By Jesse Colombo

After greater than three years of stagnation, gold has woke up with a vengeance since early-March and has promptly surged by almost $300 an oz. or 14% to an all-time excessive $2,330 — a pointy transfer for a safe-haven asset that has a popularity for its gradual and regular tendencies. Gold’s highly effective rally got here seemingly out of the blue and has confounded the vast majority of traders and commentators who’ve been rather more centered on fashionable speculative shares and cryptocurrencies as of late. On this piece, I’ll clarify a number of of the technical and elementary elements which are driving gold to all-time highs, what is probably going forward for gold, and the way traders can greatest make the most of the yellow steel’s resurgence.

A Have a look at the Technicals

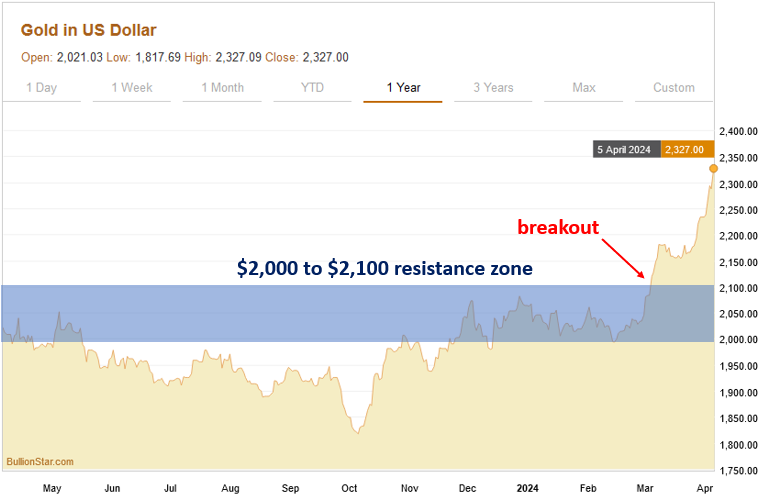

The chart of gold over the previous 12 months reveals the way it immediately sprang to life over the previous month. As I had defined in my final weblog submit on March 1st, there was an necessary technical resistance zone from $2,000 to $2,100 that had been performing as a value ceiling for gold because the center of 2020. Gold’s profitable shut above that zone signified {that a} new rally had begun regardless that the elemental drivers of it weren’t precisely obvious simply but.

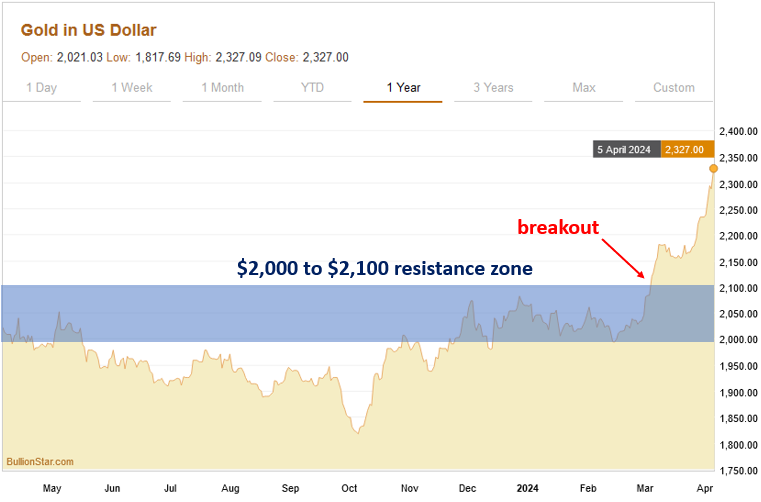

The multi-year gold chart reveals the importance of the $2,000 to $2,100 resistance zone and the way gold stored bumping its head at that degree till it lastly pushed via up to now month:

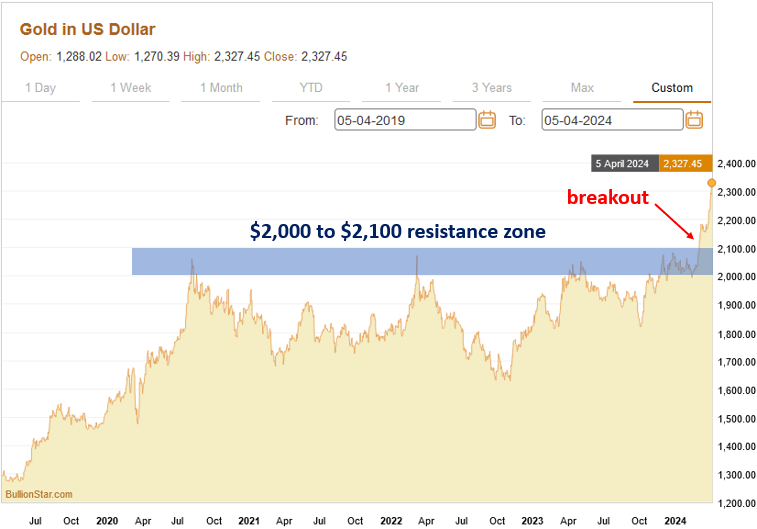

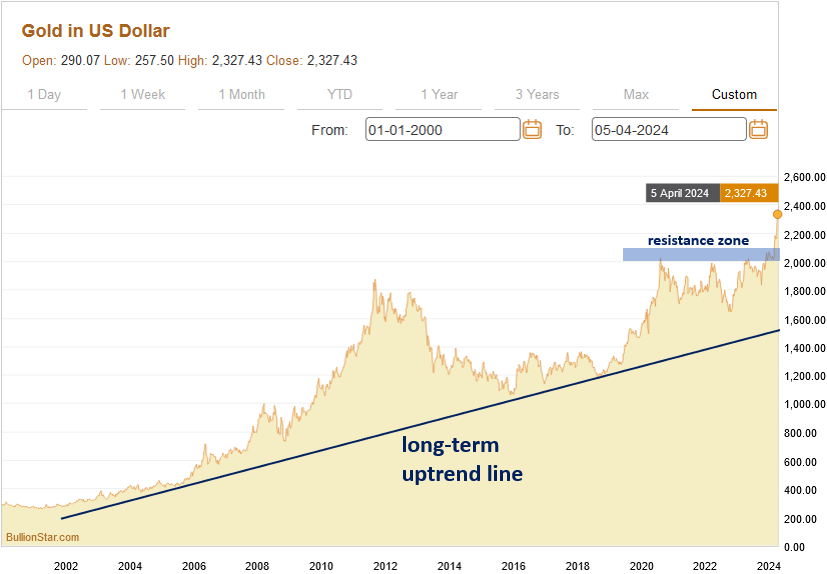

Gold’s multi-decade chart reveals that it has been steadily climbing an uptrend line that started within the early-2000s because the U.S. and different international locations kicked off an unprecedented debt binge that reveals no indicators of stopping in any way:

Gold is Rising Regardless of the Robust U.S. Greenback

What’s significantly fascinating and notable about gold’s surge over the previous month is the way it has occurred independently of the motion within the U.S. greenback. Gold and the U.S. greenback have a long-established inverse relationship, which implies that energy within the greenback sometimes causes weak point in gold, whereas greenback weak point sometimes causes the value of gold to rise.

The chart beneath compares gold (the highest chart) to the U.S. Greenback Index (the underside chart) and reveals how motion within the greenback usually causes an reverse development in gold. Gold’s latest surge came about whereas the greenback was trending barely larger, which is an indication of gold’s energy on account of its capability to buck the unfavorable affect of the strengthening greenback.

Mainstream Traders & Journalists Missed Gold’s Rally

What can be value noting is how gold’s stunning latest rally has obtained little or no mainstream consideration by a press that’s rather more enamored with sizzling AI shares in addition to Bitcoin and different cryptocurrencies which have not too long ago benefited from the U.S. authorities’s approval of numerous Bitcoin exchange-traded funds (ETFs), which has resulted in large inflows from institutional traders and retail traders alike.

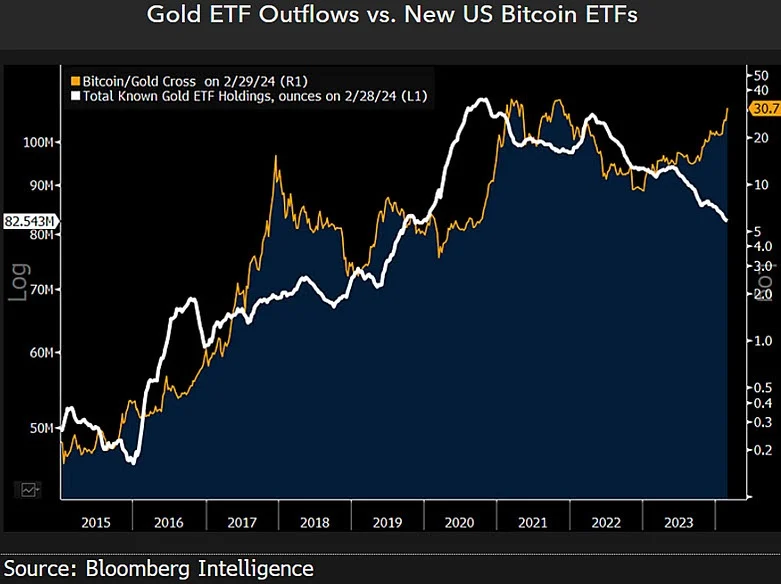

Because the chart beneath reveals, traders have pulled billions of {dollars} value of funds from gold ETFs in an effort to re-invest in Bitcoin ETFs, which is ironic contemplating its timing shortly earlier than gold’s liftoff (and is affirmation of contrarian investing ideas). The continuation of gold’s bull market will seemingly result in funds flowing again into gold ETFs, offering extra gasoline for the rally.

Central Banks Are Steadily Accumulating Gold

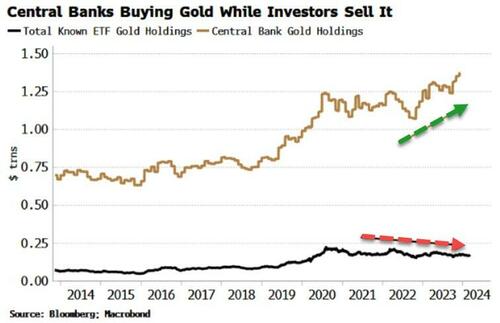

Although Western retail traders (who are sometimes thought of to be the “dumb cash” available in the market) have been sleeping on gold earlier than and even throughout its surge of the previous month, central banks — significantly these in Russia, China, Turkey, and India — have been steadily accumulating virtually all the gold that they will get their fingers on. In accordance with the World Gold Council, central banks bought a wholesome 1,037.4 metric tons of gold in 2023 in an effort to diversify out of the U.S. greenback and different fiat currencies which are being debased at an alarming fee and into a tough asset with a six-thousand 12 months historical past as sound cash that can not be printed.

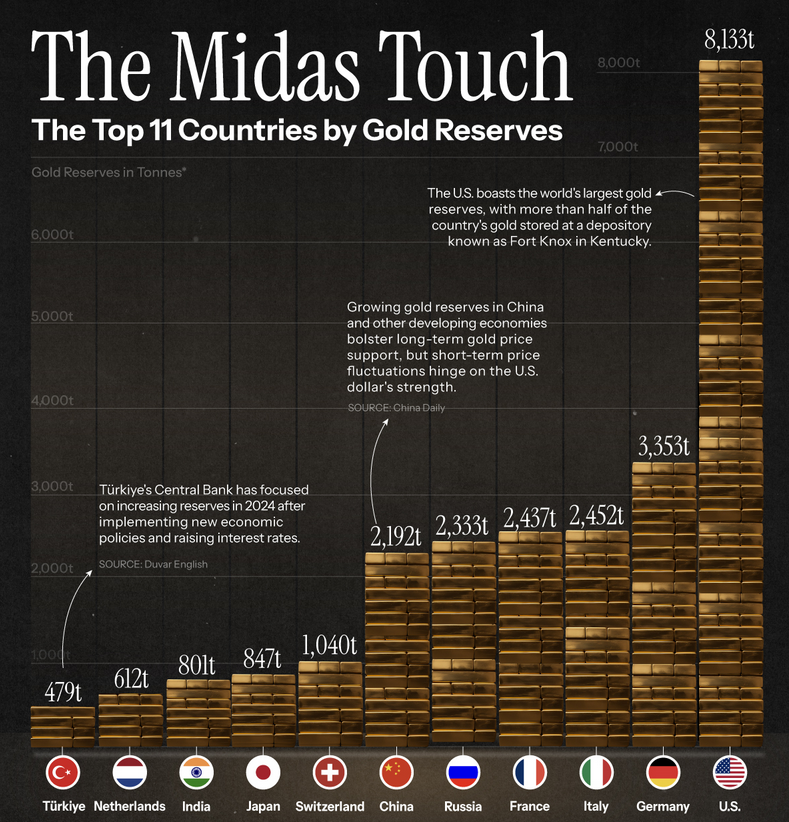

Although nearly all the world’s currencies have been downgraded to pure fiat or paper currencies that aren’t backed by gold since 1971, lots of these currencies are not directly and implicitly backstopped by gold as a result of massive gold reserves held by many international locations. For instance, the U.S. formally holds 8,133 metric tons of gold, Germany holds 3,353 metric tons, Italy holds 2,452 metric tons, France holds 2,437 metric tons, Russia holds 2,333 metric tons, and China holds 2,192 metric tons of gold. In a severe forex disaster, a rustic’s gold reserves is more likely to be one among its solely saving graces, which is why many international locations are accumulating gold at such a speedy tempo.

Chinese language Traders Are Shopping for Up Gold

Chinese language traders who’re looking for refuge from the nation’s sinking property and inventory markets are one other necessary driver of gold’s nascent rally. Beginning within the mid-2000s, China’s property and inventory markets launched into a seemingly unstoppable bull market because the nation’s economic system grew quickly and the nation started to more and more flex its financial and geopolitical muscle groups on the world stage. Sadly, like Japan within the Nineteen Eighties and the U.S. within the mid-2000s, China’s asset increase was truly an unsustainable bubble that was pushed by copious quantities of debt and reckless hypothesis.

As all bubbles ultimately do, China’s property and inventory market bubbles have burst over the previous 12 months inflicting at the least a whole lot of billions of {dollars} value of losses — together with $100 billion alone from the nation’s property tycoons. As religion in China’s economic system and monetary markets sinks, traders are turning to the previous standby, gold, which has hundreds of years of historical past in China as an outstanding retailer of worth in good and dangerous instances alike. When complicated monetary techniques and merchandise fail, as they at the moment are in China, savers and traders respect the simplicity and easy nature of bodily gold. Because the well-known financier J. P. Morgan as soon as mentioned, “Gold is cash. Every part else is credit score.”

In accordance with the World Gold Council, shopper demand for gold in China elevated by a stout 16% in 2023, whereas demand for gold bars and cash rose by an much more spectacular 27%. Retail gold shopping for in China has been dominated by the youthful generations who face a troublesome job market and are largely priced in a foreign country’s unaffordable housing market however discover bodily gold to be attainable — even when it means shopping for tiny quantities of it at a time as funds enable. Certainly, one of the crucial standard gold bullion merchandise amongst younger Chinese language are gold beans that weigh as little as one gram and value roughly 600 yuan (USD$83).

How Inflation is Contributing to Gold’s Latest Rise

One other necessary issue driving gold’s latest rally is stubbornly excessive inflation that isn’t easing as rapidly as economists had hoped and will as an alternative be on the verge of a resurgence. Gold is historically seen as a hedge towards inflation and may be very adept at sniffing out rising future inflation charges. U.S. year-over-year inflation — as measured by private consumption expenditures — elevated at a 2.5% fee in February, which precipitated merchants to barely dial again their expectations for Federal Funds Charge cuts this 12 months.

Although U.S. inflation remains to be elevated, there may be good motive to consider that the Fed will nonetheless undergo with their plans to chop charges this 12 months, which ought to show to be useful for the value of gold. In accordance with Financial institution of America’s commodities strategist Michael Widmer, “The market is decoding that the Fed is prepared to accommodate larger inflation because it cuts charges.”

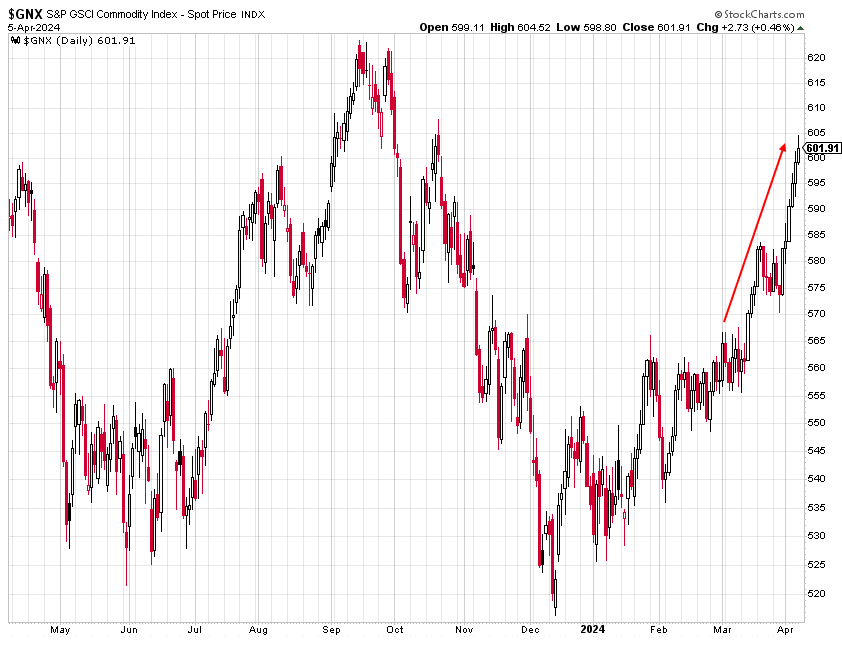

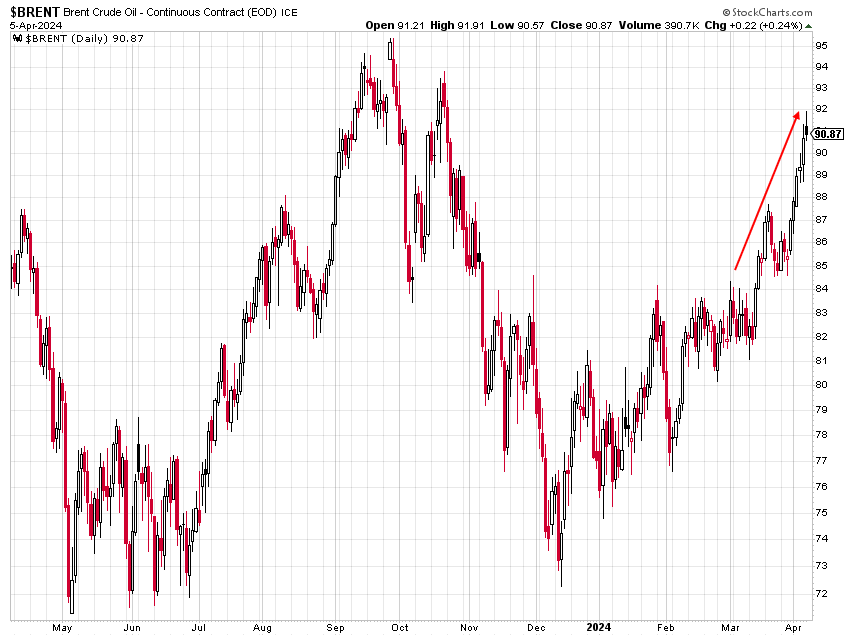

What’s value listening to particularly is the sharp surge in commodities costs over the previous month, which is probably going a sign of upper charges of inflation sooner or later:

Equally, crude oil elevated by 10% over the previous few weeks:

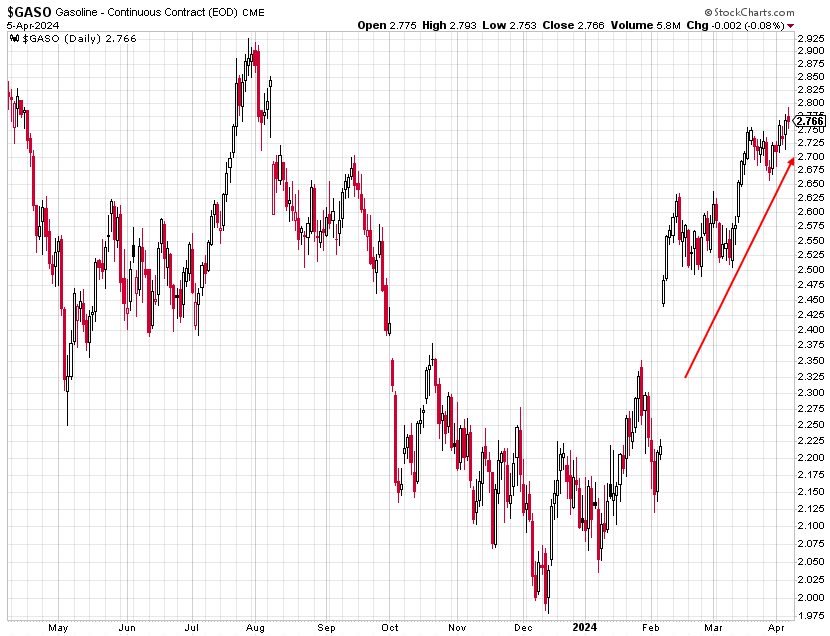

U.S. wholesale gasoline costs have spiked by roughly 30% up to now two months and are one of the crucial psychologically necessary and visual indicators of inflation within the minds of on a regular basis customers:

Gold is Benefiting From Political Uncertainty

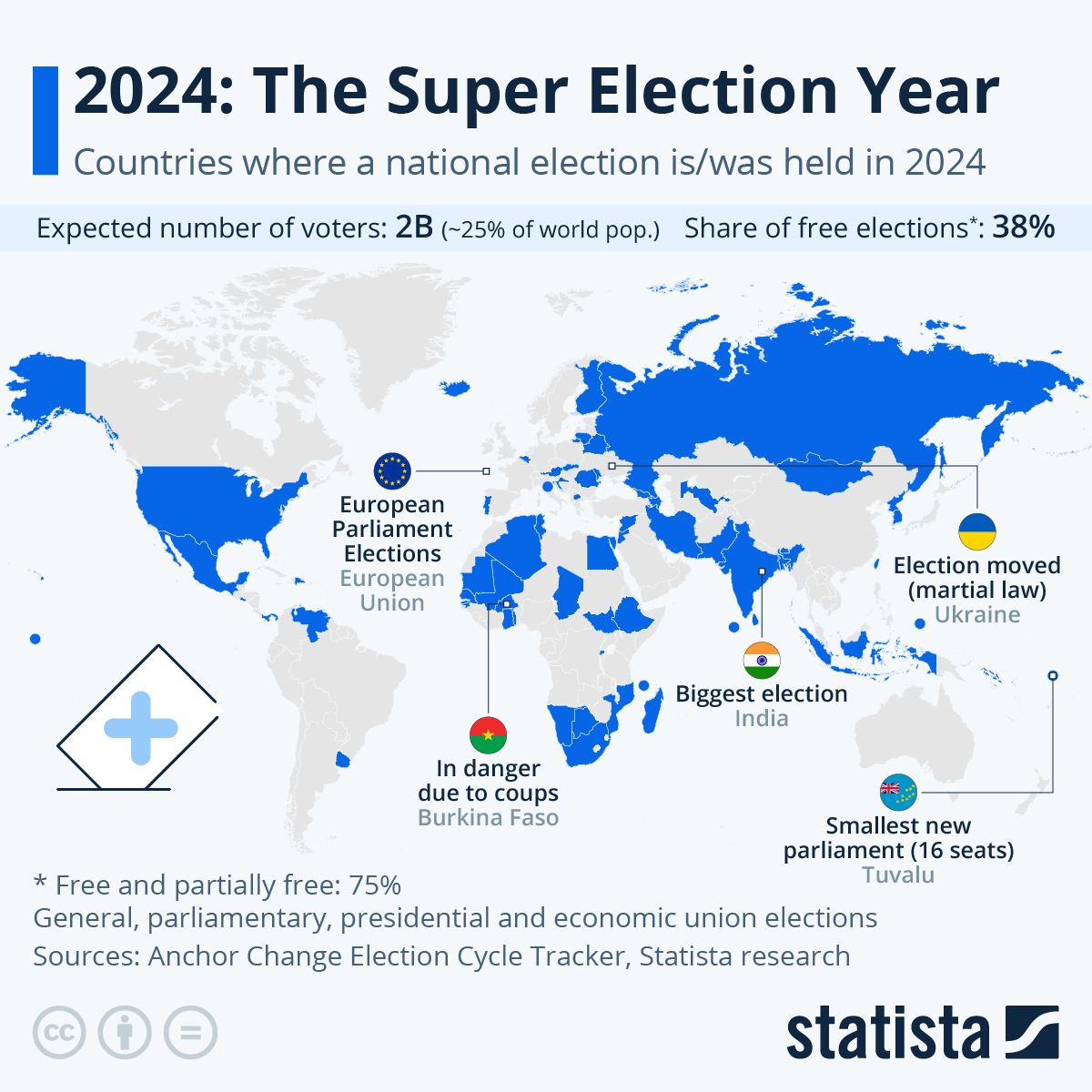

Along with being a hedge towards inflation, gold can be a hedge towards financial and political uncertainty. In 2024, greater than 60 international locations are set to carry nationwide elections, which makes it one of the crucial lively world election years in a really very long time, incomes it the moniker “The Tremendous Election 12 months.” The USA, Mexico, India and Indonesia are simply among the international locations which are holding nationwide elections this 12 months.

Financial points, together with inflation, are the highest concern for Individuals who will almost certainly select both President Joe Biden or former President Donald Trump to be the subsequent U.S. president in a redux of the hotly-contested 2020 presidential election. President Joe Biden and the Democratic Occasion have earned a popularity for heavy spending and racking up the nationwide debt, that are main the explanation why they’re blamed for the USA’ inflation downside. Based mostly on that view, a possible Biden win can be useful for the value of gold.

How Geopolitical Tensions Are Serving to Gold

As if there weren’t sufficient uncertainty and complicated cross-currents on the earth already, rising geopolitical tensions in numerous hot-spots are additionally serving to to spice up the value of gold. The Russia-Ukraine conflict has taken a flip for the more serious not too long ago after Russia shot down 53 Ukrainian drones and the Kremlin warned that Russia and NATO at the moment are in “direct confrontation.” Ukraine claimed that it destroyed least 6 Russian fighter jets, broken eight extra, and killed or injured 20 service personnel.

As well as, the Israel-Hamas conflict has now reached the six-month mark and reveals no indicators of de-escalation. Quite the opposite, Iran is now more and more concerned within the fray after Israel struck quite a few Iran-backed targets in Syria, which has now resulted in Iran vowing to retaliate, which is placing the world on edge and supporting the value of gold and crude oil.

(Our documentary, “Gold in Occasions of Disaster Ep 1 – Passage out of Vietnam” highlights the significance of holding gold in instances of geopolitical uncertainty.)

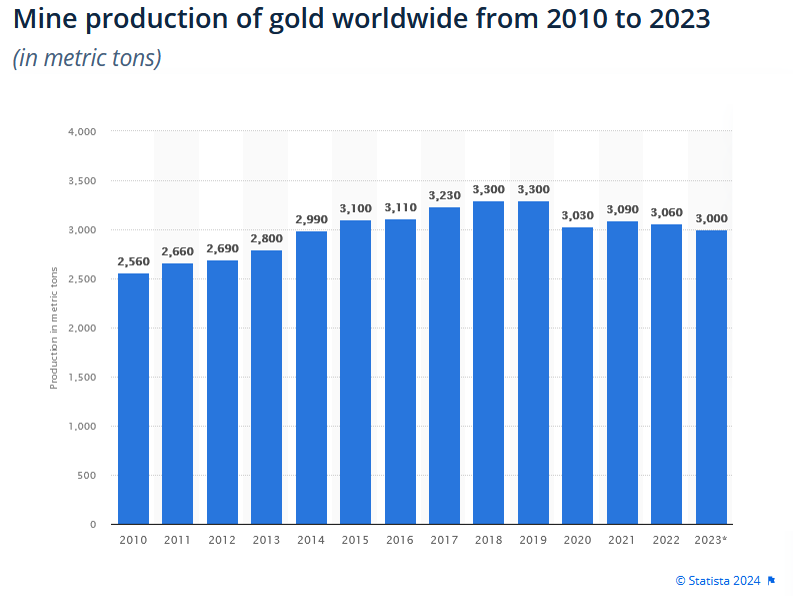

How Declining Manufacturing Helps the Value of Gold

One other issue that’s supporting the value of gold is the stagnating and declining manufacturing of gold from mines world wide. After rising steadily annually since 2010, world gold manufacturing peaked in 2019 at 3,300 metric tons and has since been declining at the same time as the value of gold rocketed 66% from $1,200 to roughly $2,000 in 2023. Many consultants consider that the world reached “peak gold” in 2018, which implies that the quantity of economically viable gold deposits world wide has peaked and entered right into a terminal decline. Supporting that principle is the US Geological Survey’s alarming estimate that every one recognized gold reserves may very well be depleted in simply seventeen years.

Why You Ought to Put money into Gold

As I’ve mentioned on this piece, gold is in a confirmed uptrend and there are quite a few elements which are driving that uptrend. To study extra concerning the extra financial and financial elements which are driving gold’s bull market, I like to recommend looking at my different latest piece, “What You Must Know About Gold’s Lengthy-Time period Bull Market.” To summarize, gold is rising in response to the alarming debasement of paper currencies and the ballooning world debt burden that ensures a severe forex disaster within the not-too-distant future.

Whereas lots of as we speak’s hottest monetary merchandise are just a few a long time previous at most and the common lifespan of a fiat forex is measured in mere a long time, gold has helped people protect their wealth from all kinds of fiscal and financial shenanigans perpetrated by governments for at the least six-thousand years. Although we dwell in a extremely complicated world that’s more and more depending on know-how (and certain too depending on know-how), the simplicity of bodily gold is one among its many robust factors — particularly when complicated techniques expertise upheaval and failure.

There are numerous trendy funding merchandise that goal to assist traders achieve publicity to gold, however most of these are “idiot’s gold” moderately than the true deal. There are gold exchange-traded funds (ETFs), gold futures and choices, contract for variations (CFDs), different derivatives, and gold mining shares, however these are simply paper claims on gold as an alternative of precise gold that you just maintain free and clear. In instances of great disaster and chaos, as I count on we’re heading into, there isn’t any substitute for bodily gold bullion that’s in your possession and utterly unencumbered by every other claims.

For those who’d like to guard and diversify your hard-earned wealth on this period of large danger and uncertainty, please check out our large assortment of gold, silver, and platinum bullion merchandise which are provided at among the lowest costs within the trade: