring Yield Curve Inversion

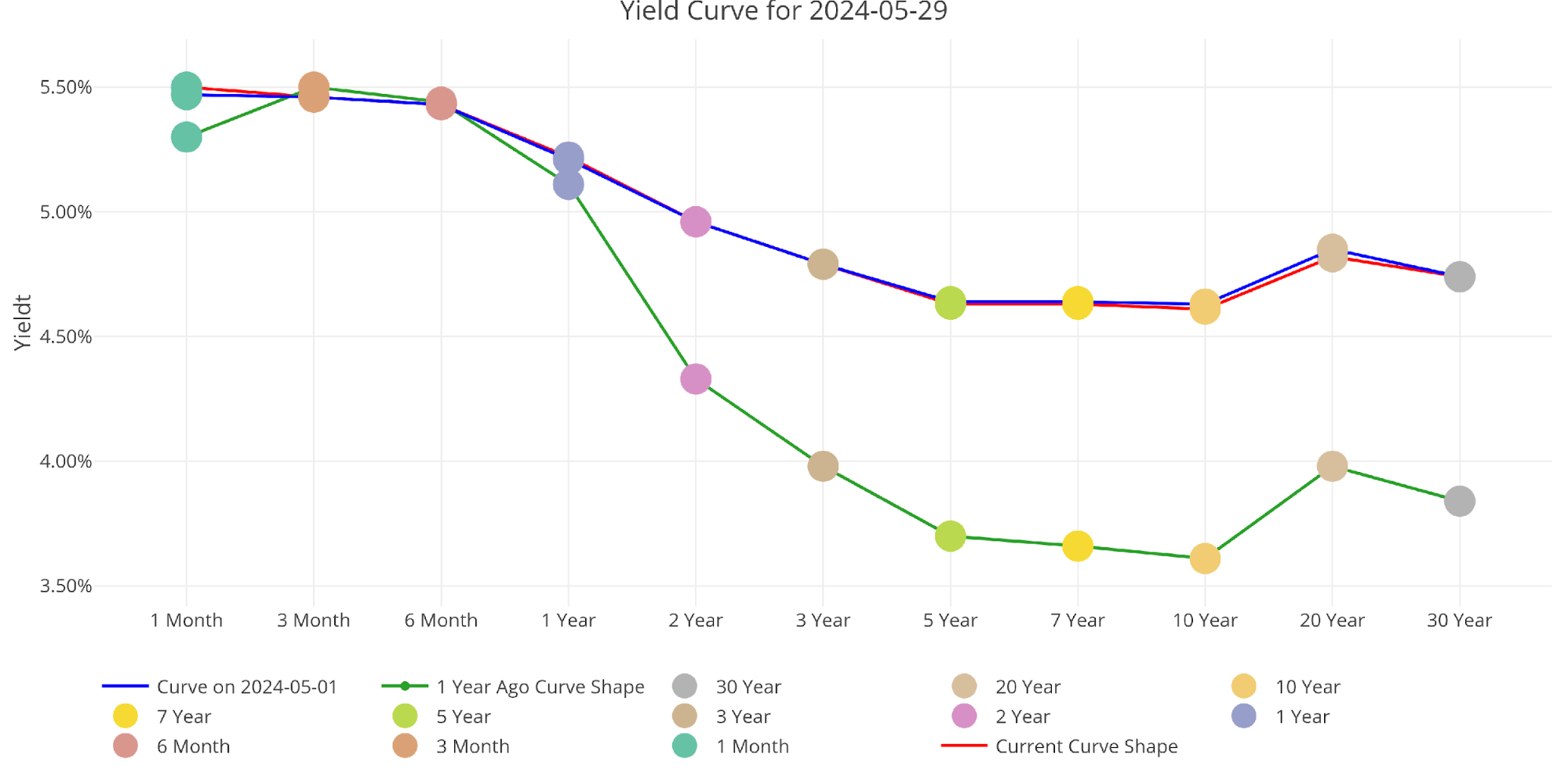

The chart beneath exhibits the present yield curve, the yield curve one month in the past, and one yr in the past. There was little motion during the last month.

Determine: 7 Monitoring Yield Curve Inversion

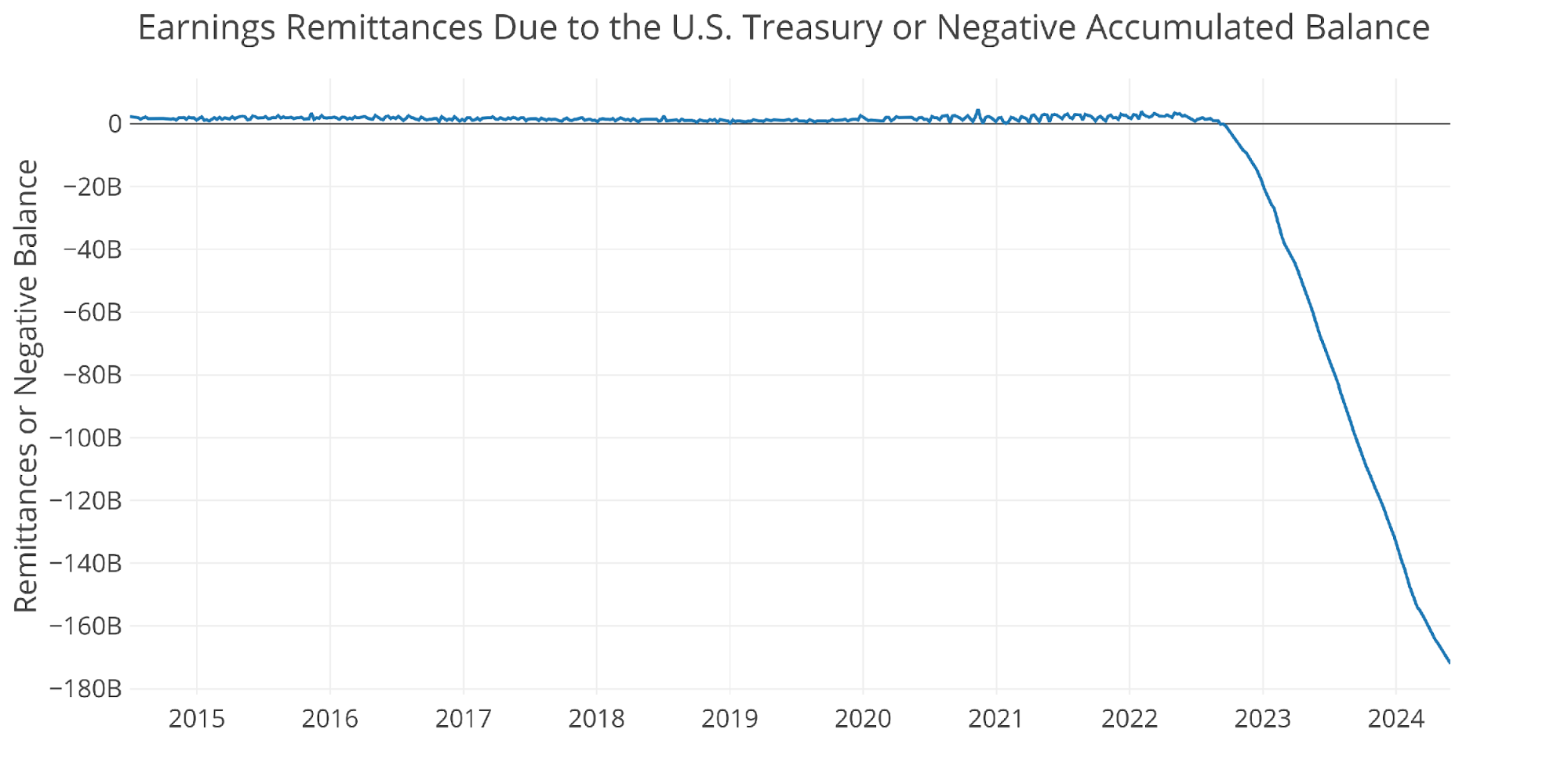

The Fed Takes Losses

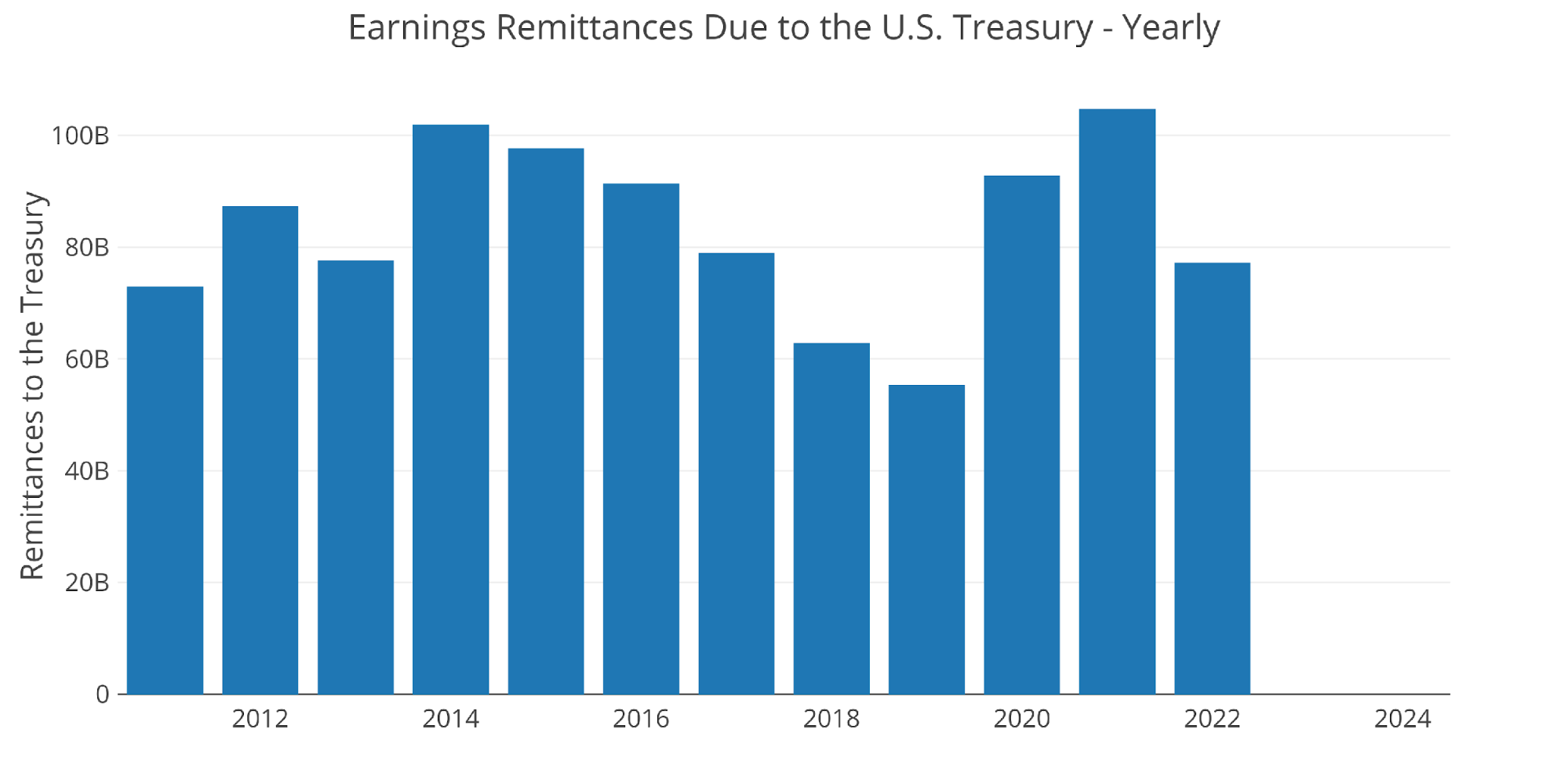

When the Fed makes cash, it sends it again to the Treasury. This has netted the Treasury near $100B a yr. This may be seen beneath.

Determine: 8 Fed Funds to Treasury

Chances are you’ll discover within the chart above that 2023 and 2024 are exhibiting $0. That’s as a result of the Fed has been dropping cash. In accordance with the Fed: The Federal Reserve Banks remit residual internet earnings to the U.S. Treasury after offering for the prices of operations… Optimistic quantities signify the estimated weekly remittances as a consequence of U.S. Treasury. Unfavourable quantities signify the cumulative deferred asset place … deferred asset is the quantity of internet earnings that the Federal Reserve Banks want to appreciate earlier than remittances to the U.S. Treasury resume.

Mainly, when the Fed makes cash, it offers it to the Treasury. When it loses cash, it retains a damaging steadiness by printing the distinction. That damaging steadiness has simply exceeded $171! This damaging steadiness is growing by about $10B a month!

Determine: 9 Remittances or Unfavourable Steadiness

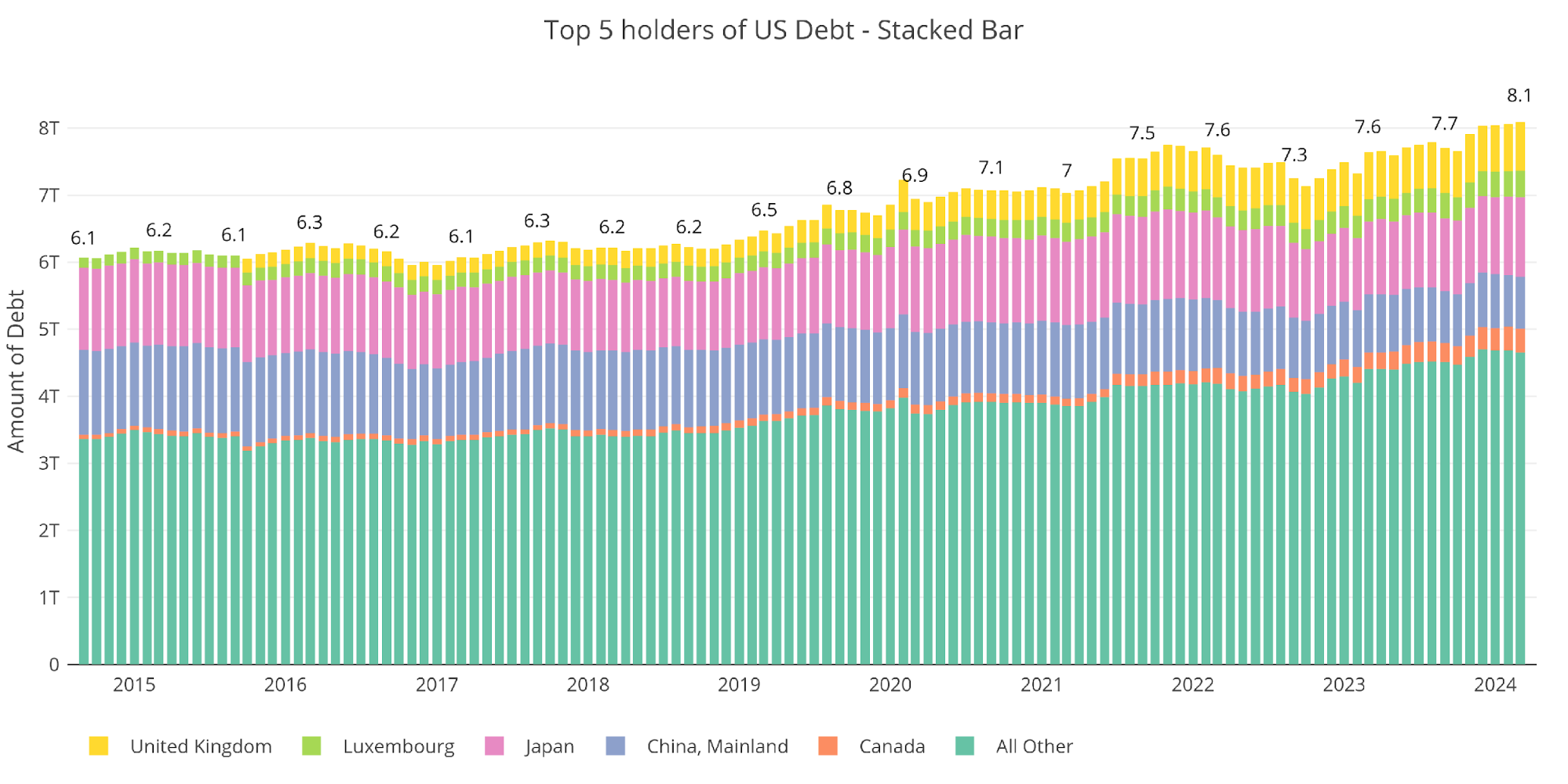

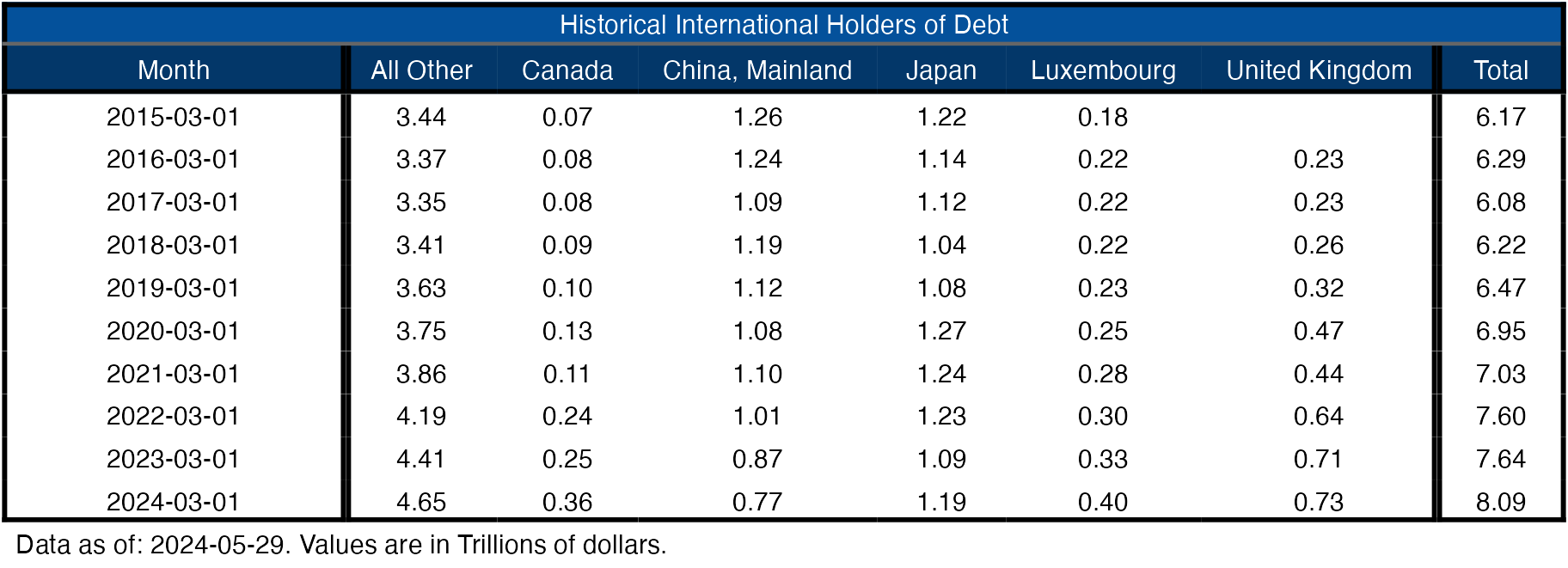

Who Will Fill the Hole?

The Fed has not been shopping for within the Treasury marketplace for over a yr (they’ve been promoting); nonetheless, the Treasury remains to be issuing tons of recent debt. Who has been choosing up the slack for the reason that Fed stepped away?

Worldwide holdings have elevated an honest quantity during the last yr by about $500B. This can be a first rate uptick, however is it sustainable and may it cowl all of the debt being issued? The reply to each questions is “in all probability not”.

Word: information is up to date on a lag. The newest information is as of March

Determine: 10 Worldwide Holders

It needs to be famous that China continues to scale back holdings of US Treasuries. They shed one other $100B, however Japan made up the distinction. Canada and Luxembourg additionally noticed giant will increase, particularly relative to their dimension. Canada elevated holdings by 50% in a single yr!

Determine: 11 Common Weekly Change within the Steadiness Sheet

Historic Perspective

The ultimate plot beneath takes a bigger view of the steadiness sheet. It’s clear to see how the utilization of the steadiness sheet has modified for the reason that World Monetary Disaster.

The current strikes by the Fed within the wake of the SVB collapse will also be seen beneath. When the subsequent break within the economic system happens, it’s seemingly that the steadiness sheet will spike once more.

Determine: 12 Historic Fed Steadiness Sheet

Information Supply: https://fred.stlouisfed.org/collection/WALCL and https://fred.stlouisfed.org/launch/tables?rid=20&eid=840849#snid=840941

Information Up to date: Weekly, Thursday at 4:30 PM Japanese

Final Up to date: Could 29, 2024

Interactive charts and graphs can all the time be discovered on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Name 1-888-GOLD-160 and communicate with a Valuable Metals Specialist right this moment!