Again in 1992, the U.S. was mired in a recession. Invoice Clinton was mounting a presidential marketing campaign to take the White Home. And, incumbent president George HW Bush was seen as out of contact with the wants of on a regular basis Individuals.

Individuals.

A Clinton advisor turned well-known for the phrase: “It’s the economic system, silly.” Certainly, the Clinton marketing campaign highlighted the failing economic system at each flip and gained the White Home, maybe partly as a consequence of that technique.

Quick ahead to the 2024 presidential race. The election season is heating up quick, with an anticipated replay of the 2020 contenders: Joe Biden versus Donald Trump.

So, if it truly is all concerning the economic system, how is it doing immediately? Let’s have a look, discover the numbers, and what it may imply for gold.

Financial Progress

Regardless of widespread expectations for a recession in 2023, the U.S. economic system is rising and Wall Road more and more expects that the Fed may obtain a so-called “soft-landing” this yr.

- In 2024, america economic system is forecast to develop at a 2.4% tempo.

- Examine that to 2024 financial progress forecasts of 0.7% for the Eurozone, 0.3% for the UK, 0.9% for Canada and 0.4% for Sweden.

Key takeaway: It might not really feel just like the economic system is powerful to some Individuals. However our nation is main the pack in opposition to different superior economies when it comes to financial progress. We’re rising twice as quick or greater than different superior economies.

Job Market

The U.S. economic system is creating new jobs at a reasonably brisk tempo. In February, employers created a complete of 275,000 new jobs for Individuals. The general unemployment charge stood at 3.9%.

What sort of job creation did we see in February?

- Well being care: 67,000 new jobs.

- Authorities: 52,000 new jobs.

- Eating places and bars: 42,000 new jobs.

- Development: 23,000 new jobs.

- Transportation and warehousing: 20,000 new jobs.

- Retail: 19,000 new jobs.

Key takeaway: U.S. employers have been creating a gradual drumbeat of recent jobs for Individuals to fill. During the last twelve months, new jobs have been created in each month starting from 303,000 (Could 2023) to as little as 146,000 (March 2023), based on the Bureau of Labor Statistics. If you need a brand new job, there’s a superb probability yow will discover one.

Curiosity Charges

The Federal Reserve is holding its benchmark rate of interest at a 23-year excessive in early 2024, because it maintains tighter financial situations in an try to battle again in opposition to inflation.

Key takeaway: The upper rates of interest hurts American debtors. This contains anybody who carries bank card debt, or needs to get a brand new automobile mortgage or mortgage. Would-be house consumers face a 6.9% 30-year mounted mortgage charge, based on Freddie Mac, which has priced some out of the housing marketplace for now.

Inflation

The February core shopper worth index (CPI) posted a hotter-than-expected studying, up 3.8% yearly. The rising costs of lease, auto insurance coverage, automobile repairs and airline tickets contributed to the stronger-than-expected inflation studying. Costs for used vehicles and clothes additionally climbed.

Inflation has fallen from its 2022 excessive at 9.1%. Nevertheless, the February information exhibits that the Fed’s battle to rein in inflation is just not over but.

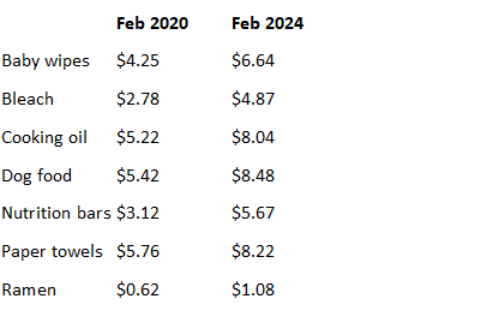

Costs are larger for on a regular basis objects and that sticks in Individuals minds. Right here’s a couple of worth comparisons pre- and post-pandemic, from NielsenIQ.

Key takeaway: Whereas inflation has dropped from over 9% to the newest 3.8% core studying, this nonetheless feels painful for a lot of Individuals. Costs on key on a regular basis items are sharply larger than earlier than the pandemic and that “reference” level creates dissonance between the widely good financial information (sturdy labor market, rising economic system) and what they pay for on a regular basis objects.

The Fed’s goal charge of two% inflation per yr, signifies that costs would rise 2% yearly. As a substitute we noticed costs rise 9% on an annual charge in June 2022. That’s large. Costs aren’t probably ever going to return to these ranges, the Fed is simply attempting to maintain annual worth positive factors to a 2% tempo.

What does this imply for gold?

These macroeconomic situations created an ideal storm for gold. The value of gold has been climbing to a sequence of historic all-time new highs in latest months. Gold is up 30% over the previous 16 months!

Inflation stays larger than the Fed’s goal, which is supportive to gold. But the central financial institution is anticipated to chop rates of interest thrice in 2024, which will even increase gold much more and weaken the greenback. The inventory market is climbing in bubble-like situations which are being in comparison with the 2001 dot.com period. Solely this time it’s Synthetic Intelligence shares which are driving the inventory market larger. That is creating new safe-haven shopping for in gold to diversify and defend portfolios.

Wall Road says gold can hold going larger. There are a sequence of gold worth forecasts for 2024 that embrace $2,300 and $2,500 an oz. with a wildcard projection for $3,000 over the following 12 to 16 months.

The presidential election across the nook in November, will solely improve financial, political and market uncertainty. Whereas that political story has but to unfold, one factor is for certain, this historic run in gold is simply getting began.

Need to learn extra? Subscribe to the Blanchard Publication and get our tales from the vault, our favourite tales from around the globe and the newest tangible belongings information delivered to your inbox weekly.