Gold’s roughly 8% month-to-date rally has room to develop with the valuable metallic poised to hit $2,300 an oz. by year-end, in accordance with Goldman Sachs analysts.

On Monday futures gained to commerce as excessive as $2,182 an oz.. The dear metallic is taken into account a secure haven throughout instances of geopolitical tensions and when rates of interest lower. Final week, the Federal Reserve continued to sign that it will decrease rates of interest 3 times this yr.

The Fed assembly “bolstered the market’s (and ours) expectations that three cuts are probably this yr, lending renewed assist to gold to check and surpass March’s earlier document excessive,” wrote a group of analysts led by Samantha Dart.

Goldman Sachs analysts upgraded their common gold worth forecast for 2024 from $2,090 to $2,180 per ounce, concentrating on a transfer to $2,300 by the top of the yr.

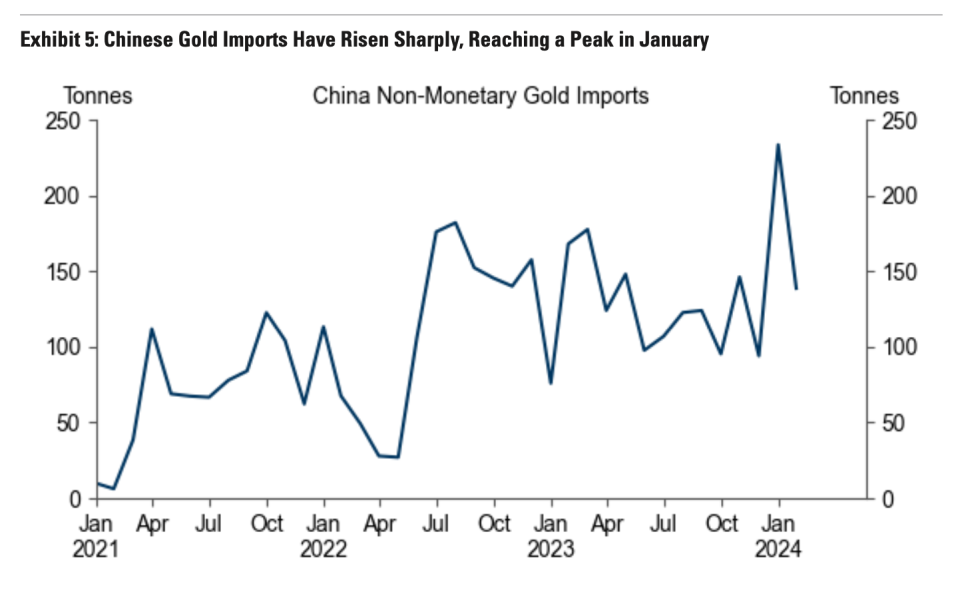

The analysts forecast gold costs within the close to time period will transfer towards one other consolidation part, barring any geopolitical shock. Nonetheless, “a substantive retracement decrease will probably even be restricted by resilience in bodily shopping for channels,” wrote Dart, citing Chinese language imports of the valuable metallic.

“Nonetheless, within the midterm we proceed to carry a constructive view on gold underpinned by eventual Fed easing, which ought to crucially reactivate the largely dormant ETF shopping for,” wrote Dart.

Bullion’s worth will increase have been disconnected from current outflows seen in gold-related ETFs. Strategists imagine buyers have been rotating cash into bitcoin ETFs because the token roared towards new highs earlier this month.

Central banks have been shopping for up gold at historic ranges, serving to to drive up demand over the previous couple of years.

Adjusted for inflation, gold hit a document in 1980 when it hit $850 per ounce, which might equal nearly $3,200 in right this moment’s {dollars}.

Ines Ferre is a senior enterprise reporter for Yahoo Finance. Comply with her on X at @ines_ferre.