Merchandise 1 of two Merchants work on the ground on the New York Inventory Alternate (NYSE) in New York Metropolis, U.S., September 11, 2024. REUTERS/Brendan McDermid/File Picture

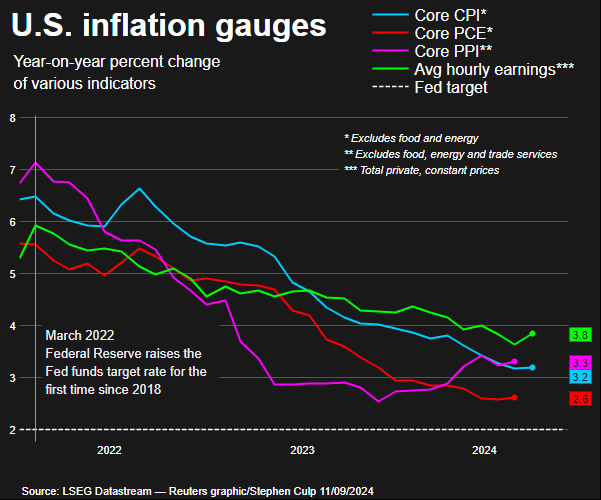

NEW YORK, Sept 11 (Reuters) – Wall Avenue reversed an earlier sell-off to shut larger on Wednesday, and Brent crude costs rebounded from 3-1/2 yr lows as a key inflation report cemented expectations that the U.S. Federal Reserve will subject a 25-basis level price minimize subsequent week.

“The inflation report form of gave inflation bears a bit of one thing and it gave inflation bulls one thing,” mentioned Chuck Carlson, chief government officer at Horizon Funding Companies in Hammond, Indiana.

“At the very least initially at the moment, there was the sensation {that a} 50-basis-point price minimize isn’t going occur,” Carlson added. “Possibly now traders are beginning to assume that perhaps that is not a nasty factor.”

Finally look, monetary markets have baked in an 85% chance that the Fed will minimize its key coverage price by 25 foundation factors at subsequent week’s coverage assembly, with a dwindling 15% probability of a double-sized 50 bp minimize, in accordance with CME’s FedWatch Device.

Market members paid shut consideration to late Tuesday’s U.S. presidential debate, listening intently for potential coverage clues from Vice President Kamala Harris and former President Donald Trump.

Yields on 10-year U.S. Treasury notes steadied from an earlier stoop during which the benchmark price touched its lowest stage since June 2, 2023.

Benchmark 10-year notes final fell 5/32 in value to yield 3.6609%, from 3.644% late on Tuesday.

The 30-year bond final fell 12/32 in value to yield 3.9743%, from 3.954% late on Tuesday.

The Japanese yen strengthened 0.04% versus the buck at 142.40 per greenback, whereas Sterling was final buying and selling at $1.3042, down 0.28% on the day.

U.S. crude jumped 2.37% to settle at $67.31 per barrel, whereas and Brent settled at $70.61 per barrel, up 2.05% on the day.

Spot gold dropped 0.2% to $2,512.30 an oz..

Enroll right here.

Reporting by Stephen Culp; Further reporting by Lawrence White in London; Modifying by Alexandra Hudson, Nick Zieminski and Diane Craft

Our Requirements: The Thomson Reuters Belief Rules.