- Upcoming election has prompted many to show to gold

- Britons are shopping for the valuable metallic as a secure haven

Britons are flocking to purchase gold and different treasured metals following the announcement of the overall election, The Royal Mint says.

Prime Minister Rishi Sunak set the 4 July election date on 22 Might, and the information has sparked a latter-day gold rush.

Gold is a well-liked haven for traders throughout instances of political uncertainty, as the worth of the valuable metallic is sort of fully faraway from political or financial goings-on within the wider world.

The speculation is that if the election has any destructive financial impact – similar to increased taxes or a weakened economic system – any cash held in gold will sit there smugly unaffected.

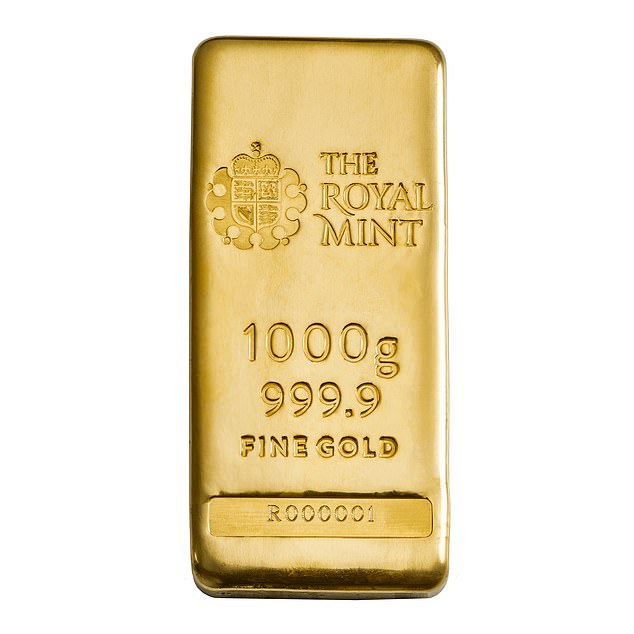

Barred for all times: Gold bars similar to this one, costing greater than £61,000, are being snapped up by traders hoping the metallic will likely be a secure place to depart their cash throughout the election

The identical is true of platinum, and to a barely lesser extent with silver.

The Royal Mint mentioned that it had seen a 49 per cent enhance within the variety of prospects shopping for treasured metallic bullion because the election was referred to as.

The amount of gold purchased via the Mint rose 117 per cent within the week after the election, with spending on bullion up 145 per cent.

The election additionally appears to have nudged many to put money into treasured metals for the primary time, as 10 per cent of latest Royal Mint prospects have by no means purchased gold, silver or platinum earlier than.

Stuart O’Reilly, of the Royal Mint, mentioned: ‘The uplift in treasured metals investing we have now seen over the previous week appears to have been pushed by “safe-haven” shopping for from traders who’re making an attempt to mitigate the dangers related to the present uncertainty.

‘Elections result in elevated questions round the way forward for the economic system, tax, and safety which may trigger spikes in funding exercise and better curiosity in treasured metals.

‘Attributable to gold’s safe-haven standing and lack of correlation with different property, we are inclined to see surges within the shopping for of gold cash and bars when traders are unsure concerning the future.

‘Along with the overall election, traders are maintaining a detailed eye on whether or not rates of interest will come down and when which may occur, in addition to waiting for America’s elections in November.’

Virtually half (42 per cent) of latest treasured metallic purchases via the Royal Mint have been to members of Technology X, aged 44 to 59 years previous.

The most well-liked merchandise have been 1oz gold and silver Britannia cash, massive gold bars and sovereign cash.

Good as gold: Some of the common gadgets amongst traders is the 2024 1oz gold sovereign, which prices £1,926 at present gold costs, and is bought via the Royal Mint

Some traders could also be selecting gold due to different causes apart from the looming election.

Jason Hollands, managing director at wealth supervisor Evelyn Companions, mentioned: ‘A excessive gold worth pushed by central financial institution shopping for will undoubtedly be attracting the eye of many traders and that is possible compounded by geopolitical tensions and maybe a priority that valuations in components of the US inventory market are extreme too.

‘If you’re investor with an Isa or a Sipp, the best option to make investments is by way of a gold trade traded commodity just like the Invesco Bodily Gold ETC.

‘One cause the Royal Mint could also be seeing a very robust surge might nonetheless be tax associated.

‘That’s as a result of gold cash produced by the Royal Mint are thought-about authorized tender forex and are due to this fact not topic to capital good points tax. Costs are nonetheless at a premium to mirror the craftsmanship concerned.

‘What is perhaps occurring right here is that some individuals who have determined to put money into gold outdoors of tax-free Isas and pensions, are doing to by way of the Royal Mint within the occasion that capital good points tax rises below a Labour authorities.’

The value of gold is up roughly 21 per cent prior to now 12 months, with a lot of the good points prior to now six months. Over 5 years, it is up almost 80 per cent.