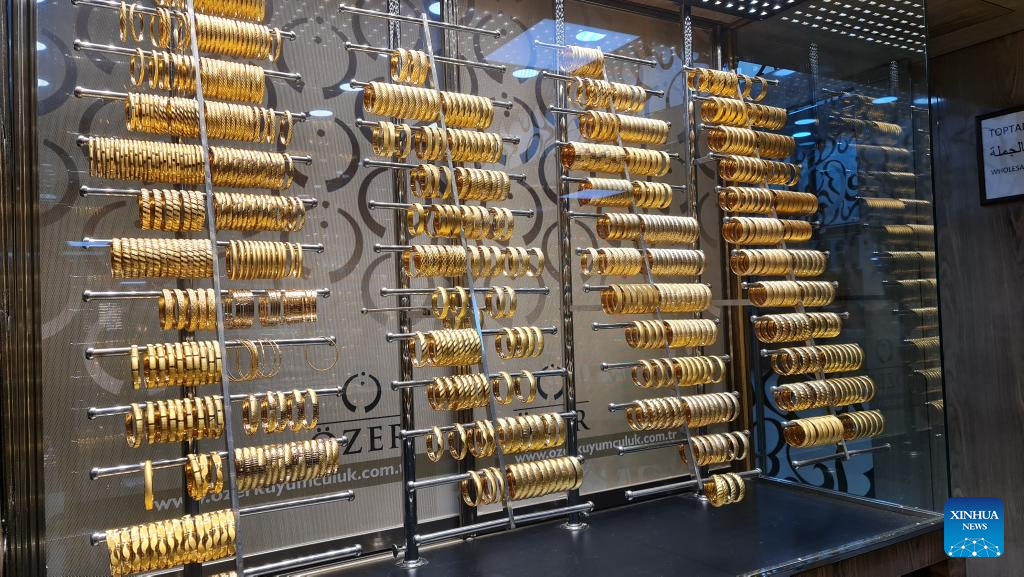

This picture taken on April 17, 2024 exhibits gold ornaments on show in a jewellery retailer in Istanbul, Türkiye. (Photograph by Safar Rajabov/Xinhua)

ISTANBUL, April 24 (Xinhua) — Faruk Mutlu, a Turkish citizen, stepped right into a bustling jewellery retailer in Türkiye’s vibrant metropolis of Istanbul. Armed along with his financial savings, he resolved to transform them into gold, another he deems “at all times useful.”

With the escalating tensions within the Center East firstly of final week, rumors swirled of an imminent rise in gold costs, prompting Mutlu to grab the chance.

“In Türkiye, it is a cherished custom to bestow gold upon newlyweds, and with the summer season wedding ceremony season quick approaching, our demand for this valuable metallic is hovering,” Mutlu instructed Xinhua.

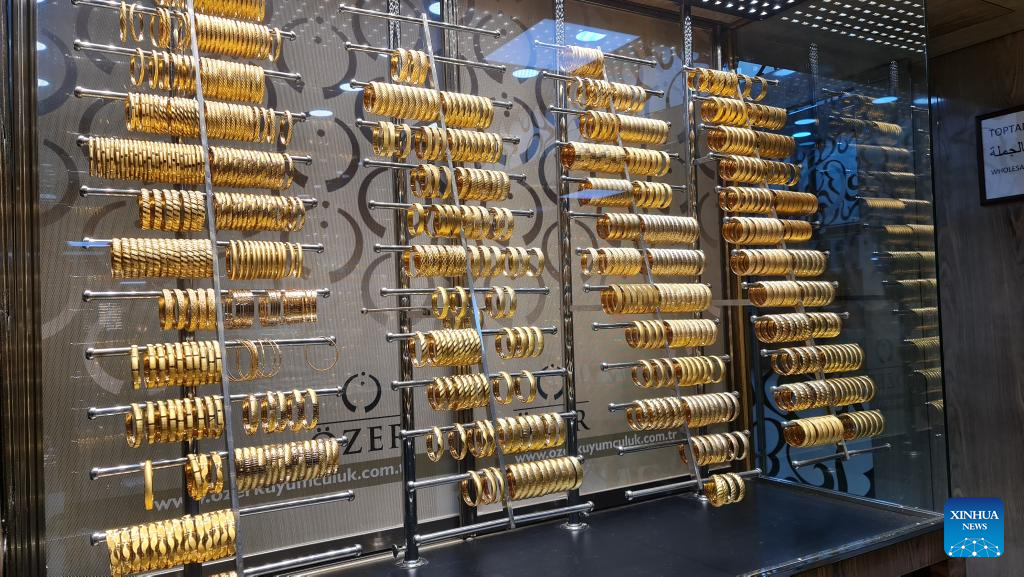

In Kuyumcukent, a neighborhood in Istanbul famend as Türkiye’s jewellery business hub, prolonged queues have shaped at gold shops amid issues that the stress between Israel and Iran might escalate into the broader area.

After Iran launched missile and drone assaults on Israel on April 13, Riza Gokay Tugsavrol, proprietor of the Harem Gold jewellery retailer, instructed Xinhua that the continued rise in costs, pushed by growing want, has made gold much more engaging.

“In instances of chaos and geopolitical upheavals similar to battle, buyers usually see gold as a safe refuge, counting on it as a secure asset,” he stated.

“Earlier than the battle, one gram of gold was hovering across the 2,500-Turkish-lira (76.75-U.S.-dollar) mark,” he stated. “After the escalation, it surged to 2,630 liras and even started testing the two,650 ranges.”

At the beginning of the yr, one gram of gold debuted at roughly 2,000 liras in Türkiye.

As tensions barely eased, the worth of 1 gram of gold went all the way down to the two,450 mark on Tuesday. Nonetheless, consultants anticipate rounds of rise all year long in gold costs, spurred by escalating petrol prices amidst international uncertainties.

Echoing Tugsavrol, Murat Tufan, an analyst with the Ekoturk broadcaster, stated that the rising costs and the escalating rush for gold underscore the heightened geopolitical dangers in international international coverage.

“The concern index has began to exert its affect, particularly after Iran’s retaliatory measures in opposition to Israel,” Tufan stated.

“This uptick means that buyers are rising more and more uneasy in monetary markets, with issues that the battle between Israel and Iran might probably escalate additional.”

As demand amongst Turks continues to extend, Abdullah Yasir Sahin, head of the Turkish State Mint, has issued a cautionary be aware to residents and store homeowners concerning counterfeit gold in small workshops, notably at a time when gold manufacturing is struggling to fulfill demand. ■

Individuals wait in line to purchase gold in entrance of a jewellery retailer in Istanbul, Türkiye, April 17, 2024. (Photograph by Safar Rajabov/Xinhua)