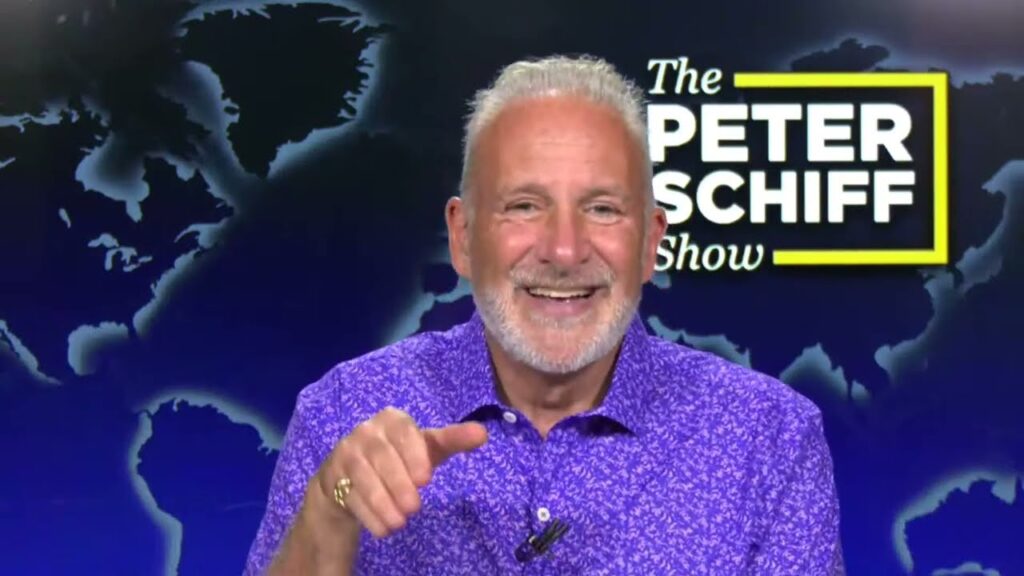

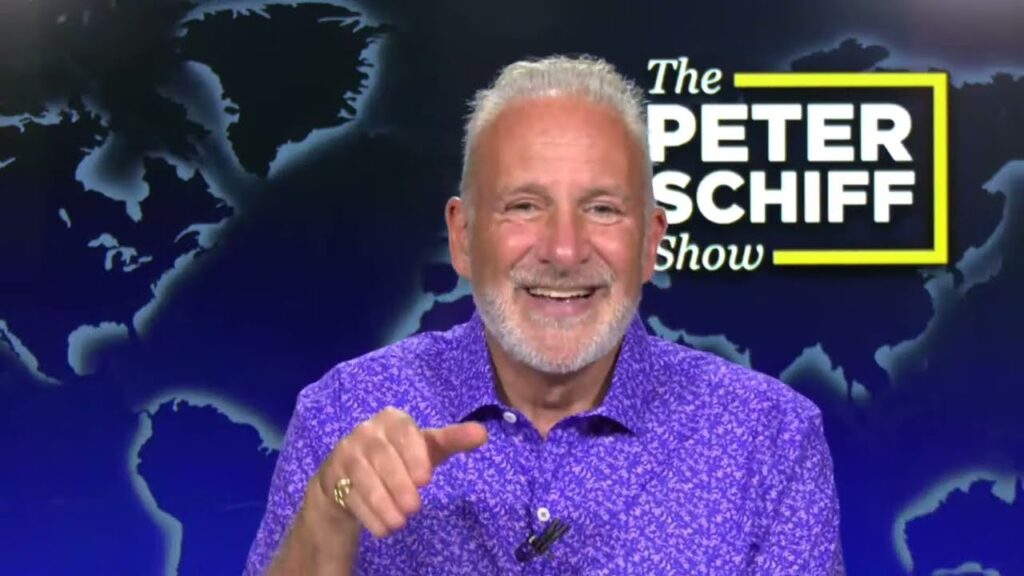

This week Peter recaps one other stellar week for treasured metallic. He additionally discusses Friday’s jobs report, commodity costs, and Bitcoin.

Peter begins by placing this week’s surge into context:

“There’s an outdated Wall Avenue saying: ‘no one rings a bell,’ that means that no one warns you if you’re at a significant high or a significant backside. The issue is there are bells. It’s simply that folks don’t acknowledge them. They don’t hear them. They don’t know what to pay attention for. Properly, there was an enormous bell rung at present within the gold market, within the silver market. And everyone is tone deaf. … To offer you an thought of the scale of the achieve this week in gold and silver, gold rose 4% on the week, which is an enormous transfer for gold in a single week. Silver rose 10%.”

Friday’s comparatively robust jobs report is not any comfort since most of this month’s new jobs are within the public sector:

“All these jobs— web— are part-time jobs. Have a look at the roles. Virtually 70% of them are authorities jobs. They’re well being care jobs, and numerous well being care jobs are actually authorities jobs in disguise. And meals and beverage, hospitality, waiters, bartenders, lodge maids, that sort of stuff— that’s the place the roles are. We had no creation of producing jobs in any respect. And final month’s lack of manufacturing jobs, which was initially reported at minus 4,000, was revised to minus 10,000.”

Even with bond yields rising, gold nonetheless went up this week. This means there’s one thing extra at play than what Wall Avenue’s buying and selling algorithms can detect:

“Gold’s going up it doesn’t matter what. It’s simply that it’ll go up much more on weak financial information than on robust financial information. However regardless of the information is, gold goes up! Gold is being repriced. Central banks are rising their gold reserves. They don’t care! They don’t care concerning the Fed at this level. They don’t care what number of charge cuts we’re going to get this 12 months. They don’t even care if we get any charge cuts this 12 months. None of it issues. Gold goes up it doesn’t matter what.”

Proof retains mounting that inflation is just not beneath management, with the CRB Commodity Index up 17% this 12 months and oil up 22%. This instantly counters the Federal Reserve’s most up-to-date narrative:

“The Fed must be mountaineering charges, however they’ll’t. As I stated, they’ll trigger a monetary disaster. … In order that they maintain speaking about how inflation is contained— that they nonetheless suppose it’s coming down. They’re simply not fairly positive but. They want a little bit bit extra proof. All of the proof reveals that inflation goes up. So it’s all B.S. They’re sticking to their script. … If the Fed hiked charges, it could be the most important admission of a mistake, as a result of if the Fed hikes charges, what does that imply? … They had been fallacious!”

Right this moment’s financial system is paying homage to 2007’s. Each financial downside is supposedly beneath authorities management— till it isn’t:

“That is all like 2007, 2008, when after so a few years of warning about an issue within the housing market and the subprime market, it lastly blew up. And the mainstream had been nonetheless fully oblivious. They had been nonetheless holding to this ‘Goldilocks’ best story ever informed. … Proper up till the collapse of Lehman. This is identical factor. We’ve had the equal of the subprime lenders going bankrupt and folks pondering, ‘Don’t fear about that. It’s contained.’ And on the identical time, we obtained all these Bitcoin ETFs creating this big distraction, this big facet present that’s distracted folks’s consideration from the middle ring. They’re throughout there in Bitcoin, and so they’re lacking out on gold.”

Among the financial harm may’ve been contained had Jerome Powell and the Fed not enabled disastrous Federal coverage:

“When the president makes a mistake and the chairman of the Federal Reserve is aware of it’s a mistake, he doesn’t simply sit there silent! It’s his job to criticize it, as a result of the common American doesn’t know. … We’re supposed to place actual sensible guys to go the Federal Reserve— smarter than the common truck driver or waitress. So he wants to clarify to that truck driver and that waitress what they’re doing is fallacious. They’re going to destroy the worth of your financial savings— of your paychecks. However no, he’s afraid to try this. He received’t criticize any coverage as a result of he doesn’t wish to upset any of the congressmen. Why not? In the event that they’re doing the fallacious factor, what’s extra vital? Their emotions? Their political profession or the nation?”

Sadly it does in actual fact appear that the political forces at play will maintain the Fed from exercising the correct financial coverage wanted to appropriate years of inflation.

Name 1-888-GOLD-160 and converse with a Treasured Metals Specialist at present!