One thing is afoot with gold.

Earlier than analysing the thriller, a query. Is gold overpriced?

The World Gold Council estimates that 6.8 billion ounces of gold are above floor. They’re in jewelry, central financial institution reserves, bars, cash and alternate traded funds. At present costs all this gold is price $15.1 trillion.

The market capitalisation of “Magnificent Seven” shares is $13.8 trillion. Both Microsoft, Apple, Nividia and the others are costly or gold is reasonable.

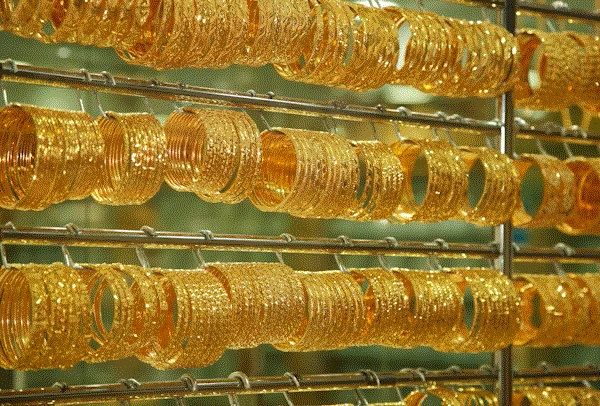

Picture by Saj Shafique Jewelry customers in Dubai and India are resisting report costs.

The overwhelming majority of analysts, merchants and bankers are bullish. Which may be a yellow warning mild. A number of count on bullion to rise to $2,500 an oz.. They cite beneficial monetary situations. The Swiss Nationwide Financial institution is the primary main central financial institution to chop rates of interest. The US Federal Reserve Board and different central banks are forecast to comply with. It’s an election 12 months. Wars are dragging on.

After touching $2221 an oz., a number of days in the past, gold slipped to $2160. However on Thursday March 28 it soared to an all time peak $2234. This can be a decisive break. To maintain the upward pattern gold ought to stay above $2200.

The flags within the bull ring are flapping northwards. Those that know why aren’t telling.

“The stealth rally has caught Western forecasters without warning,” says Ross Norman, CEO, Metals Each day and a former bullion vendor. “It suggests to me that the shopping for is past the purview of most of us.”

The next content material is premium and requires a paid subscription to entry.

(When you do not want to vault the premium paywall, kindly click on Commodities Predict. The publication has free articles about Ukraine, Russia, cocoa, and water.)

Please respect copyright. When you use a part of this text or different items, please attribute to Commodities Predict and the writer. If you wish to use the complete put up please ask for permission.