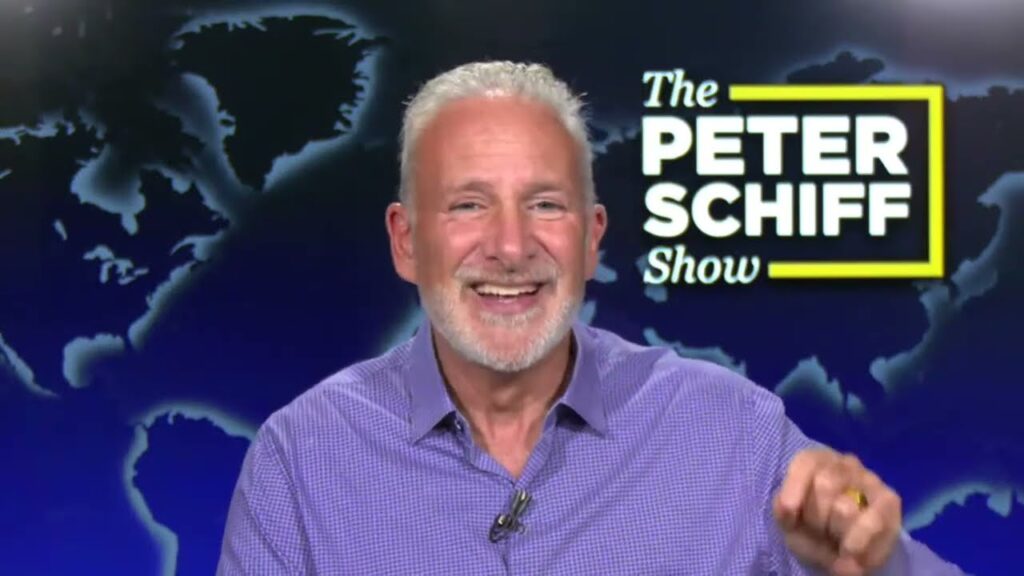

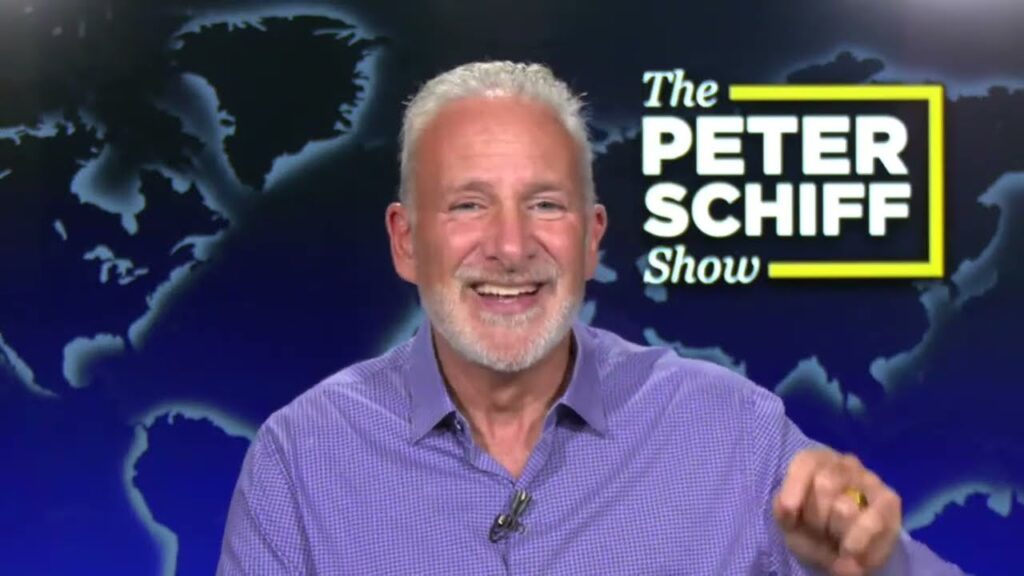

Peter’s again in Puerto Rico this week for his podcast after one other week of file gold costs. On this episode, he discusses media protection of inflation, this week’s CPI report, and Bitcoin’s weakening value relative to gold.

Peter begins by recapping this week’s value motion and actions within the greenback’s energy. The greenback is at present performing higher than different foreign currency echange, however that doesn’t imply it’s doing nicely:

“The greenback index was up right now, however that doesn’t imply the greenback was up. Gold tells you the greenback was down. What the rising greenback index tells you in an atmosphere of a rising gold value is that the greenback is shedding worth. It’s simply shedding much less worth than the euro— or shedding its worth extra slowly than the euro or the pound or the yen. That’s what’s taking place. I imply, if I’m going backwards at 10 miles an hour and there’s a automotive subsequent to me going backwards at 20 miles an hour, relative to that automotive, I’m going forwards. However I’m not. I’m truly going backwards. I’m simply going backwards extra slowly than the opposite automotive.”

The monetary press is both fully oblivious to the explanations gold is surging or they’re selecting to offer political cowl to policymakers chargeable for inflating the greenback:

“Like I mentioned with the canary and the coal mine, as an alternative of recognizing, ‘Gee, gold’s going up due to inflation,’ they’re making up different causes for why gold’s going up. Just like the Canary died of a coronary heart assault. ‘Gold’s going up due to geopolitical threat.’ They don’t need to admit that gold’s going up due to inflation, as a result of the Fed is making a mistake, as a result of these price cuts are fallacious, as a result of they need to be mountain climbing charges. So that they [the press] do that complete section on inflation, they usually don’t even point out gold.”

With persistent proof of inflation, the media is not less than beginning to query the narrative that we want extra rate of interest cuts:

“They’re now beginning to say, ‘Hmm, possibly we’re not going to get any cuts.’ They’re not saying that we’re going to get hikes. … They’re beginning to query the validity of the cuts, however no one is questioning the fact of the truth that they need to by no means have stopped mountain climbing— that that’s what the rising gold value is signaling, that rates of interest are too low and that they should go up. Not simply within the US, they should go up in all places. … All people has to boost charges sharply. I’m not speaking about ‘mamby-pamby’ quarter level price hikes. We’d like 200 foundation level hikes.”

Gold’s and silver’s bullish streaks bode nicely for the metals, however not for Bitcoin and different cryptocurrencies:

“The value of Bitcoin is right down to about 18.6 ounces of gold. The excessive was 27 two and a half years in the past. So we’re getting deeper into bear market territory. None of those Bitcoiners need to acknowledge this. Regardless of all of the hype, ETFs, all this massive rally, Bitcoin by no means made a brand new excessive in actual cash. And it could not.”

Wednesday’s CPI got here in scorching once more, with a 0.4 % improve from final month. Yr-over-year inflation is now at 3.5%, which isn’t near the Fed’s 2% goal:

“When you had been goal and simply trying on the CPI, you’ll say, ‘Oh, we higher hike charges. Inflation goes up, not down.’ However they’re nonetheless saying, ‘No, no, no, we’re anticipating to chop charges.’ Why? Primarily based on what would you count on to chop charges? Actually not primarily based on the info. The information doesn’t assist a price minimize.”

Between growing institutional demand for gold and powerful proof of future inflation, the destiny of the greenback doesn’t look good:

“Think about how a lot stronger [gold’s] going to be when the greenback goes down, and it’ll go down. And if something, the rising gold value is what is going to trigger the greenback to go down, as a result of sooner or later when gold will get excessive sufficient, there might be a stampede into gold by international central banks, by the general public, by hedge funds, pension funds, and endowments. And the place are they going to get the cash to purchase all that gold? They’re going to make use of {dollars}. So the greenback goes to get killed. It has no likelihood towards gold.”

The following few months might be vital for the American and world economies. If the Fed continues its inflationary coverage, it should spell catastrophe and worsen the approaching disaster.

Get Peter Schiff’s most vital gold headlines as soon as per week – click on right here – for a free subscription to his unique weekly e-mail updates.

Taken with studying how one can purchase gold and purchase silver?

Name 1-888-GOLD-160 and communicate with a Valuable Metals Specialist right now!